Fixed Income

New issue coupons drive high yield returns

Fixed Income

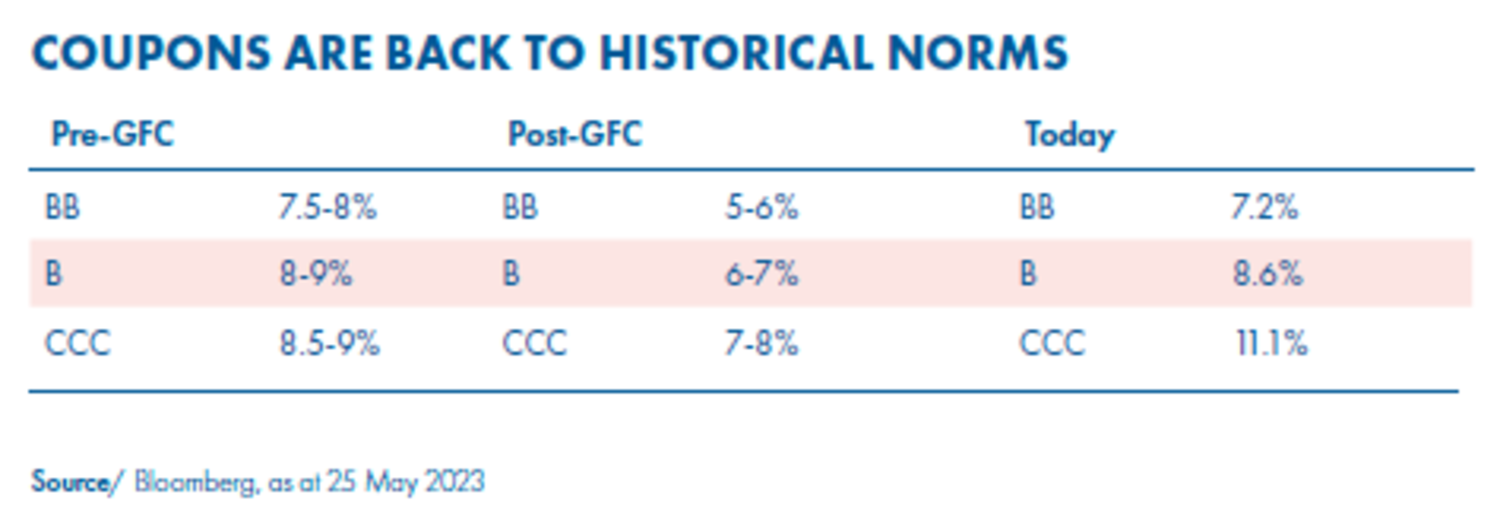

As US base rates have risen from the historic low of 0.00–0.25% in December 2008 to 5.00–5.25% today, we are seeing coupon levels on new issue high yield (HY) bonds trending back towards historical norms of 9%, with spreads widening out to around 500bps.

In the post-Global Financial Crisis (GFC) era of extreme QE and ultra-low rates, much of the fixed income universe became a ‘zero yield’ environment. The only part with much to offer was HY, and that was on a relative value basis – it essentially became a spread product. For example, a BB-rated bond might offer a spread of 250bps over US Treasuries, which seems reasonable, but the absolute yield might only be 2.5% or 3%, which is very low versus history.

