Fixed Income

Extraordinary times in EM debt

Fixed Income

It’s an extraordinary time across the global fixed income universe. Emerging debt markets – which rarely enjoy an easy ride – are battling against seven major headwinds.

What’s the effect of this macro backdrop on EM debt?

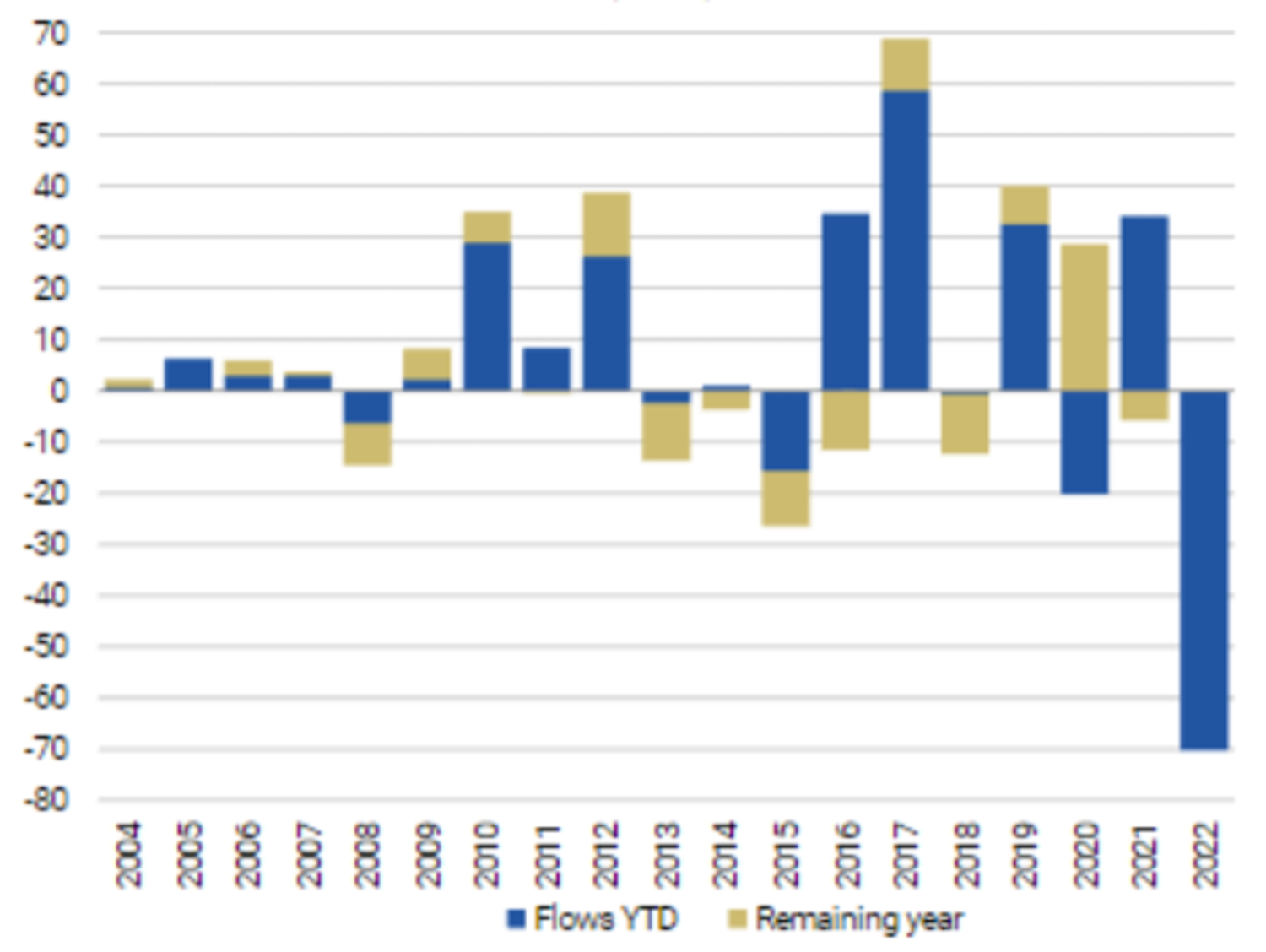

The asset class has suffered outflows of over USD70bn year-to-date, layering on top of significant outflows in H2 2021.

