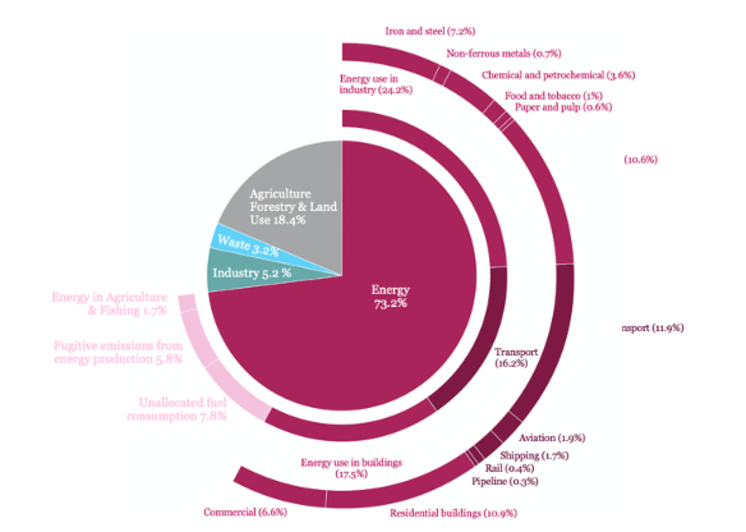

Around 40% of global greenhouse emissions are driven or influenced by companies through their purchases (purchased goods and services) and through the products they sell (use of sold products)[5]

Considering impacts of climate change

We are heavily focused on the strategy that issuers have in transitioning to lower carbon, looking at actions to decrease emissions in the short-term and in the long-term – and reviewing their momentum of change. Understanding the full picture of their emissions, especially across their value chain, will be key. With this in mind, it’s important to continue encouraging companies across sectors to disclose and be more transparent on their carbon emissions across the value chain by disclosing in line with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations. This will help harmonise disclosed data and identify hotspots, which we can explore further through our engagement programme with issuers.

We focus on bottom-up climate-related risk analysis to understand how well issuers are factoring in climate and transition risks so we can better understand the investment impacts. However, one year’s worth of data only provides a snapshot - we need to measure this information in a consistent way year after year to identify if there is a positive momentum by issuers in reducing their greenhouse gas emissions.

Managing risks and opportunities in decarbonisation

As the global economy decarbonises, industries will experience positive disruption and staying competitive in this environment will separate out those issuers that are successful in navigating the energy transition and those that are not.

There is also an opportunity, as investors, to shift capital away from carbon intensive industries and companies, for which renewables are a viable alternative (i.e., thermal coal industry). We believe that decarbonising to meet net-zero alignment by 2050 and the interim goal of 50% emission reductions by 2030 requires a quick and complete phasing out of thermal coal. Consequently, exclude pure thermal coal players. This reduces our risk and exposure to carbon-intensive and carbon-dependent companies and industries; and manages stranded-asset risk and long-term environmental risks.

Our focus then shifts on a two-pronged approach. First, using our capacity as investors to allocate capital and reward companies that are changing their businesses and adopting climate solutions. These solutions can range from electrification to energy efficiency to renewable storage solutions. Second, engage with companies in high emitting industries (such as car, agriculture or oil and gas companies). These companies are themselves looking to invest to change their business to accelerate the energy transition and arrive at Paris aligned business activities.

[4]https://www.msci.com/www/blog-posts/scope-3-carbon-emissions-seeing/02092372761

[5]https://sciencebasedtargets.org/resources/files/SBT_Value_Chain_Report-1.pdf

IMPORTANT INFORMATION

This marketing document is for the exclusive use of the individual to whom it has been given and may not be either copied or transferred to third parties. In addition, this document is not intended for any person who is a citizen or resident of any jurisdiction where the publication, distribution or use of the information contained herein would be subject to any restrictions or limitations.

The contents of this document are provided for information purposes only and shall not be construed as an offer or a recommendation to subscribe for, retain, pursue or dispose of fund units, shares, investment products or strategies. Potential investors are recommended to seek professional financial, legal and tax advice prior to making an investment decision. The sources of the information contained in this document are deemed reliable. However, the accuracy or completeness of the information cannot be guaranteed, and some figures may only estimates. All investment involves risks.Past performance is not indicative or a guarantee of future returns, and investors may lose the amount of their original investment.

This communication may only be circulated to Eligible Counterparties and Professional Investors and should not be circulated to Retail Investors for whom it is not suitable.

This document is issued by the following entities: in the UK: Mirabaud Asset Management Limited which is authorised and regulated by the Financial Conduct Authority under firm reference number 122140; in Switzerland: Mirabaud Asset Management (Suisse) SA, 29, boulevard Georges-Favon, 1204 Geneva, as Swiss representative. Swiss paying agent: Mirabaud & Cie SA, 29, boulevard Georges-Favon, 1204 Geneva. In France: Mirabaud Asset Management (France) SAS, 13, avenue Hoche, 75008 Paris. In Spain: Mirabaud Asset Management (España) S.G.I.I.C., S.A.U.., Calle Fortuny, 6 - 2ª Planta, 28010 Madrid.