Fixed Income

With short-term government bonds and UK money market funds yielding close to 5% against the highest level of macro uncertainty that we’ve seen in years, it can be tempting to hide in cash. But if you look beyond the short term, we believe yields across the bond universe are at very exciting entry points to achieve a more attractive return for your fixed income allocation.

The question is, where’s best to invest? After waiting patiently for the pivot that didn’t come, investors face an economic trajectory that could go in one of three main directions.

But fear not the multi-headed ‘economic Cerberus’, there’s a fixed income opportunity for each scenario that we expect to deliver significantly more attractive returns than short-term government bonds and money markets.

SCENARIO 1: HARD LANDING

Full-blown recessionary scenario, central banks forced to cut rates

Inflation & policy mix |

|

Economic growth |

|

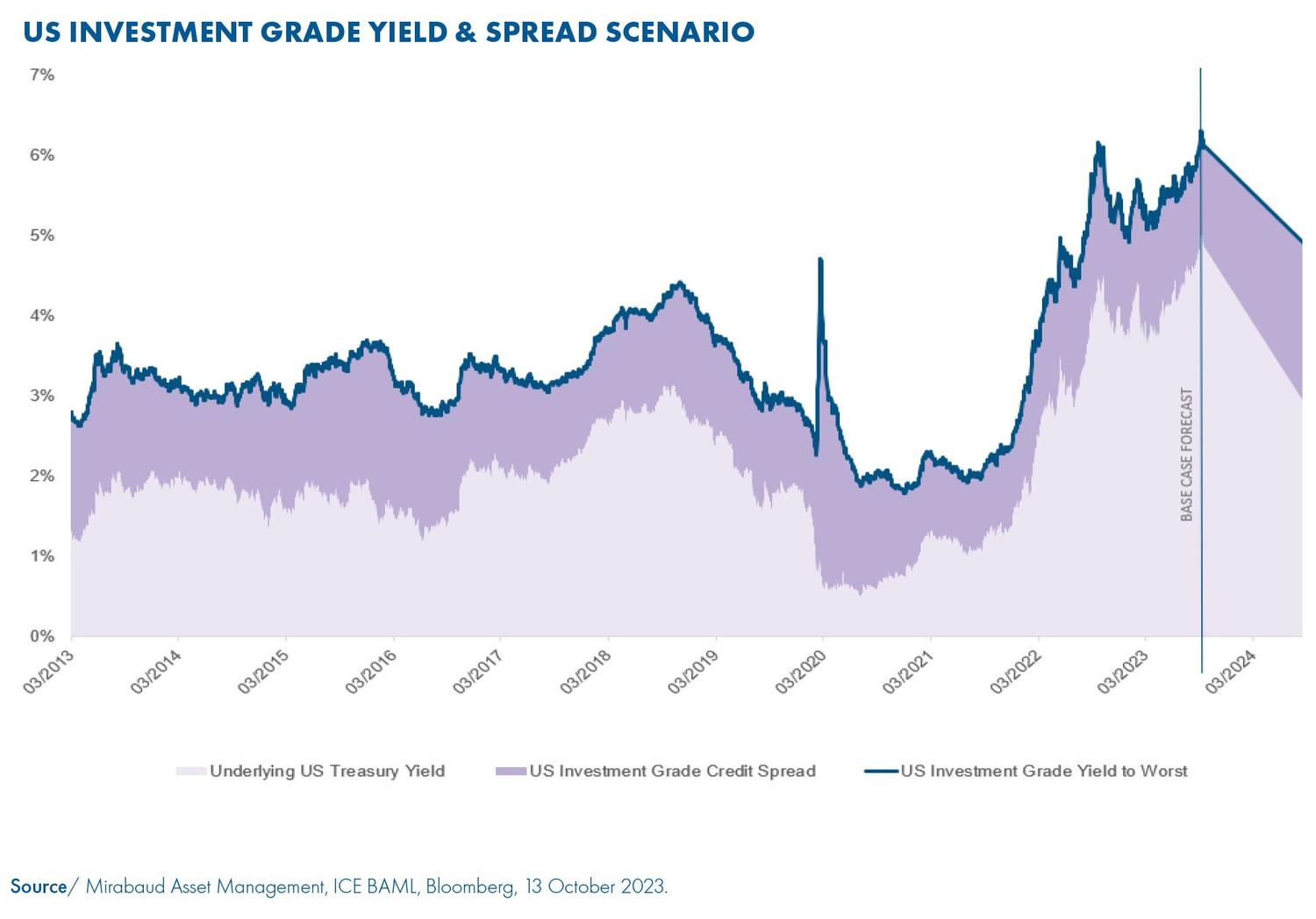

Here we’d expect to see spreads widen and the US Federal Reserve to lead the pack and begin cutting interest rates, causing government bond rates to rally. In this case, our view is that a fixed income portfolio of predominantly global investment grade and/or global government bonds makes the most sense, with lower government rates more than offsetting higher credit spreads, plus you also receive higher carry, facilitating a potential 12-month return profile of 10%+. Below we use a US investment grade scenario as an example.

