Convertible Bonds

2023’s new-issuance surge marks a long-term trend

Convertible Bonds

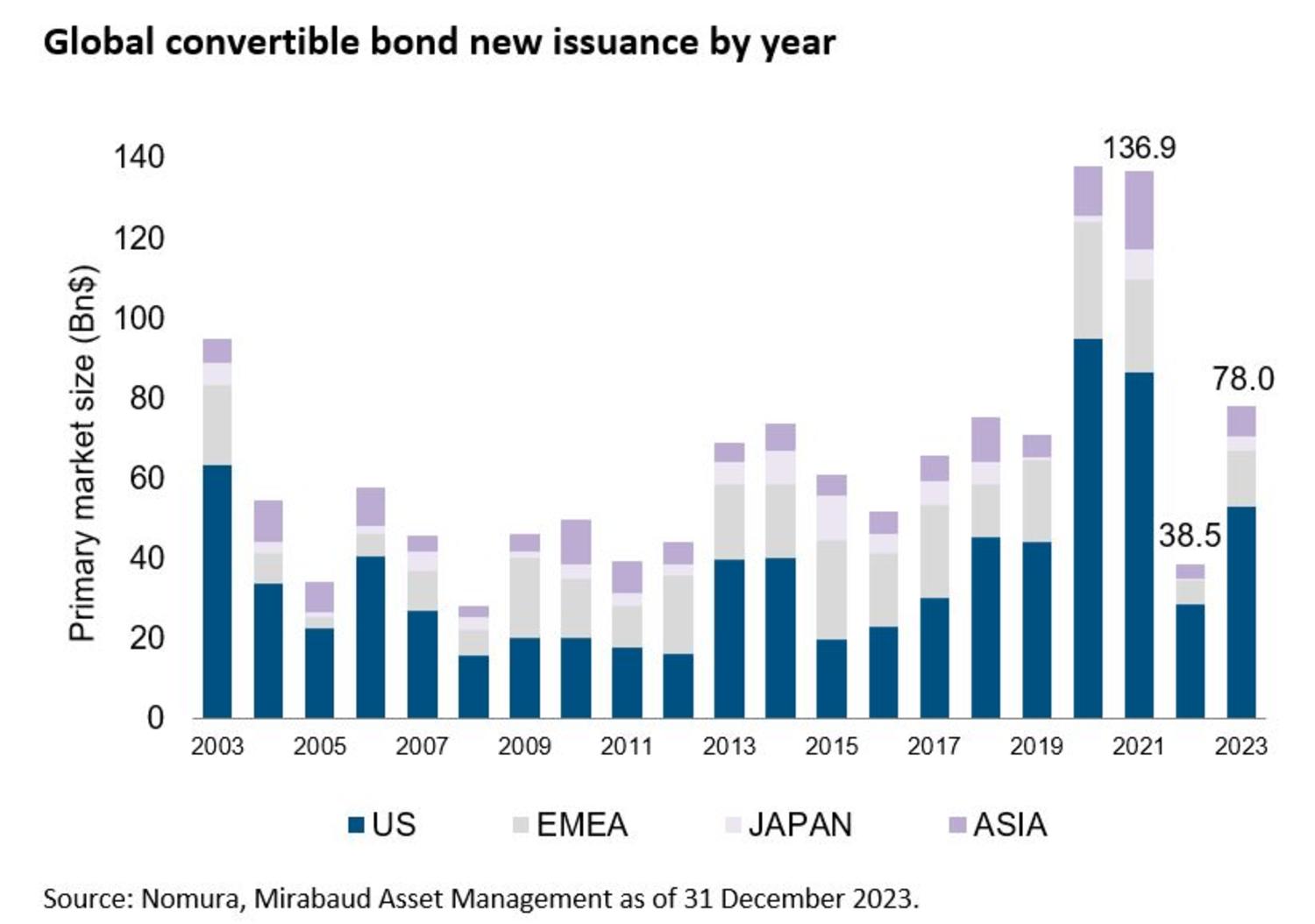

A backdrop of higher borrowing costs has historically favoured convertible bonds over straight credit financing. The primary market for global convertibles in 2023 was more than double that of 2022, with volumes reaching USD78bn via 115 new issues. Although that is almost half the volume of the 2020–2021 pandemic timeframe, it is well above the average of USD60bn for the decade to 2019.

Nearly 37% of proceeds have been used for debt refinancing, which is a near-record since 1998, according to BofA Research. This trend is indicative of convertibles' growing popularity in a rising rates environment. As the Financial Times wrote on 4 January, “US companies dive into convertible debt to hold down interest costs”, with US volumes representing close to 60% of global issuances.

Convertibles – which have historically been the preference of start-up tech and biotech businesses – are increasingly drawing interest from established players across a variety of industries. Near to 30% of 2023’s new deals globally were investment grade-rated, marking a record since 2013. The uptick was driven by utilities, which comprised 15% of all new paper. It is worth noting that deal terms were in investors’ – rather than issuers’ – favour, with final pricing often coming at a discounted price to fair value.