EM debt dedicated total annual & YTD flows (US$bn)

Source: Morgan Stanley, as at 30 September 2022

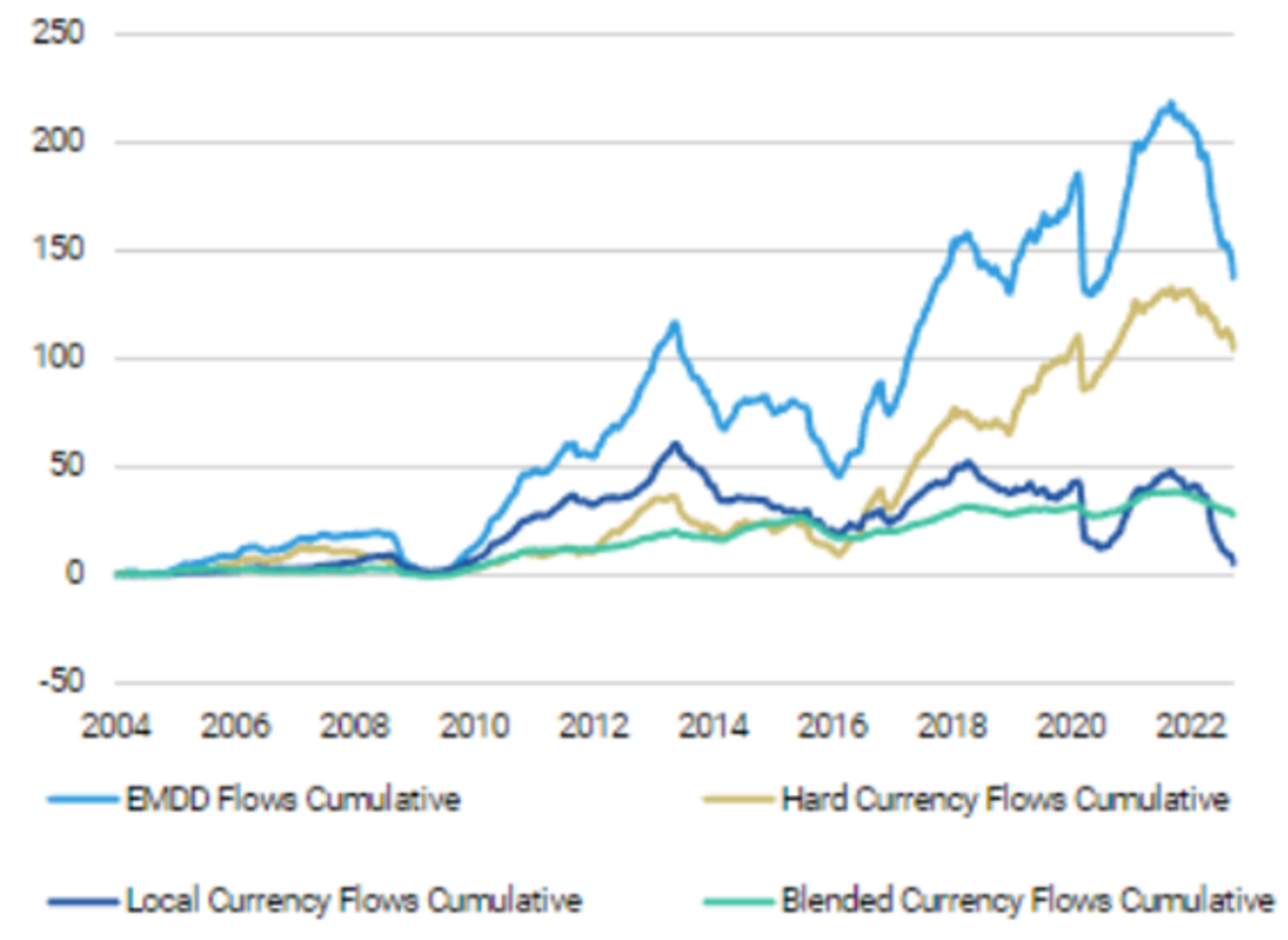

While it’s not easy to find a silver lining in the flows data, the EM local currency debt does offer us one. Local currency investments in dedicated EM funds are now close to zero, illustrating an unravelling over 20 years of inflows into the sub-asset class in just 18 months. Given that money flows are what ultimately dictate asset prices, with no flows left to come out from dedicated funds, pricing pressure should reduce.

EM debt cumulative flows (USD$bn)

Source: Morgan Stanley, as at 30 September 2022

What’s going to happen next?

US Federal Reserve (Fed) policy has arguably been the biggest driver of market direction this year, so to build an outlook on EM, you need to take a view on US policy direction.

I think Fed policy has become dislocated – it overdid the Covid response, ignored inflation for over a year and is now ignoring the risk of recession. The Fed desperately needs credibility and looks likely to do whatever it takes to claw some back by bringing headline inflation down. But the likelihood of another policy mistake is high. Should this manifest and policy has to be reversed to preserve market integrity, this could prove a positive catalyst for EM risk assets.

Are there any opportunities in EM debt?