SCENARIO 2: SOFT LANDING

No technical recession, inflation returns to 2% target

Inflation & policy mix |

|

Economic growth |

|

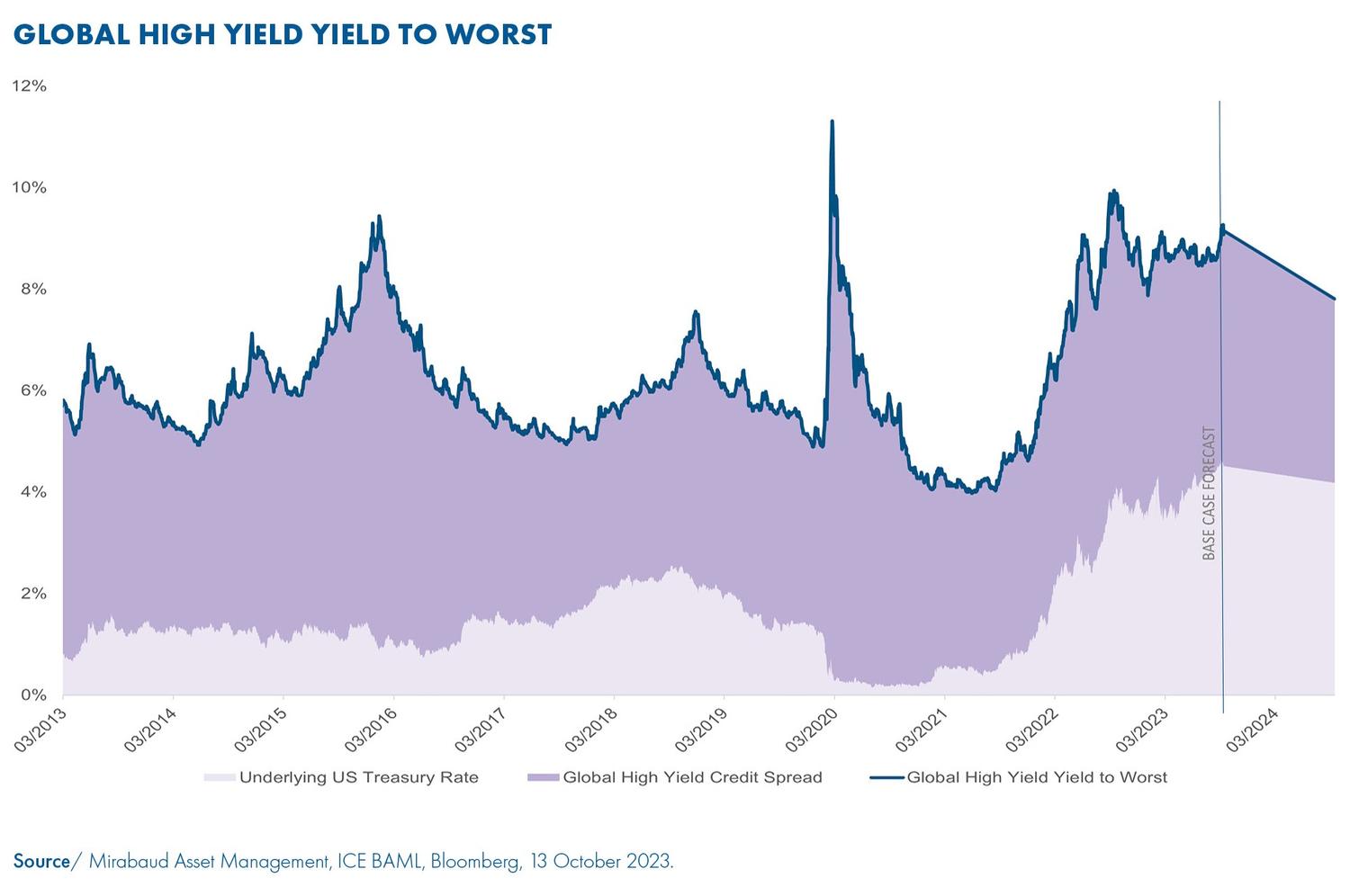

If we see a soft-landing scenario, we expect economic growth will slow but avoid a technical recession – that being two consecutive quarters of negative growth. This would remove the fear of a deep recession from high yield spreads and we’d expect to see the beginning of a new economic cycle being priced in. The outcome here would be spreads tighten and bond prices rally. In this environment of stabilised rates, high carry and spread compression, we would expect global high yield to deliver a 10%+ return, complemented by a low default rate.

