Fixed Income

Optimising high yield returns in a data-dependent market

Fixed Income

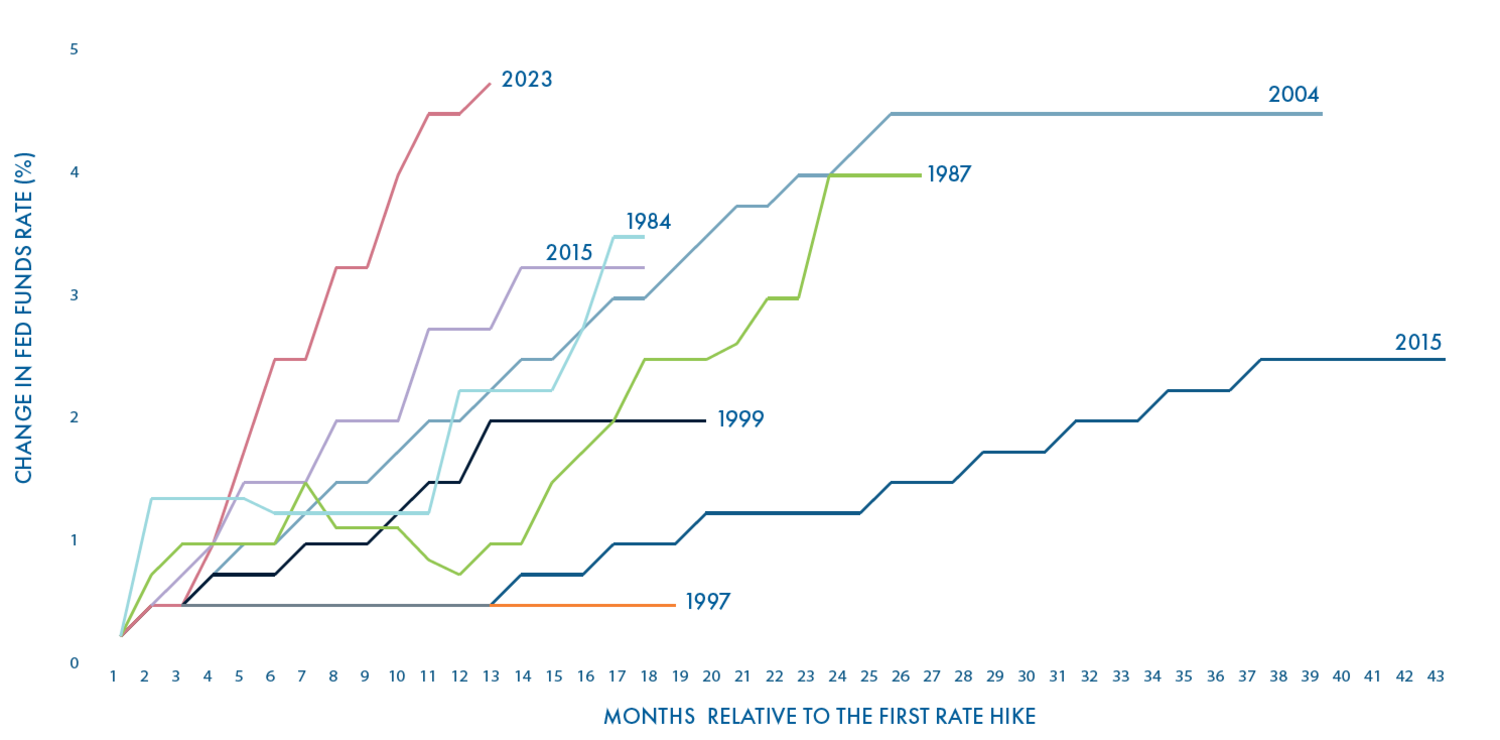

After the turbulence and uncertainty that characterised 2022, there are now only two macro topics that matter – inflation and recession. Whichever story dominates dictates market direction that day.