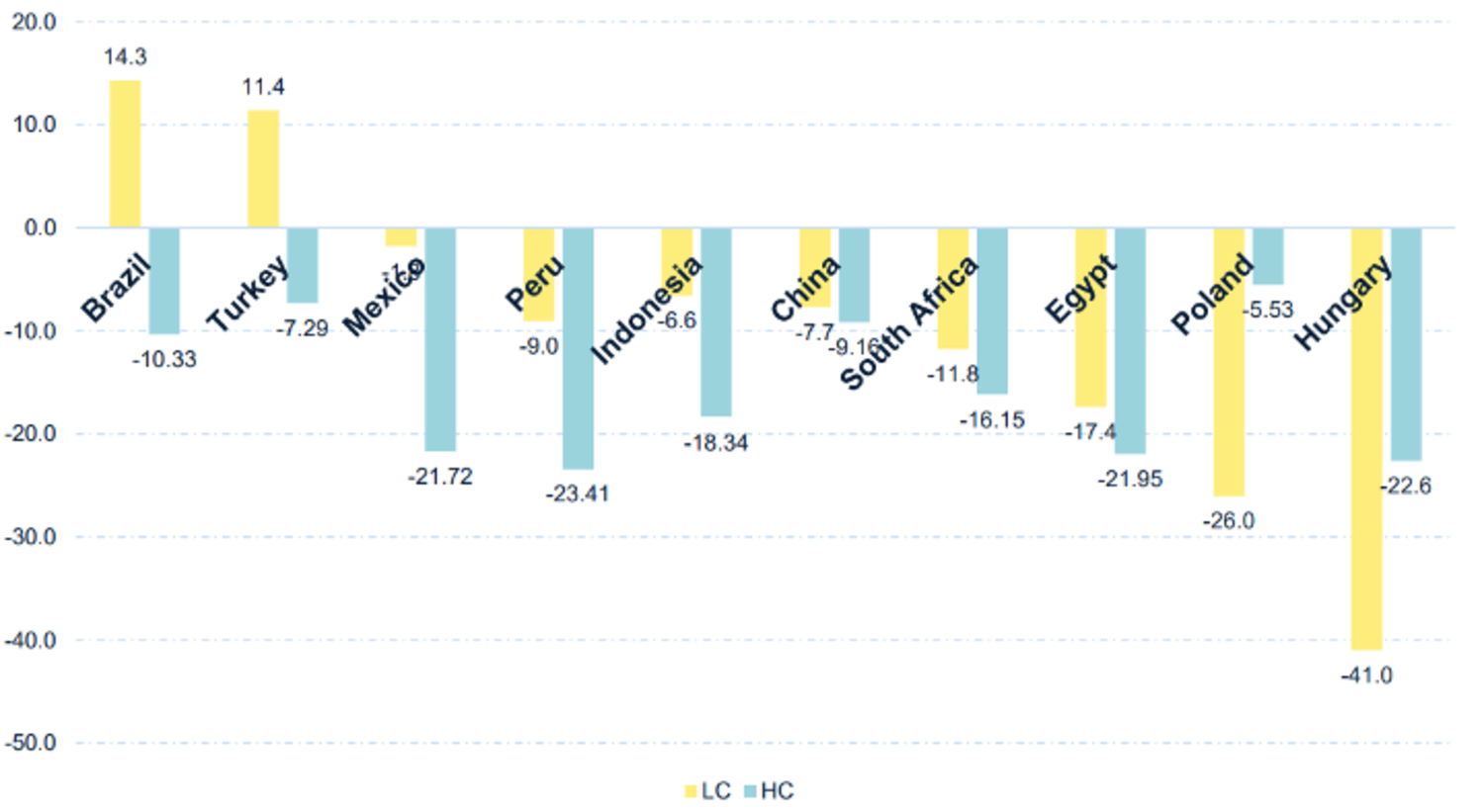

Now is a time for individuality, not aggregates. It’s undeniable that the universe as a whole is not a good buy, but given it totals over USD30 trillion spread across over 80 economies[3], there are certainly specific opportunities within it. Brazil, Mexico and the Middle East are markets we have been finding attractive investments in recently. And with Fed policy proving so dominant, currency also counts for a lot right now. For example, Brazilian local currency sovereign debt has delivered 14.3% year-to-date to 3 October, whereas the hard currency equivalent is down -10.3%1. Similarly, in local currency, Turkey is up 11.4% year-to-date, while the hard currency debt is down -7.3%1.

Metrics across the market are at 20-year extremes, which you can view as alarming or as providing a natural opportunity to add to quality positions. High-quality investment grade and some of the most highly rated names within the high yield universe offer attractive prospects, in my view.

2022 year-to-date EM debt index returns (%)

As measured by JPMorgan Emerging Market Bond Global Diversified Index (EMBIGD) and JPMorgan Government Bond Index-Emerging Markets Global Diversified (GBI-EM)

Source: JPMorgan as at 7 October 2022.

[1] Mirabaud Asset management, October 2022

[2] The Economist, February 2022

[3] Bloomberg, as at 3 October

IMPORTANT INFORMATION

This marketing material is for your exclusive use only and it is not intended for any person who is a citizen or resident of any jurisdiction where the publication, distribution or use of the information contained herein would be subject to any restrictions. It may not be copied or transferred.

This material is provided for information purposes only and shall not be construed as an offer or a recommendation to subscribe, retain or dispose of fund units or shares, investment products or strategies. Potential investors are recommended to seek prior professional financial, legal and tax advice. The sources of the information contained within are deemed reliable. However, the accuracy or completeness of the information cannot be guaranteed and some figures may only be estimates. In addition, any opinions expressed are subject to change without notice.

All investment involves risks, returns may decrease or increase because of currency fluctuations and investors may lose the amount of their original investment. Past performance is not indicative or a guarantee of future returns.

Issued by: in the UK: Mirabaud Asset Management Limited which is authorised and regulated by the Financial Conduct Authority. D14 In Switzerland: Mirabaud Asset Management (Suisse) SA, 29, boulevard Georges-Favon, 1204 Geneva. In France: Mirabaud Asset Management (France) SAS., 13, avenue Hoche, 75008 Paris. In Luxembourg, Italy and Spain: Mirabaud Asset Management (Europe) SA, 25 avenue de la Liberté, L-1931 Luxembourg.

Continuer vers