SCENARIO 3: HIGHER FOR LONGER

Inflation proves more persistent, staving off rate cuts to late next year

Inflation & policy mix |

|

Economic growth |

|

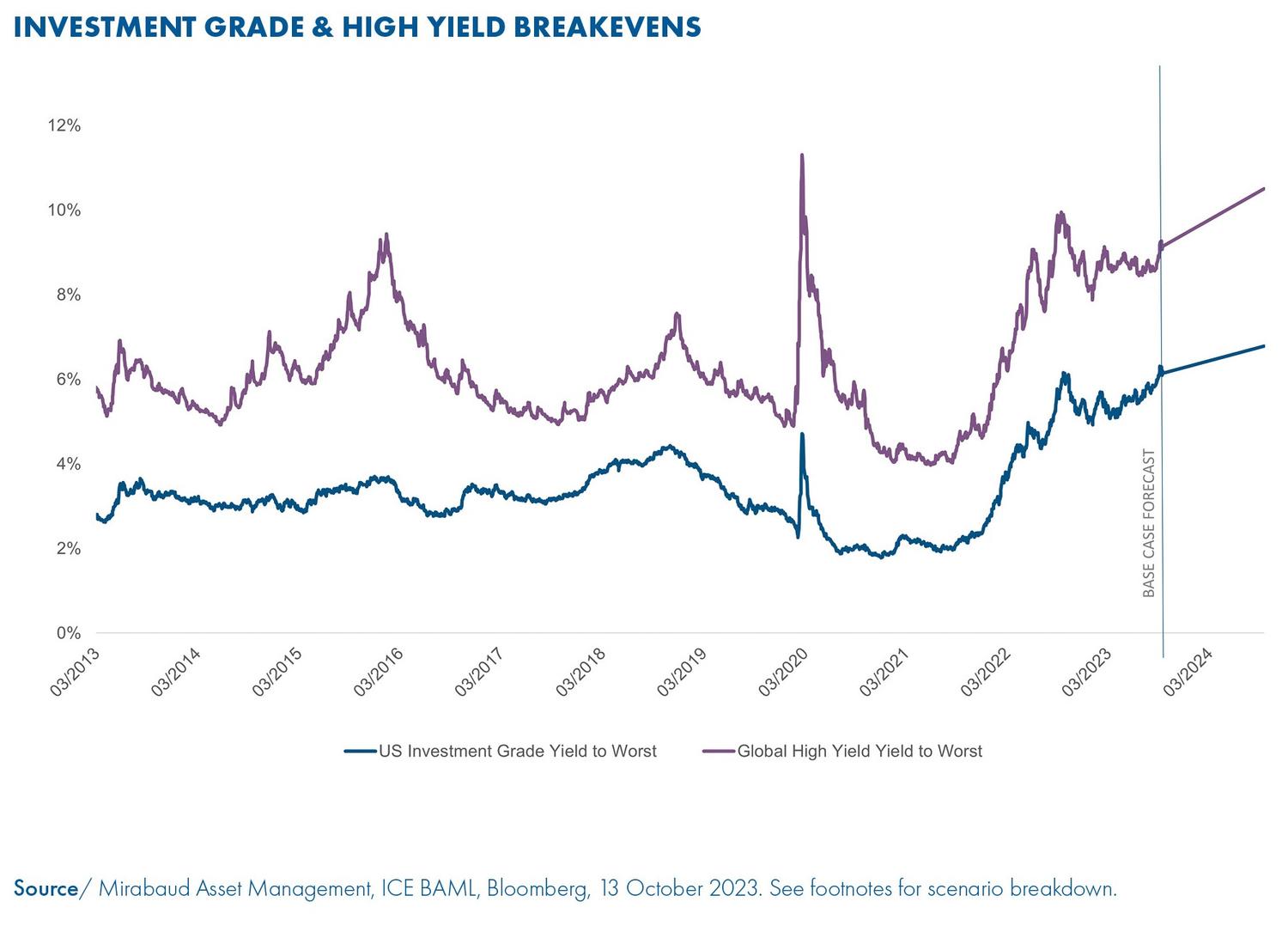

In this scenario, we would expect both rates and spreads to stay range bound near today’s high levels. Central banks are close to peak rates and it’s just a question of how long they stay there, while spreads are pricing in a reasonable chance of an economic slowdown but have no reason to blow-out. To benefit, our view is that you need high carry (yield/coupon) instruments in your fixed income allocation. Here, we look to global investment grade bonds and high-quality global high yield, as both offer historically high levels of carry in excess of 6%+ and 8+%, respectively.

The amazing thing in this scenario is that the carry buffer is so large that you have very high breakevens, so even if the scenario moves against you, returns should still be positive – resulting in what we think would be a beneficial asymmetric return profile.

On the desk, we’re expecting to be in scenario 3, ‘higher for longer’, until the data definitively turns towards one of the landing scenarios, which will likely become clear over the next six months or so. But fortunately, you don’t need to fear economic Cerberus, as fixed income offers attractive return opportunities for all three outcomes, in our view.

What we think is going to be key in driving performance is that you are positioned to receive carry while we wait for clarity on which scenario plays out. When the data starts to come through, the market will move quicker than you can re-allocate. Therefore, it’s essential to be positioned ahead of the move to capture it, and hey, receiving 6-8% in investment grade or high-quality high yield while you wait to make 10%+ seems like a good deal to me.

If you’re thinking this all sounds very US-focused, then you’re not wrong. While central banks have been broadly coordinated, individual country economic cycles do move at different speeds. For example, Europe seems likely to go into recession before the US, while the UK struggles with stickier inflation dynamics, delaying a Bank of England pivot. This is why we’re big advocates of a fully flexible, global approach that dynamically responds to macro developments and maximises opportunities across different economic cycles as they play out.

So, the key take away? There’s nothing to fear in fixed income, but you won’t get ahead by being out of the market.

Asset management

Benjamin CARTER

Head of UK Wholesale

Continuer vers