Navigation

Fermer

Convertible Bonds

While the growth of ESG investing among global convertible investors has risen dramatically, we often hear that excluding certain companies or industries may reduce portfolio diversification. In other words, exclusion may prove a constraining strategy for convertible portfolios, given that the investable global universe is only USD373 billion. In our opinion, the effective implementation of ESG analysis should both maximise risk management and give funding to deserving businesses.

The exclusion of companies involved in severe controversies or producing controversial outputs, like weapons, tobacco, thermal coal mining, unconventional oil & gas and adult entertainment helps us to discriminate, but those industries currently representing only a very small portion of the market.

More importantly, positive screening by region offers the potential to increase portfolio diversification simply because issuers of convertibles in Europe would otherwise dominate, given that they have the best ESG ratings on average.

We have also found that convertible bonds from issuers with better ESG performance are less volatile and have higher bond floors, suggesting an SRI approach can contribute to reinforce the natural convexity of convertibles.

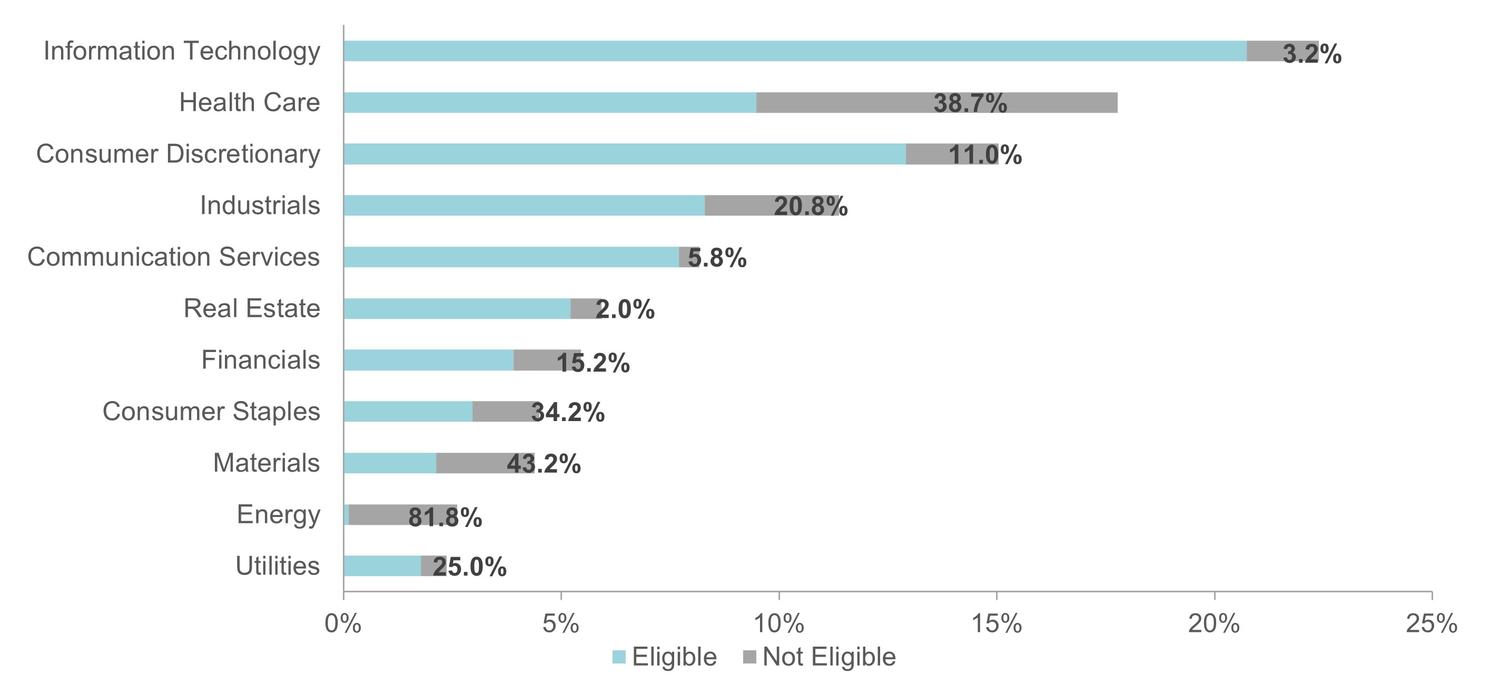

Our quantitative filters exclude roughly 20% of our universe, leaving us with a generous choice of around 600 investable convertible bonds with deviations across the sectors, as shown in chart 1. This compares to 28 green and six sustainability-linked issues outstanding, totaling just 4.5% of the global size in market value, which is not enough to build a reliable sustainable investment strategy in the asset class.

