Equities

Europe’s forgotten opportunity

Equities

Everyone seems to be obsessed with the US. Portfolios are stuffed with mega caps, passive flows keep chasing the same names, and the S&P has become the only game in town. But step back and ask a simple question: does it really make sense for three quarters of your equity exposure to sit in one country?

I don’t think so.

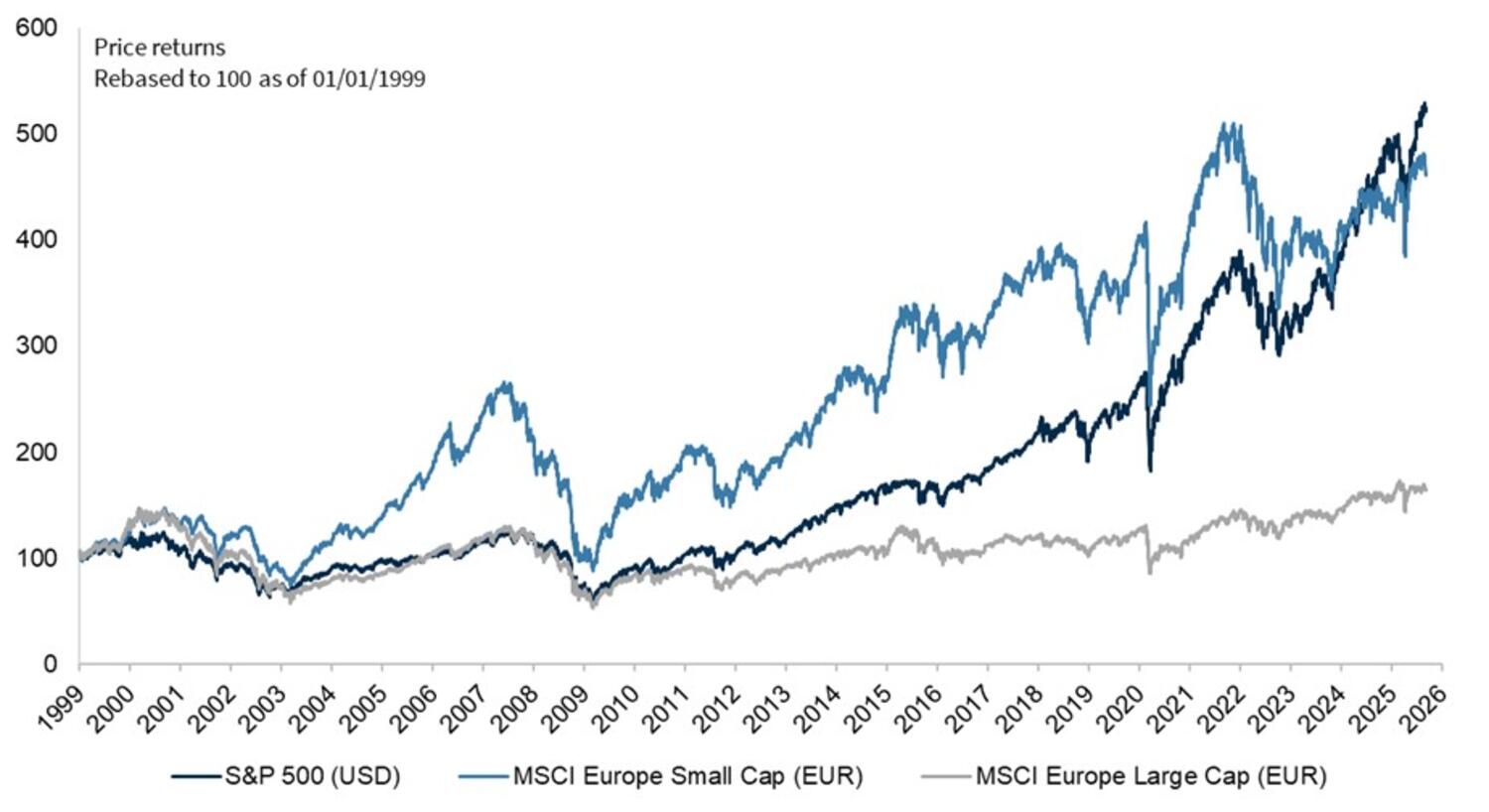

Europe, in my view, is still the forgotten opportunity. For much of the past decade, investors have overlooked this market, distracted by the extraordinary momentum of US growth stocks. Now, the difference between the two is quite shocking. A single US mega-cap now carries more weight in global indices than the entire equity market of any individual European country. That imbalance of attention is exactly what makes Europe so interesting.

