Equities

Why Swiss dividend strategies stand out in a zero-rate world

Equities

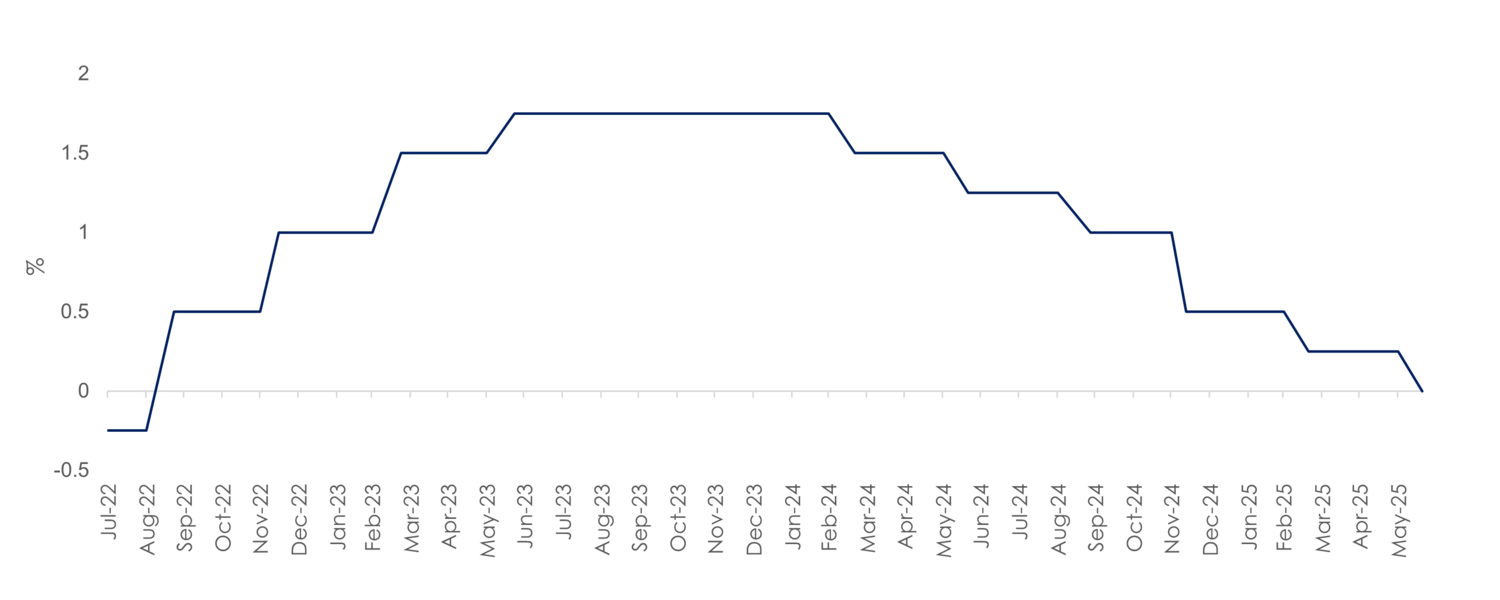

Uncertainties and ever-changing sentiment continue to dominate financial markets. Investors are navigating a difficult environment: low interest rates, persistent inflation pressures, and heightened volatility across global markets. In Switzerland, the central bank has adopted a zero-interest policy once again, with suggestions that negative rates may be a possibility. Meanwhile, Swiss government bonds offer no protection against inflation currently.

Given this backdrop, dividend strategies offer a compelling solution for Swiss investors. They not only provide the potential for above-average income but also capital appreciation, driven by the compounding characteristics of the holdings. Additionally, these strategies present an attractive risk/reward profile with lower downside risk – addressing three critical needs in today’s environment.

Traditional sources of income and stability – sovereign bonds and cash – no longer serve their historical role. At the same time, equity markets remain choppy, leaving many investors on the sidelines, unsure when or how to re-enter.

Dividend strategies offer a viable alternative to both parts of a balanced portfolio, as they are more conservative and less volatile than a plain vanilla equity portfolio, but higher yielding with more capital appreciation upside potential than a traditional bond allocation. Additionally, dividend strategies can provide a portfolio tilt towards more mature businesses, which generate free cashflow to be regularly distributed to shareholders. A stable and transparent dividend policy often reflects good governance and aligns with shareholder interests.

In today’s environment, dividend strategies offer a balanced and reassuring path forward. By focusing on reliable, steadily growing income streams, they provide a return source that is less dependent on market timing, while helping protect capital and sustain equity exposure.

Dividend-paying companies – typically mature, cash-generative and well-governed – provide investors with several key advantages. In Switzerland, these benefits are further reinforced by the intrinsic qualities of the Swiss equity market. Swiss companies are traditionally well-managed, with strong balance sheets and a culture of consistent shareholder returns. This makes Swiss dividend strategies especially compelling in today’s low-yield, volatile environment.

Add to this the standout qualities of Swiss companies – lean, agile, high-quality businesses – and the proposition becomes even more attractive. Switzerland’s world-class education system, political stability, and exceptional quality of life help attract and retain top talent, creating an ideal environment for innovation. This has proven particularly beneficial in growing globally competitive companies capable of generating significant long-term value – we call them compounders. Operating out of a home base with steadily appreciating Swiss francs and rising costs, only the strongest and most agile businesses make it to the top in this microclimate.

IMPORTANT INFORMATION

This publication is for information, education, and non-commercial purposes only. It is not suitable for readers who have no prior knowledge of financial markets. The views and opinions expressed are those of the named author(s) and may not necessarily represent views expressed or reflected in other Mirabaud communications.

It does not constitute an offer and is not intended to provide investment advice or investment recommendations. Any sectors, asset classes, securities, regions or countries shown are for illustrative purposes only and are not to be considered a recommendation to buy or sell. This publication is not intended for and cannot be shared with any person who is a citizen or resident of any jurisdiction where the publication, distribution or use of the information contained herein would be subject to any restrictions.

Past performance does not predict future returns. All investment involves risks, including loss of the money invested. Diversification does not necessarily ensure a profit or protect against losses in declining markets. There is no guarantee that any particular asset allocation or mix of investments will meet given investment objectives or generate a given level of income. Exchange rate changes may cause the value of any cross-border investments to rise or fall. In general, investments in stocks and bonds are subject to risks such as country/regional risk, issuer, volatility and currency risk, which are not necessarily addressed herein. Do not base any investment decision on this publication alone.

This publication has been prepared without taking into consideration the objectives, financial situation or needs of any particular investor or type of investor. Neither the issuer nor its affiliates accept liability for any loss incurred in connection with the use of the information available in this publication. The sources used are deemed reliable. However, the accuracy or completeness of the information cannot be guaranteed, and some figures may only be estimates. Statements of facts, opinions, estimates, analysis or conclusions contained herein are provided in good faith and without obligation to update, revise or complete. They are subject to change without notice and may be revised at any time. This material may include projections, forecasts, and other forward-looking statements which are hypothetical in nature. They involve certain risks and uncertainties that could cause actual results to differ from those stated herein.

Mirabaud Asset Management, all rights reserved. Partial reproduction subject to proper quoting, full reproduction subject to MAM prior consent.

Continue to