Convertible Bonds

Why is the current backdrop for convertibles so attractive?

There are currently seven key tailwinds supporting convertibles. For example, we highlighted in our summer insight that there are several examples of “negative basis”, where prices have dropped below bond floors, calculated using observable credit spreads of a similar issuer. We believe this situation should reverse quickly once inflows come back to the asset class.

Are we nearing the capitulation?

We are not aware of any remaining redemptions for long-only global CB funds, so it seems reasonable to draw the conclusion that we are nearer the end than the beginning. The total AUM in the category has declined from USD56.1bn to USD32.3bn over the last 24 months, according to BofA Global Research, with the difference being explained by approximately USD15.5bn of net outflows and USD8.3bn of negative price effect. Unique environments require unconventional thinking.

Asset allocators, attention please!

Consider a scenario in which you were able to raise your chances of winning a game without raising your chances of losing it, convertible bonds give you a way to do that within a core allocation. What makes them so attractive? Their positive asymmetry!

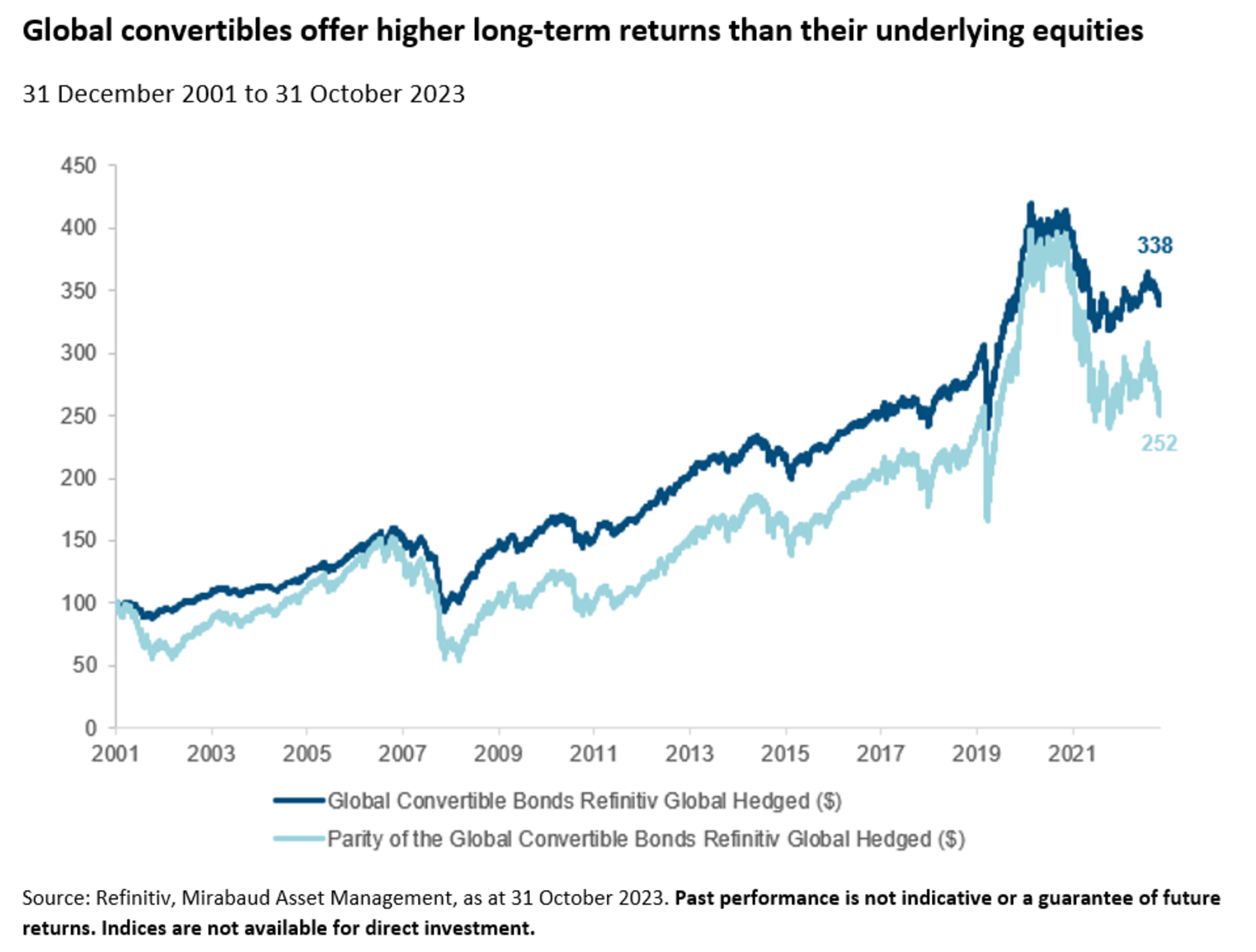

Illustration in the chart below, global convertible bonds, represented by the Refinitiv Global Convertible Bond Hedged Dollar Index, offered higher long-term returns (5.7% vs 4.3%) than those of their underlying equities, as measured by the parity of the same index calculated by Refinitiv. In addition, they have shown structurally less volatility than their underlying equities (8% vs 18.4%).

The asset class provides diversification

The hybrid structure cannot be replicated by combining equities and bonds because the convertible market has a make-up by sector and market capitalisation exposures that differ from global equity markets. Additionally, many convertible bond issuers have no existing straight debt, thus providing additional investor diversification.

Convertibles can play many different roles in a portfolio, depending on an investor’s objectives, the asset class they want to fund an allocation from, and what their view is on the outlook for equity and credit markets.

We believe that having a 5%–10% allocation to convertibles in a balanced portfolio maximises the Sharpe ratio over a full cycle (with more outperformance during market downturns than underperformance during market upturns).

Convertible Bonds

Mirabaud Sustainable Convertibles Global

CONVERTIBLE BONDS

Mirabaud Discovery Convertibles Global

Continue to