On days when inflation leads the narrative, short-term government rates rise and risk-on sentiment strengthens, with equities and high yield risk performing on the hope of a soft economic landing in the US. When recession fears lead, the risk-off mood dominates and you typically see interest rates shift lower, government bonds perform and equities and high yield spreads selloff.

This traversing between dominant macro drivers highlights how uncertain and data-driven the market has become. Fundamentals will only get you so far as market participants wait on the next piece of economic news or indication of central bank direction to set the tone for the day’s trading.

Source/ Bloomberg, February 2023

WHY IS THE MARKET SO DATA DEPENDENT?

The US economy is currently positioned between two stages of the economic cycle – ‘late cycle’ and ‘recession’. Either the Federal Reserve (Fed) has tightened enough (or even over-tightened) and the US economy will rapidly enter recession. Or it has done sufficient groundwork to facilitate a soft-landing and shift the economy towards the ‘early recovery’ stage.

The market outlook for the two scenarios is quite different, and the only way of knowing which scenario will prevail is to read the macro clues – having a strong top-down element within your investment strategy is key here.

Source/ Mirabaud Asset Management, February 2023

Focusing solely on fundamentals through corporate earnings releases doesn’t tell a timely enough story, as indicators are released quarterly, meaning you’ll miss any shift in market direction by weeks or possibly months by following a pure bottom-up strategy.

Once we have a new data point, we must then decipher if headline ‘good news’ is actually good news for investors, or if it will ultimately have a negative impact on markets.

Weak data indicates we are closer to a change in policy direction from the Fed – but it also means the performance of corporates will likely weaken. Conversely, positive data indicates a reduced risk of recession, but also increases the risk inflation could remain stubbornly high and the Fed must therefore continue to increase rates to get it under control.

We expect the macroeconomic landscape to remain turbulent and short-termist. Each new data point provides an immediate steer on market direction but can’t be relied upon to support a longer-term directional view. Being attuned and responsive to data is what will separate successful investors from the laggards.

High yield bonds currently offer genuinely high yields, low interest-rate risk, and default rates are expected to remain below average.

We believe the asset class is set to deliver solid returns through to the end of the cycle, with the possibility of superior returns on a long-term view.

