Equities

European Discovery Stories: Truecaller

Equities

This is not an investment recommendation. This example is designed to illustrate our investment process.

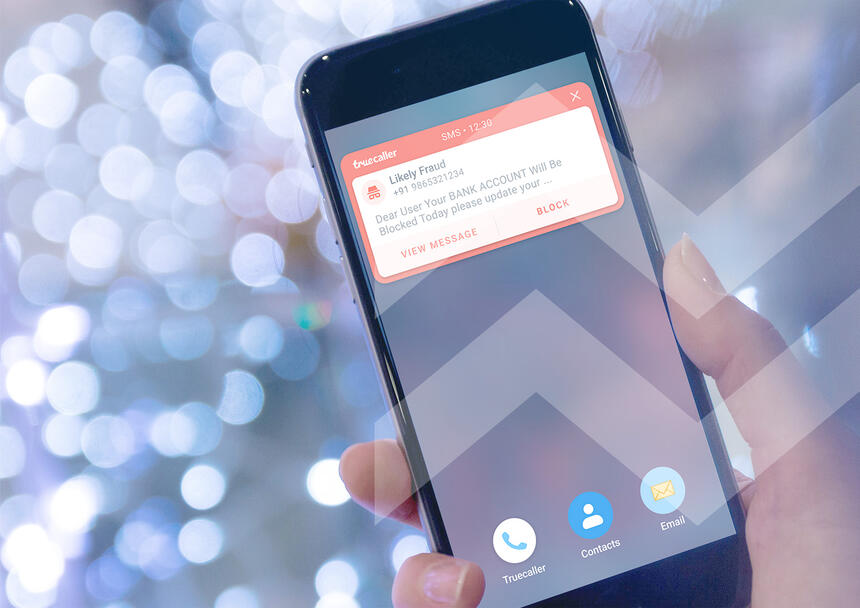

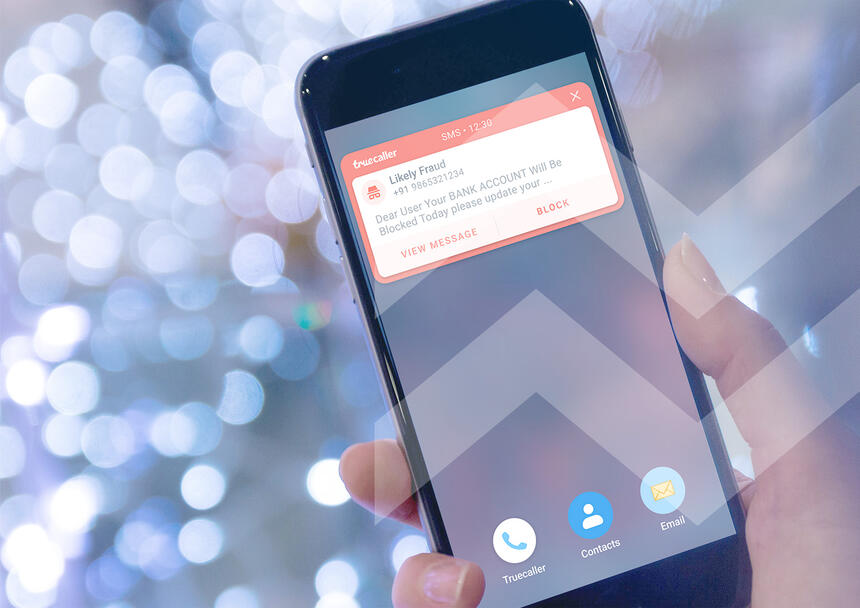

Scam calls are a problem nearly everyone can relate to. Aside from being annoying, they can have serious financial implications if the person on the other end of the line requesting your bank details isn’t who they say they are. And with AI and deep-fake capabilities improving all the time, how can you know for sure? In 2024, phone scammers stole USD1.03 trillion globally, with only 4% of scam victims able to recover their losses1.

Swedish company Truecaller is helping to tackle this problem by allowing users to verify caller IDs in real time, protecting individuals and businesses from fraud.

Founded in 2009 by two entrepreneurs in Sweden, Truecaller is a leading name in caller ID and spam blocking software. Fraud and unwanted communications are endemic to digital economies, especially in emerging markets (EM), where Truecaller is most established. Here, the majority of communication between businesses and their customers is carried out over the phone. Digital infrastructure for secure messaging and in-app communication is less established, and the majority of people have pay-as-you-go Android phones. Android-dominant markets contribute to the prevalence of phone scamming for several reasons – the phones are cheap, can be bought without ID, and the numbers are recycled frequently.