Even after its strong year-to-date run, valuations remain compelling, both in absolute terms and relative to the US, reflecting the extreme levels of scepticism priced into European equities. And here’s the kicker: in the small and mid-cap market (SMID), one in three companies is still trading down more than 60% from its peak. That’s not a market that has ‘run too far’ – it’s a market with huge catch-up potential.

You only see the extent of Europe’s SMID opportunity if you’re prepared to dig beneath the surface. That’s why I spend my time out on the road, talking to companies that most investors never see. These aren’t the ones on parade at sell-side roadshows. They are under-researched, founder-led businesses, often with real skin in the game and models competitors can’t easily copy. That’s where mispricing lives.

Naturally, SMIDs come with risks. They are more volatile, more exposed to sentiment, and often face thinner liquidity. But risk cuts both ways. Today the real danger, in my view, lies in the crowded end of the market – large caps inflated by relentless passive inflows. SMID companies, by contrast, have already been through the worst period on record. They have cut costs, adapted, and are now leaner and better positioned for recovery, trading on lower multiples and increasingly benefitting from fiscal and policy tailwinds.

The way I see it, we are at the start of a European renaissance. Investors are beginning to question whether US exceptionalism can last forever, and fiscal and monetary dynamics in Europe are turning more supportive. For those willing to go off the beaten track, the opportunities in European small and mid-caps are as good as I’ve seen in over a decade.

The market has written Europe off too many times. This time, I believe, it will be proven wrong.

European Equities

European Equities

EUROPEAN EQUITIES

IMPORTANT INFORMATION

This publication is for information, education, and non-commercial purposes only. It is not suitable for readers who have no prior knowledge of financial markets. The views and opinions expressed are those of the named author(s) and may not necessarily represent views expressed or reflected in other Mirabaud communications.

It does not constitute an offer and is not intended to provide investment advice or investment recommendations. Any sectors, asset classes, securities, regions or countries shown are for illustrative purposes only and are not to be considered a recommendation to buy or sell. This publication is not intended for and cannot be shared with any person who is a citizen or resident of any jurisdiction where the publication, distribution or use of the information contained herein would be subject to any restrictions.

Past performance does not predict future returns. All investment involves risks, including loss of the money invested. Diversification does not necessarily ensure a profit or protect against losses in declining markets. There is no guarantee that any particular asset allocation or mix of investments will meet given investment objectives or generate a given level of income. Exchange rate changes may cause the value of any cross-border investments to rise or fall. In general, investments in stocks and bonds are subject to risks such as country/regional risk, issuer, volatility and currency risk, which are not necessarily addressed herein. Do not base any investment decision on this publication alone.

This publication has been prepared without taking into consideration the objectives, financial situation or needs of any particular investor or type of investor. Neither the issuer nor its affiliates accept liability for any loss incurred in connection with the use of the information available in this publication. The sources used are deemed reliable. However, the accuracy or completeness of the information cannot be guaranteed, and some figures may only be estimates. Statements of facts, opinions, estimates, analysis or conclusions contained herein are provided in good faith and without obligation to update, revise or complete. They are subject to change without notice and may be revised at any time. This material may include projections, forecasts, and other forward-looking statements which are hypothetical in nature. They involve certain risks and uncertainties that could cause actual results to differ from those stated herein.

Mirabaud Asset Management, all rights reserved. Partial reproduction subject to proper quoting, full reproduction subject to MAM prior consent.

Continue to