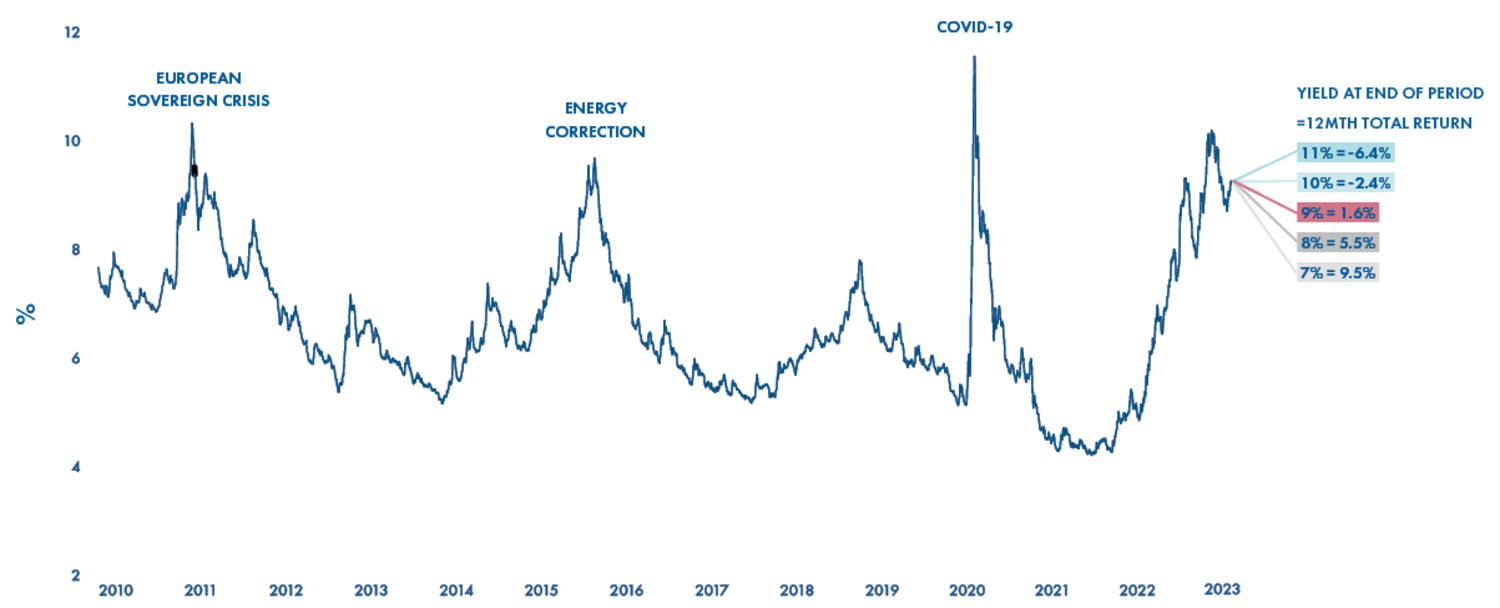

Typically, when yields go above 8% in the high yield universe, the asset class delivers positive forward returns on a 12-month view. When yields exceed 9%, then forward returns are generally strong.

Spreads on the ICE BofA Global High Yield Index are currently in the 450-500bps range. In a typical recession, we would expect to see wides of around 700bps. We don’t foresee such spread highs this time around; the economic forecast and our base case thinking is for a shorter and shallower global recession, where spread widening should be relatively constrained and certainly remain below 700bps.

We also have a higher government interest rate component than in prior cycles and any slowing would see this compress, offsetting some of this tightening. If we see a soft landing, spreads could go back to pre-financial crisis levels of 300-350bps.

Source/ Bloomberg, Mirabaud Asset Management, ICE BAML, assumes 2.5% default rate with 40% recovery. Data as of 30 December 2022

Pandemic-induced economic uncertainty pushed corporates to conservatively manage their balance sheets, resulting in an improved cost base and greater focus on leverage and cashflow generation.

The weakest companies in the universe defaulted during 2020 and 2021, with those left largely representing good-quality, well-run businesses that can withstand a slowdown in growth. Over half the global high yield universe is BB rated, with a number of formally investment-grade, fallen-angel names having entered the market.

Source/ Bloomberg, 1 February 2023. Numbers may not add up to 100 due to rounding

