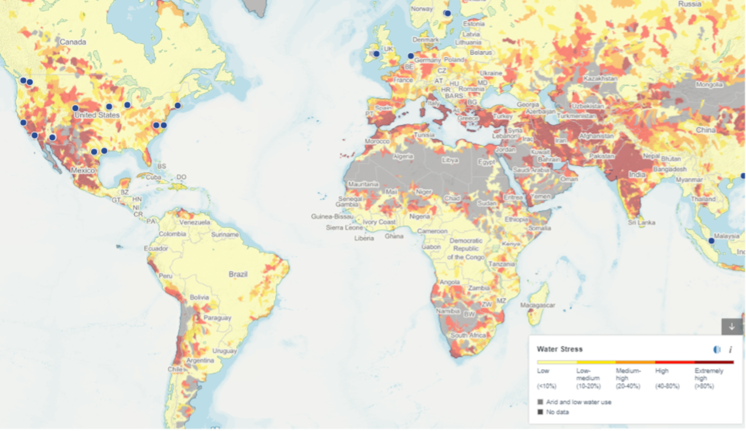

The future picture is even more disturbing: the World Resources Institute estimates that by 2040, almost one in four children will live in areas of extremely high water stress[3].

Alongside reducing greenhouse gas emissions, it is imperative that corporates and governments tackle this issue.

What does this mean for ESG analysis?

Water stress has the ability to financially affect companies in a number of ways: the cost of water itself, operational interruptions, environmental fines, and the expense of building new water-efficient infrastructure.

Studies have shown there can be a financial cost to delaying mitigation strategies - the 2020 Carbon Disclosure Project Global water report found that the potential financial impact of water risks to businesses was over five times higher than the cost of addressing them[4].

Water intensive sectors such as semiconductors, pharmaceuticals and household products can be exposed if they locate their manufacturing sites in regions of water stress.

If there is insufficient water supply to these sites, companies might need to introduce special measures, such as shipping water in from more replenished basins at substantial extra cost.

A poor water supply can mean cuts in production and consequently the disposal of other input material used in the production process, which can increase costs and reduce revenue.

Companies have the opportunity to address this through reducing their water consumption and developing initiatives for the recycling of waste water.

This can have positive operational benefits, as it can shorten production timetables and cut down on how much companies pay for their water supplies. These measures can result in financially material savings that could increase operating margins.

We also believe it is critical for investors to engage with businesses on their exposure to water stress and their water management strategies.

Encouraging companies to publish reduction targets, disclose relevant data on water use, and outline their overall water management strategy will help tackle water scarcity, and it will allow investors to more accurately price in both the risks and opportunities in relation to water stress.

Case Studies

Below are some case studies of holdings in Mirabaud’s Sustainable Global Equities fund that illustrate how these themes can be considered within ESG analysis and the critical importance of engagement in our investment process:

Taiwan Semiconductor Manufacturing Company (TSMC) is a global semiconductor manufacturer. Their raw wafer and chemical company suppliers need fresh water in their manufacturing processes and a third of their raw materials supply chain is based in regions in Taiwan facing water stress.

TSMC estimates that three days of drought in the region could result in c. $99m of lost revenue as well, as well as disruption and added costs for their customers further down the supply chain[5]. Future reports of severe drought in the region would lead us to discount revenue growth in that quarter for both TSMC and their customers further down the supply chain.

TSMC also has a comprehensive water reduction plan[6] running between 2016 and 2025, where it aims to:

- Reduce water discharge loss and overall water consumption across all their facilities

- Create new wastewater recycling facilities and expand their capacity

- Be on track to reduce water consumption per unit by 30% against 2010 figures.

The company estimates that reducing water consumption will allow them to bring forward their production schedule by around three months and save between $270m and $1.08bn per annum by 2025[7]. This is a positive material impact for the operating margin that we believe enhances the investment case of the business

Thermo Fisher Scientific is a supplier of equipment for healthcare, diagnostics and environmental research. Water is used in their pharmaceutical products and in the manufacturing and cleaning of articles such as microscope slides. Eleven of their manufacturing facilities are in regions of extreme water stress.

During our February 2021 engagement meeting with the business, they outlined their plan to conduct operational water materiality analysis. We subsequently encouraged the business to publish the results and how this was being integrated into their broader strategy, given their operational exposure, so investors can better assess their approach.

Conclusion

It is critical for investors to incorporate water management into their assessment of companies. This is not only to tackle the growing problem of global water scarcity, but due to the multitude of ways water risk can impact shareholder value.

IMPORTANT INFORMATION

This marketing document contains information or may incorporate by reference data concerning certain collective investment schemes ("funds") which are only available for distribution in the countries where they have been registered. This document is for the exclusive use of the individual to whom it has been given and may not be either copied or transferred to third parties. In addition, this document is not intended for any person who is a citizen or resident of any jurisdiction where the publication, distribution or use of the information contained herein would be subject to any restrictions or limitations.

The contents of this document are provided for information purposes only and shall not be construed as an offer or a recommendation to subscribe for, retain or dispose of fund units, shares, investment products or strategies. Before investing in any fund or pursuing any strategy mentioned in this document, potential investors should consult the latest versions of the relevant legal documents such as, in relation to the funds, the Prospectus and, where applicable, the Key Investor Information Document (KIID) which describe in greater detail the specific risks. Moreover, potential investors are recommended to seek professional financial, legal and tax advice prior to making an investment decision. The sources of the information contained in this document are deemed reliable. However, the accuracy or completeness of the information cannot be guaranteed, and some figures may only be estimates. There is no guarantee that objectives and targets will be met by the portfolio manager.

All investment involves risks. Past performance is not indicative or a guarantee of future returns. Fund values can fall as well as rise, and investors may lose the amount of their original investment. Returns may decrease or increase as a result of currency fluctuations.

This document is issued by the following entities: in the UK: Mirabaud Asset Management Limited which is authorised and regulated by the Financial Conduct Authority under firm reference number 122140.; in Switzerland: Mirabaud Asset Management (Suisse) SA, 29, boulevard Georges-Favon, 1204 Geneva, as Swiss representative. Swiss paying agent: Mirabaud & Cie SA, 29, boulevard Georges-Favon, 1204 Geneva. In France: Mirabaud Asset Management (France) SAS., 13, avenue Hoche, 75008 Paris. In Spain: Mirabaud Asset Management (España) S.G.I.I.C., S.A.U., Calle Fortuny, 6 - 2ª Planta, 28010 Madrid. The Prospectus, the Articles of Association, the Key Investor Information Document (KIID) as well as the annual and semi-annual reports (as the case may be), of the funds may be obtained free of charge from the above-mentioned entities.