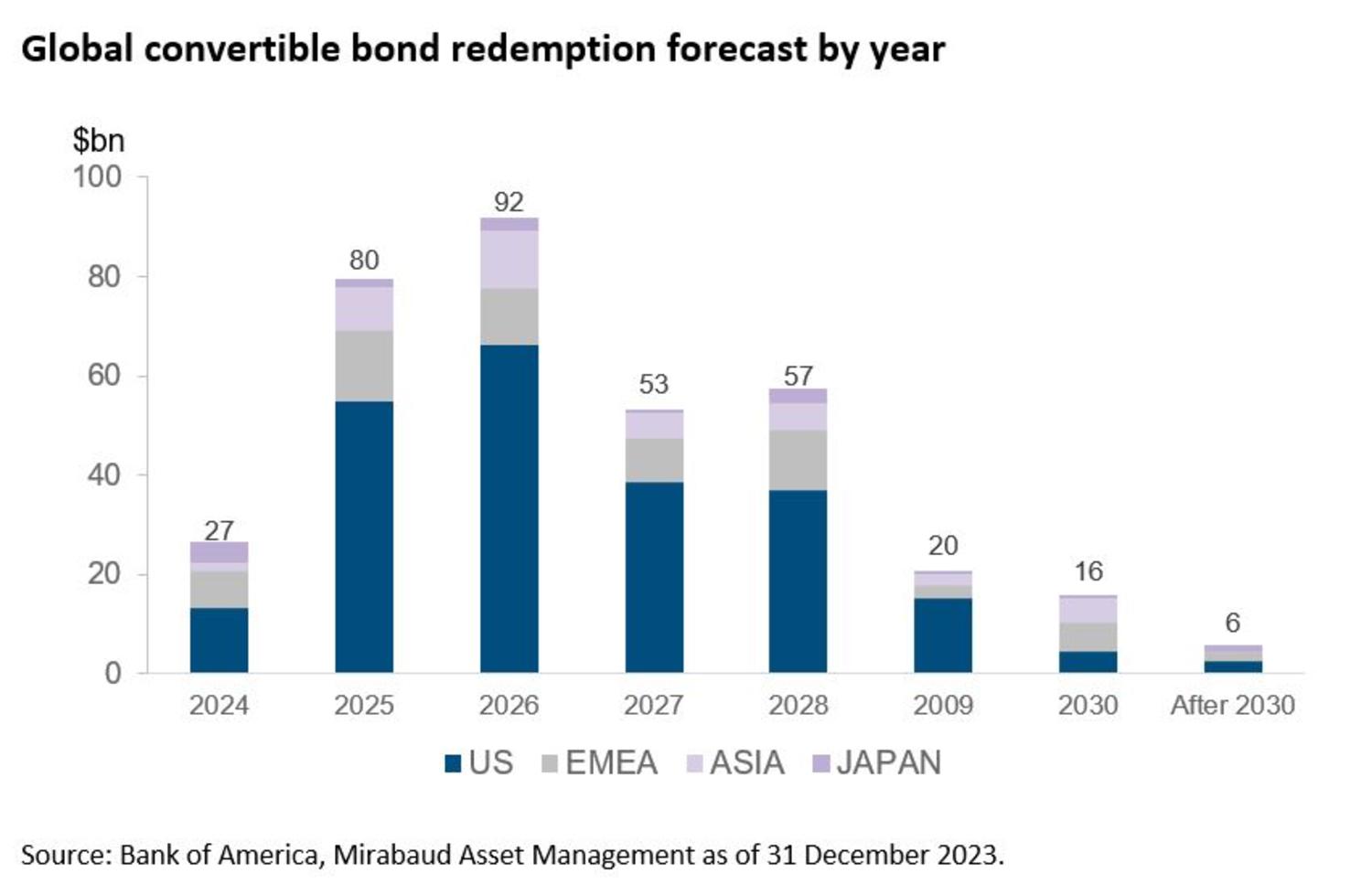

We anticipate that this refinancing trend will persist in 2024 due to the approaching maturity wall in both straight and convertible bonds. In addition to USD600bn of global high yield paper scheduled to retire by 2026, there will be USD80bn of convertibles due in 2025 and USD92bn in 2026, of which 55% and 71% respectively currently have a delta below 40% and so a low chance of conversion.

In that context, CFOs may face greater pressure to act than they did in 2023, when they had the luxury of time to wait for a period of lower costs before acting. We anticipate issuers of investment grade and high yield bonds to prefund 12 months and 18 months before maturity – not only to get ahead of the massive refinancing wave in the broader convertibles market, but also to take advantage of favourable financial conditions.

Next month, we will detail why we think the current boom in the primary market is on the verge of boosting the upside participation of convertibles to rising equities.

Convertible Bonds

CONVERTIBLE BONDS

Continuer vers