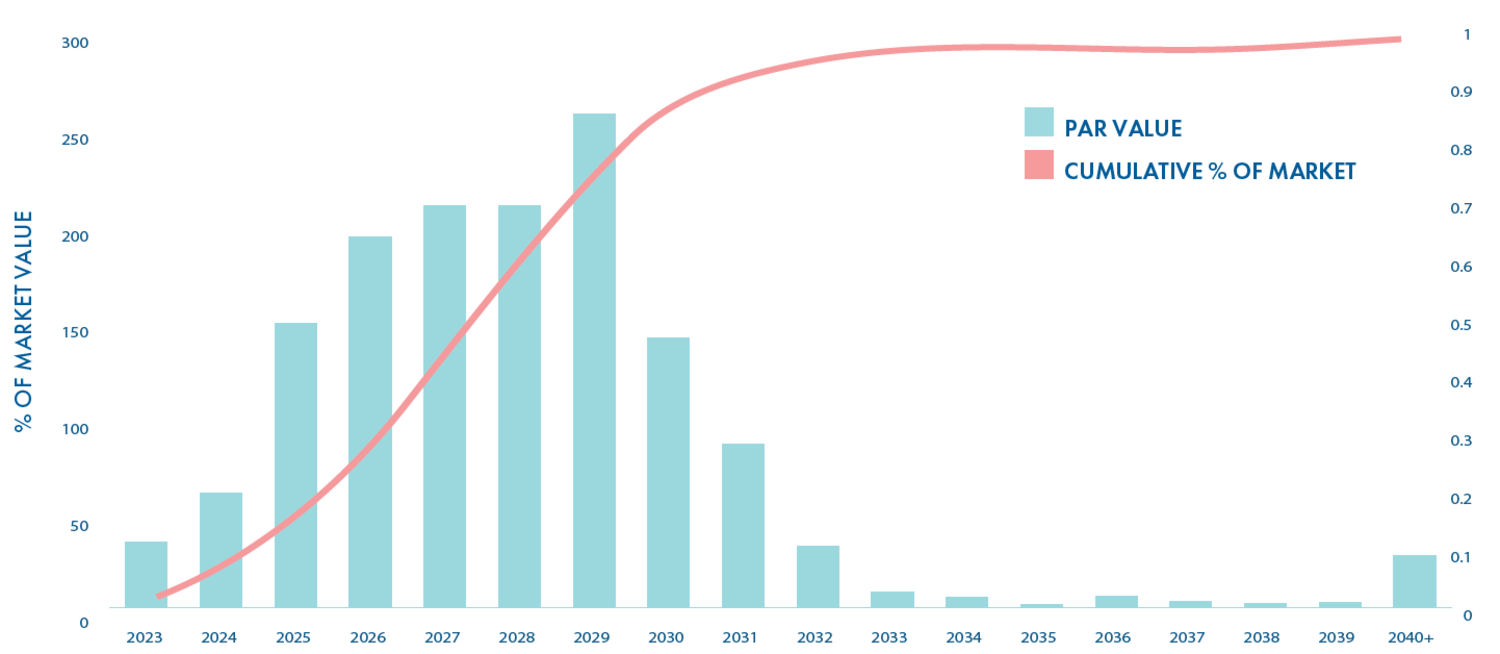

Only 17.5% of the market is due to mature before 2025. There is no big maturity wall looming as companies have refinanced to take advantage of years of low rates, extending their maturity dates. This means most corporates won’t be forced to refinance at today’s elevated rates.

Source/ Bloomberg, February 2023

Default rates are close to historical lows and should remain below average through 2023. We are expecting 3-4% rather than 5-7%, reflecting the quality of the universe and the lack of maturity wall.

Additionally, there are no dominant ‘stressed’ sectors that could trigger a default cycle, as we saw with housing in 2008 and energy in 2015.

At the brink of most economic slowdowns, corporate fundamentals are typically already weak. But today’s high yield bond issuers are in much better financial shape than issuers entering past recessions, thanks in part to years of low rates and an extended period of uncertainty surrounding the pandemic.