Truecaller’s largest market is India. Among a population of 1.4 billion2, half of all smartphone users have the app installed3. This vast reach helps power the company’s success, which is fuelled by strong network effects. Its app requires users to share contact information, which in turn strengthens the database that powers its verification engine. Truecaller estimates its core markets (India, Nigeria, Egypt, Algeria, South Africa) represent half of global smartphone users and will be exposed to 50%+ of future smartphone growth4. These markets all share the characteristics that drive Truecaller’s success: heavy mobile use, limited digital infrastructure, and high levels of fraud.

Truecaller is in the business of trust, and that starts with its staff. While its headquarters are in Stockholm, its workforce hails from 35 countries including its core operating markets5, giving them first-hand knowledge of the prevalence of scam calls and phone fraud. The app aims to build trust in digital transactions, with users sharing contact information to identify callers and report scam callers, collectively helping to prevent individuals from falling victim to scammers posing as legitimate institutions.

For consumers, the protection is free thanks to a ‘freemium’ model; its core offering is monetised through advertising. With over 1 billion app installs and 450 million active monthly users6, this model allows Truecaller to deliver safety at no cost to the user. After a long period of functioning best on Android, Truecaller now has a comprehensive iOS proposition, opening it up to the global iPhone customer base – a target market more likely to afford subscription premium features.

With such a vast reach, Truecaller offers large-cap scale in a c.EUR 2 billion7 smallcap structure. It is only covered by eight research analysts8, yet the company has a clear growth trajectory supported by secular tailwinds in digital trust and mobile-first commerce, alongside emerging market population trends.

1 Global Anti-Scam Alliance, 2024 Global State of Scams Report.

2 Statistics Times, May 2025.

3 Truecaller, 2021.

4 Truecaller, 2023.

5 Truecaller, 2023.

6 Truecaller, as at end 2024.

7 Bloomberg, May 2025.

8 Truecaller, 20 February 2025.

European Discovery Stories

European Equities

EUROPEAN EQUITIES

IMPORTANT INFORMATION

This marketing material contains or may incorporate by reference information concerning certain collective investment schemes (“funds”) which are only available for distribution in those jurisdictions and countries in which they are registered. It is for your exclusive use only and it is not intended for any person who is a citizen or resident of any jurisdiction where the publication, distribution or use of the information contained herein would be subject to any restrictions. It may not be copied or transferred.

This material is provided for information purposes only and shall not be construed as an offer or a recommendation to subscribe, retain or dispose of fund units or shares, investment products or strategies. Before investing in any fund or pursuing any investment strategy, potential investors should take into account all their characteristics or objectives as well as consult the relevant legal documents. Potential investors are recommended to seek prior professional financial, legal and tax advice. The taxation position affecting investors in each jurisdiction is outlined in the Prospectus. The sources of the information contained within are deemed reliable. However, the accuracy or completeness of the information cannot be guaranteed and some figures may only be estimates. In addition, any opinions expressed are subject to change without notice. There is no guarantee that objectives and targets will be met by the portfolio manager.

All investment involves risks, returns may decrease or increase because of currency fluctuations and investors may lose the amount of their original investment. Past performance is not indicative or a guarantee of future returns.

This communication may only be circulated to Eligible Counterparties and Professional Investors and should not be circulated to Retail Investors for which it is not suitable.

Issued by: In the UK: Mirabaud Asset Management Limited which is authorised and regulated by the Financial Conduct Authority (FRN: 122140). This product is based overseas and is not subject to FCA sustainable investment labelling and disclosure requirements. This document has been approved for the purposes of Section 21 of the Financial Services and Markets Act 2000, by Mirabaud Asset Management Limited at the date of publication. Any Mirabaud Funds referenced herein (unless otherwise stated) are to “recognised” schemes that are registered for distribution under the Financial Services & Markets Act 2000 (as amended). Potential investors in the United Kingdom are advised that none of the protections afforded by the United Kingdom regulatory system will apply to an investment in these Funds and that compensation will not generally be available under the Financial Services Compensation Scheme and that access to the UK Financial Ombudsman Scheme may be limited. In Switzerland: Mirabaud Asset Management (Suisse) SA, 29, boulevard Georges-Favon, 1204 Geneva, as Swiss representative. Swiss paying agent: Mirabaud & Cie SA, 29, boulevard Georges-Favon, 1204 Geneva. In France: Mirabaud Asset Management (France) SAS., Spaces 54-56, avenue Hoche, 75008 Paris. In Luxembourg, Italy and Spain: Mirabaud Asset Management (Europe) SA, 6B, rue du Fort Niedergruenewald, 2226 Luxembourg. The Prospectus, the Articles of Association, the Key Information Document (KID) as well as the annual and semi-annual reports (as the case may be), of the funds may be obtained free of charge from the abovementioned entities and on the webpage: www.mirabaud-am.com/en/funds-list/.Further information on sustainability is available at the following link: www.mirabaudam.com/en/responsibly-sustainable.

Continuer vers