At 1.5°C, the impacts would be serious but less severe, with lower risks of food and water shortages, lower risks to economic growth and fewer species at risk of extinction.[1]

That said, both scenarios come with heightened physical climate risk that will have profound impacts on global societies and economies.

What this means for ESG analysis

The potential physical consequences of physical climate change carry extremely significant financial costs.

Insurer Munich Re estimates that between 1980 and 2019, global natural disasters (of which almost 60% were meteorological and climatological) resulted in losses of c. $5.2 trillion, with the figures trending upwards.[5]

This is because extreme weather events lead to costly disruptions, with manufacturing operations having to pause at great cost or suffering a loss of revenue due to interruptions in their supply chains – creating an obvious incentive for measures to mitigate the impacts of these events.

Increasing instances of extreme weather events mean the infrastructure of towns and cities needs to be invested in. In March 2021 US President Joe Biden proposed a spending bill called “The America Jobs Plan,” that included an additional $621 billion USD of investment into transportation, infrastructure and resilience[6].

This creates an opportunity for investors looking to allocate capital to solution providers who will provide products and services that make towns and cities more resilient against the impacts of physical climate change.

Given the huge potential impact on companies of physical climate change, it is important that investors continue to engage with companies around their operational and supply chain exposure to extreme weather events and understand the risk management plans they have in place to address this risk.

This will encourage companies to disclose exposures around physical climate change and to enhance their mitigation strategies.

Case Studies

Below are some case study examples of how these themes can be considered within ESG analysis:

Novo Nordisk is a Danish pharmaceutical business focussed on manufacturing treatments and equipment related to diabetes. The business has an Active Pharmaceutical Ingredient (API) facility in Denmark for insulin treatments (80% of sales).

The Intergovernmental Panel on Climate Change (IPCC) predicts that precipitation will increase in northern Europe and that high extremes of precipitation (e.g. cloudburst events) will likely increase in magnitude and frequency[7]. Novo Nordisk estimates that in the event of heavy rainfall there is a risk of facility water damage resulting in DKK 20m-60m per week from sterilisation costs and increased operating costs.[8]

It is for this reason the business has invested in updating their sewer systems at facilities in areas with high water levels to route water to local green spaces

Advanced Drainage Systems is a US infrastructure business that makes drainage structures to manage the flow of urban stormwater using lightweight, recyclable high-density polyethylene (HDPE) pipes. This reduces the chance of flooding and sewage overflows in extreme weather conditions, using material that is less energy intensive to install, has a longer service life and is more recyclable than its concrete and steel alternatives.

In 2021, US President Joe Biden announced £111bn in water infrastructure investment to modernise aging drinking water, stormwater and wastewater systems as part of his “America Jobs Plan.”[9] Advanced Drainage is therefore well positioned to benefit from the US federal infrastructure spending aimed at mitigating the impacts of physical climate risk.

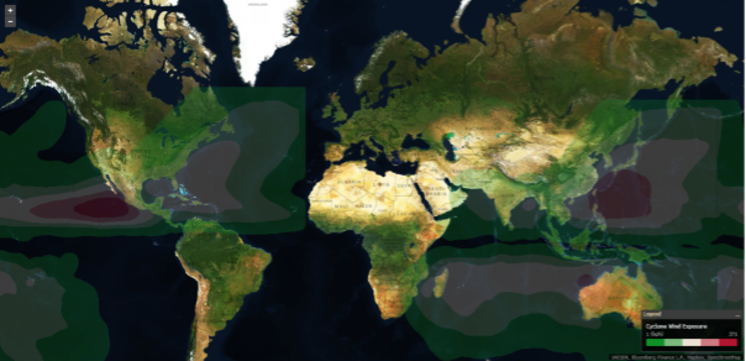

Colgate Palmolive is a leading oral care business. They have a manufacturing site in the Guangdong province of China, which is prone to flooding and cyclone risk. We engaged with the company in August 2021 and asked them to outline clearly how they manage these physical climate risks at that particular site as part of their Enterprise Risk Management framework.

Conclusion

Given the likelihood of increased frequency in extreme weather events, investors should ensure they are aware of the risks to the operations of the businesses they are invested in, seek out businesses solving some of the challenges of physical climate risk and engage with companies to ensure they are managing these risks properly.

IMPORTANT INFORMATION

This marketing document contains information or may incorporate by reference data concerning certain collective investment schemes ("funds") which are only available for distribution in the countries where they have been registered. This document is for the exclusive use of the individual to whom it has been given and may not be either copied or transferred to third parties. In addition, this document is not intended for any person who is a citizen or resident of any jurisdiction where the publication, distribution or use of the information contained herein would be subject to any restrictions or limitations.

The contents of this document are provided for information purposes only and shall not be construed as an offer or a recommendation to subscribe for, retain or dispose of fund units, shares, investment products or strategies. Before investing in any fund or pursuing any strategy mentioned in this document, potential investors should consult the latest versions of the relevant legal documents such as, in relation to the funds, the Prospectus and, where applicable, the Key Investor Information Document (KIID) which describe in greater detail the specific risks. Moreover, potential investors are recommended to seek professional financial, legal and tax advice prior to making an investment decision. The sources of the information contained in this document are deemed reliable. However, the accuracy or completeness of the information cannot be guaranteed, and some figures may only be estimates. There is no guarantee that objectives and targets will be met by the portfolio manager.

All investment involves risks. Past performance is not indicative or a guarantee of future returns. Fund values can fall as well as rise, and investors may lose the amount of their original investment. Returns may decrease or increase as a result of currency fluctuations.

This document is issued by the following entities: in the UK: Mirabaud Asset Management Limited which is authorised and regulated by the Financial Conduct Authority under firm reference number 122140.; in Switzerland: Mirabaud Asset Management (Suisse) SA, 29, boulevard Georges-Favon, 1204 Geneva, as Swiss representative. Swiss paying agent: Mirabaud & Cie SA, 29, boulevard Georges-Favon, 1204 Geneva. In France: Mirabaud Asset Management (France) SAS., 13, avenue Hoche, 75008 Paris. In Spain: Mirabaud Asset Management (España) S.G.I.I.C., S.A.U., Calle Fortuny, 6 - 2ª Planta, 28010 Madrid. The Prospectus, the Articles of Association, the Key Investor Information Document (KIID) as well as the annual and semi-annual reports (as the case may be), of the funds may be obtained free of charge from the above-mentioned entities.