Convertible Bonds

M&A wave could enhance convertible bond returns in 2024

Convertible Bonds

Takeover activity was strong in 2023, both among private equity and strategic buyers. The outlook for this year looks just as promising, in our view, reflecting the recent improvements in liquidity and economic conditions. There is a large amount of dry powder to be deployed, and the hope that interest rates are stabilising should build market confidence, although the Federal Reserve has been unwilling to provide reassurances on this.

Regarding convertible bonds, acquisitions play an important role, since they are, in general, protected by change-of-control clauses.

The convertible bond (CB) asset class incorporates two protective mechanisms in case of ownership shifts. While CBs with a high conversion premium would not benefit from the profitability of the ratchet clause, they remain attractive thanks to the “put clause”. Puts are beneficial for out-of-the-money convertibles trading below par. We saw this in Q1 2024, when a California-based business software provider was acquired by two private equity firms, which pulled-to-par its 1% CB from the mid-80s. We were positively exposed to this activity in our small and mid-cap strategy.

In our view, this interdependent relationship underscores the appeal of the CB asset class in a merger & acquisition (M&A) landscape, regardless of market conditions.

Chart 1 depicts a total of 17 takeovers within the global convertible bonds universe since early 2023, with the most recent being the acquisition of a medical device maker by a US healthcare giant, announced on 5 April 2024. The device maker’s 1% 15/08/2028 convertible, issued last summer and held in our global strategy, gained 26% from announcement to mid-April, additionally boosted by its “ratchet clause”, which increased the conversion ratio to compensate for the loss of value time. This acquisition serves as a testament, in our view, to burgeoning signs of optimism as the appetite for strategic deals among businesses primed for growth continues to rise.

Transactions have surged within the software realm, and healthcare is also undergoing substantial transformation, rendering it a dynamic sector worth monitoring closely.

Additionally, the global drive for decarbonisation has spurred activity, exemplified by a prominent global investment firm's acquisition of a pure-play German renewable energy company, which concentrates on European onshore wind and solar. We included the German issuer’s 1.875% perpetual convertible bond in our portfolios on account of its robust growth potential, with much of it not yet reflected in the valuation.

Looking deeper into 2024, we anticipate this trend persisting, fueled by the positive impact of a strong ESG profile on long-term business growth, particularly amidst the ongoing surge of regulatory measures in this domain.

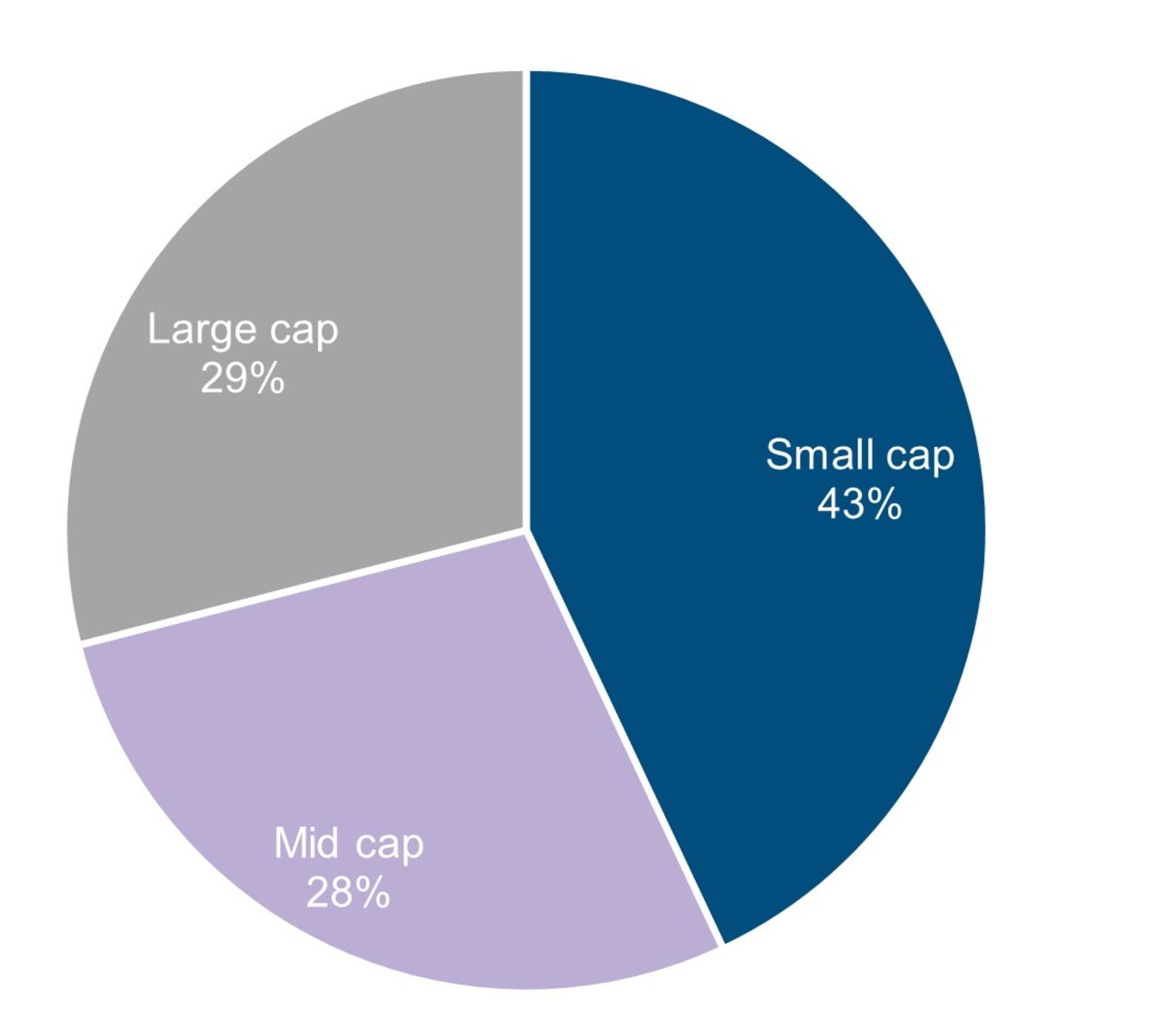

Convertibles have thus a notable presence in takeover activity, largely driven by the substantial number of small and mid-cap issuers (with market capitalisations below USD5 billion). These issuers constituted 71% of takeover targets within the global convertible bond universe from 2014 to the end of March 2024, as depicted in chart 2.

In our assessment, a synchronised upswing in global economic growth is likely to boost companies’ confidence to pursue transformative deals, especially those with the means to proceed without relying on external financing. Historically, M&A activity tends to occur near the peak of economic cycles, when companies face challenges in achieving the robust earnings per share growth expected by the market through organic means alone.

We also believe that pricing power plays a significant role in driving M&A activity across many industries, often leading to waves of acquisitions as competitors feel urgency to seize on a consolidation trend. Additionally, there is a notable focus on integrating appropriate technologies within traditional industrial manufacturing settings, offering management the potential to substantially reduce costs and enhance efficiency.

Given this context, we believe M&A activity has the potential to significantly enhance returns, particularly as a series of convertible bond issuers may attract buyers.

Convertible Bonds

CONVERTIBLE BONDS

Continuer vers