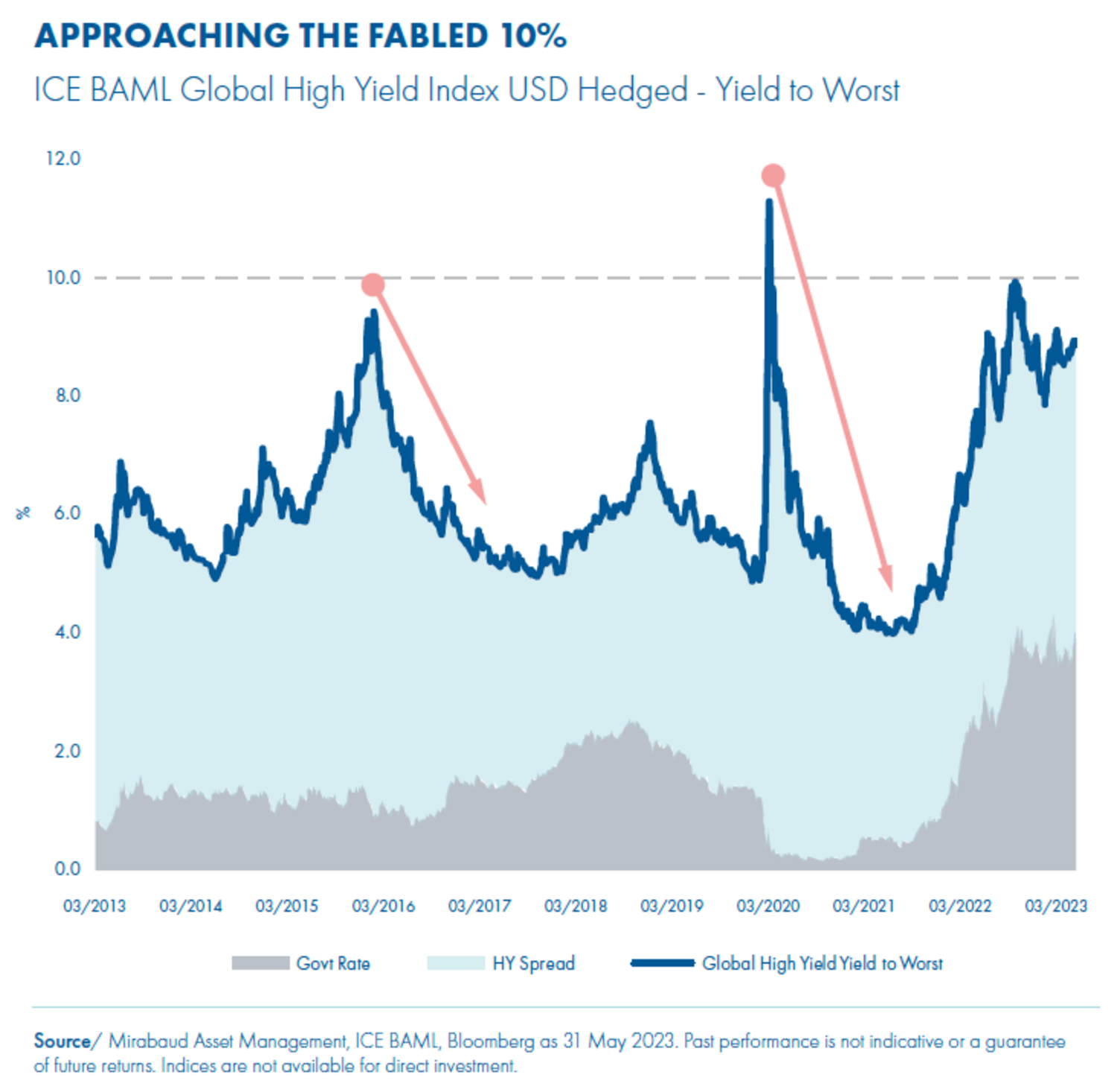

But the recent increase in yields means HY is interesting again from an absolute valuation perspective. Within today’s yields you have a healthy cushion created by both government bond rates and credit spread, each protecting against a widening in the other. The asset class’s return potential has been restored to that last seen 10-15 years ago.

Today’s near 9% average HY yield makes the asset class particularly interesting because of its proximity to the fabled ‘10% peak’. History shows us that each time the HY market reaches c.10%, something shifts – either government bonds rally or we might see some intervention action from central banks that acts to bring yields down.

Additionally, HY also offers a capital appreciation component. Over the past 10yrs, average prices have sat in a range of 85-105, while the 20yr average comes in at 97. Today, the average price is 87.

So, while a degree of term-term volatility is expected if we enter a recessionary environment, on a 12-18mth view, HY investors stand to benefit from higher coupons and a degree of capital appreciation as prices trend closer to par. We think now is an optimal time to consider an allocation to HY.

The higher the coupon at the start of your investment, the higher chance you have of making a positive return. As we move into a higher-coupon environment for new issues, HY as an asset class has reset to being as attractive as it was pre-GFC with coupons in the 8-12% range combined with a degree of capital appreciation.

Seeking out investment opportunities across the global high yield universe, the Mirabaud – Sustainable Global High Yield Bonds Strategy aims to make the most of an active, flexible, unconstrained approach.

Top-down macro views inform our dynamic allocation across the different geographies and sectors, moving between credit and duration risk. Bottom-up analysis along with ESG integration helps us identify strong sustainable opportunities. We mitigate down markets with an active hedging process.

Continue to