KNOW WHAT YOU OWN

A trend towards passive

Research has shown that an active management approach will, over time, likely underperform passive equity portfolios. This has driven managers, sponsors and other investment decision makers, to move away from active investment strategies towards indexation. This trend towards passive is predicted to continue. For example, in September 2019 last year, assets in U.S. index-based equity mutual funds and ETFs topped those in active stock funds for the first time*.

The case for indexation in equities is well documented through multiple studies conducted under a variety of market conditions. For example, 70% of European active equity funds underperformed the S&P Europe 350 Index during 2019**. However, perhaps this observation, and the resultant conclusions and responses of market participants, means the investment community is looking in the wrong direction. It implies that selecting either active or passive funds is a permanent investment commitment, rather than realising the decision to buy or sell, the duration of ownership, and the size of the investment, is an active choice.

The traditional mantra

This misunderstanding is based on the “mantra” that you cannot or should not attempt to time the market. This mantra is widely accepted and trying to time the markets is seen as a foolish and imprudent pursuit. Major disruptive events inevitably lead to a herd instinct to exit the market at the wrong time, and then subsequently poorly time or, even worse, fail at attempts to reinvest. The potential impact of this behaviour to sit on the side-lines during market corrections is exhibited in studies. For example, being out of the S&P 500 Index for the best 10 performing days over the previous 20 years would have cut your overall returns by half. Furthermore, being out the market for the best 20 days would have lost you money in nominal terms***. This is a strong argument to remain invested in periods of major disruption and market corrections. But what the above misses is that it doesn’t represent the real world reality that every time an investor buys, increases, reduces or sells a fund, or switches between asset classes, geography, sectors or investment styles, there is an element of market timing going on, and they are all active decisions.

Why is Indexation in general, and ETF investing in particular, so popular?

We believe there are several reasons:

Cost: Although a direct comparison between the return of an active fund and an index has a fault in its logic (because you cannot buy the index without cost) the bulk of passive money shows average fees of circa 0.4% versus 1.4% for active funds****.

Structure: Mutual funds suffer the disadvantage of the need for order reconciliation and a highly involved processing infrastructure, through to trading the underlying securities, which generates considerable costs and fees. Conversely participants in ETF’s can effectively trade with each other, not a fund manager, which reduces cost.

Transparency: Many mutual funds suffer from a lack of transparency, with full disclosure of holdings hidden from view, while both index constructions are implicitly visible. Indeed, many ETF’s disclose full holdings daily.

Misunderstandings

A common misunderstanding is that owning an index carries no risk beyond the systematic risk of owning the ‘market’. This can be somewhat misleading. Investing in an index comes with nuanced considerations, which have investment implications. For example, the FTSE 100 Index has explicit factor bias’s that change through time. This is more easily understood when one considers how its sector composition has altered over say the last 20 years. This can mean the index sensitivity to exogeneous macro events will vary as the index composition evolves. Many large, well run FTSE 100 companies have been taken over in recent years, which has left the index more ‘value’ and cyclically orientated than it used to be. In technical speak, this means an index is rarely style neutral.

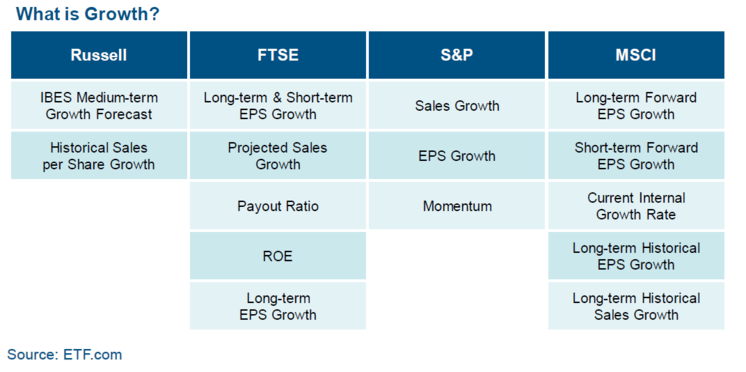

A key consideration for any investor, including those using passive and active investment approaches, is to understand what you are investing in. In addition, for those implementing an index-based approach, it is important to have a clear understanding of what the strategy tracks. Creating index exposure involves choices by the index provider in the classification and/or constituency of the index, driving very different outcomes. For example, in emerging market equities some index providers include certain important markets such as South Korea while others do not. The same is true of style based or smart beta approaches. The actual exposures can vary considerably depending on the methodologies used to create the index on which the investment will be based. Asking the index provider what they mean by ‘growth’ or ‘value’, can lead to radically different sets of stocks in the index as well as weightings.

To explain this, the schematic below shows the differing inputs or metrics that some well-known Index providers use when constructing a ‘growth’ index.