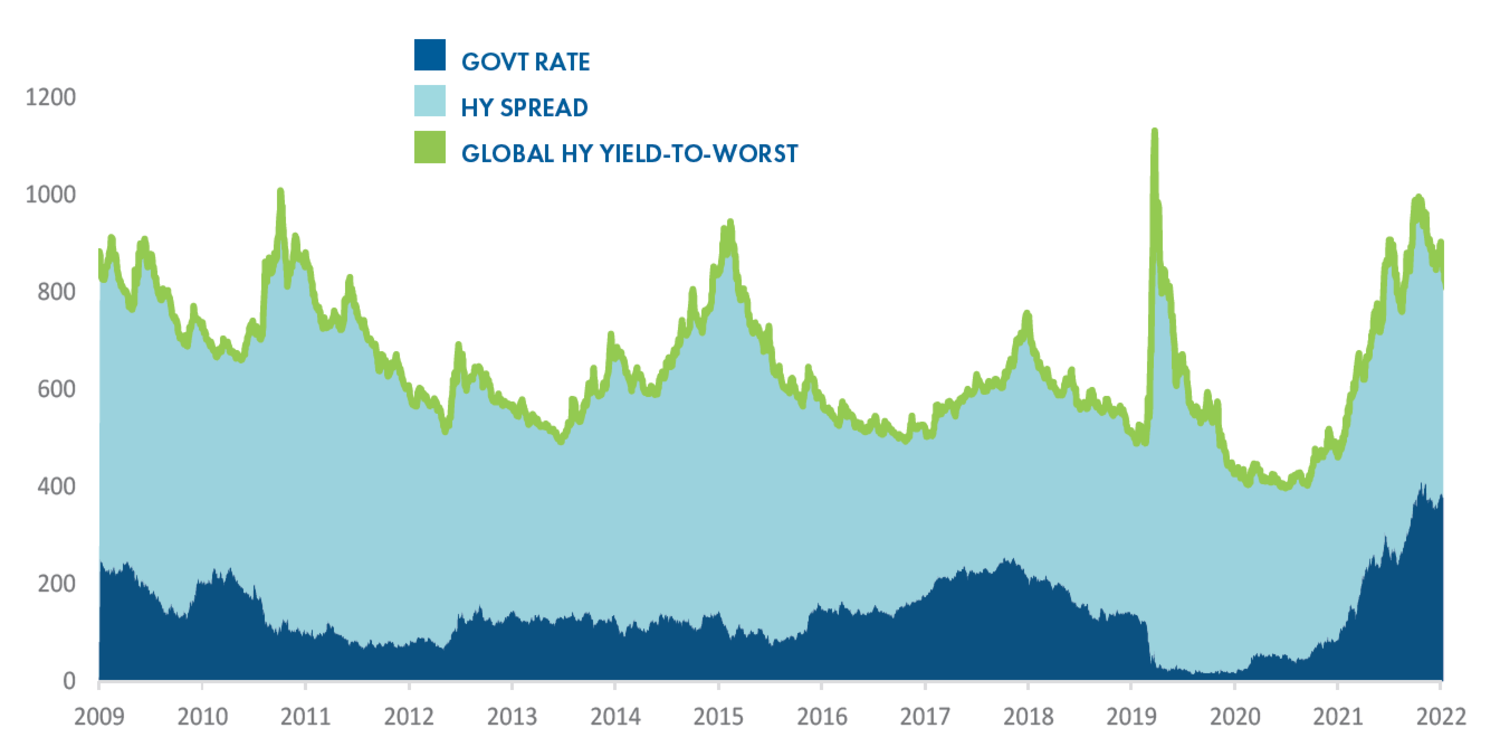

If we look at historically challenged times, high yield spreads widen (depicted in pale blue in chart 6). But this situation is different today as for the first time we have a large government rates buffer (depicted in dark blue). The yield on high yield is made up of the government rate plus the high yield spread, so as spreads widen it means the economy is slowing and the Fed will have reached its pivot point and government rates will compress. The total yield will be relatively unchanged, so even with a recession and wider spreads, you can still generate positive returns in high yield.

We think the risk/reward trade-off is currently more favourable in high yield than in equities as you still have double-digit upside in credit, but with much greater downside protection. In a downturn, government rates go lower, and this goes directly into the price of high yield bonds as a part of the yield. For equities, that often goes into the valuation multiple, but that would be dominated by the downgrade to earnings.

Source/ Mirabaud Asset Management and Bloomberg, as at 31 December 2022

INVESTMENT BOTTOM LINE

All financial markets will likely experience some near-term volatility, but investors with a medium-term investment horizon should be able to take advantage of historically high yield levels to achieve attractive returns on a long-term horizon. We believe high yield should be considered a core fixed income allocation throughout the cycle.

Actively sourcing high yield opportunities from across the global

As flexible and active investors, we favour a globally unconstrained, benchmark agnostic approach to capture the best potential opportunities across the investment universe in any macro environment. In today’s uncertain, data-driven market, following an active, flexible approach has never been more critical for return generation.

The unprecedented rates environment and data-reliance means investors can’t set a macro view at the beginning of the year looking 12 months ahead and then trade based on bottom-up fundamentals alone.

Our outlook evolves daily, reflecting the latest data releases and newsflow. We combine this intel with bottom-up insights from companies, adjusting our underlying cash bond positions and overall portfolio risk using macro hedging overlays.

We believe our nimble and flexible approach, implemented by a small, hands-on team, presents the best way to capture upside potential amid ongoing volatility, while managing downside with active hedging.

Continue to