Chart 1: Sustainable convertible bonds universe

Source: Mirabaud Asset Management using proprietary methodology, April 2023

However, the lack of standards can make ESG investing challenging, and the desire to reduce a firm to a single ESG score, and make investments based upon it, distracts from what ESG is meant to be — a method of research.

Ratings can be of doubtful quality, and by the time they are published, they may not accurately reflect the company's current state, especially for small and mid-cap names (61% of convertible issuers have a market cap below USD5bn).

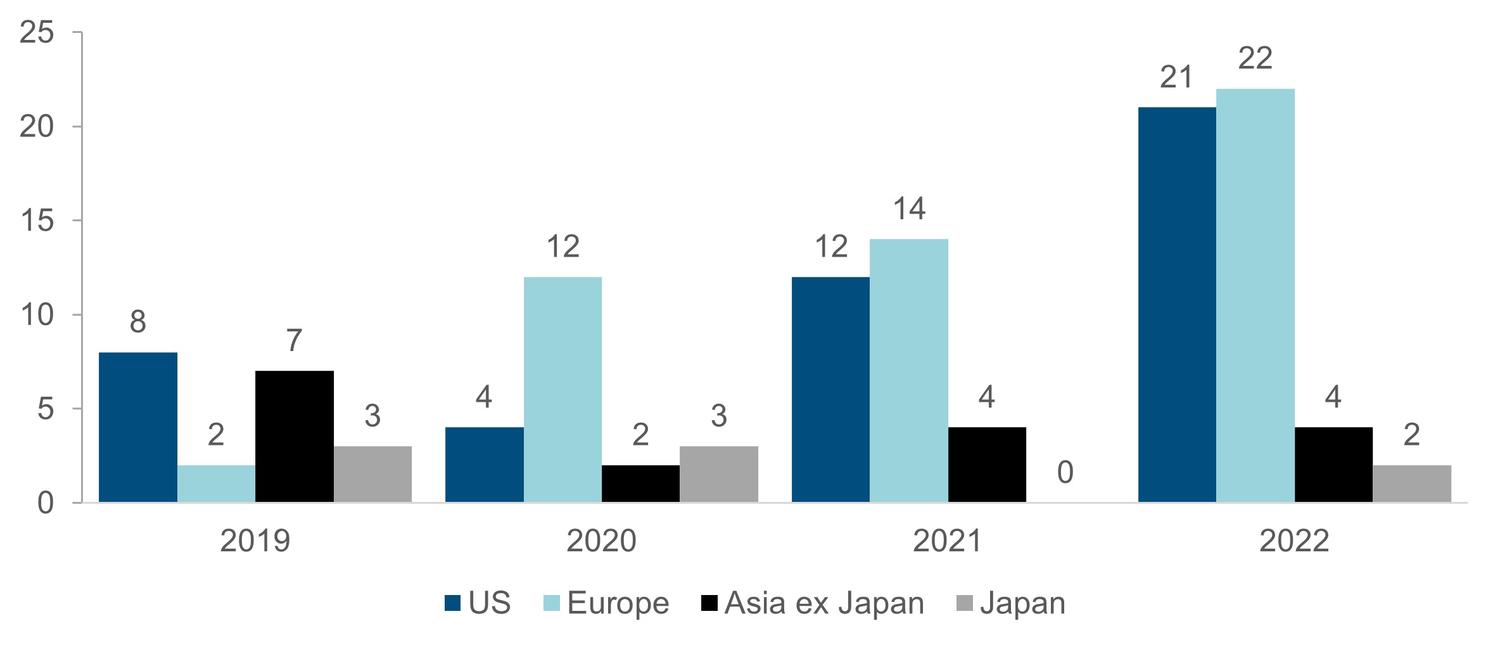

We think that encouraging transparency and promoting good practices requires deliberate engagement, which can keep us a step ahead of rating agencies, as some update their scores with a frequency of 18 months. Last year, we engaged directly with 49 companies on over 179 issues, which is a significant increase from when we started in 2019, as shown in chart 2.

Chart 2: Engagement activities by market

Source: Refinitiv, Mirabaud Asset Management, 30 April 2023

This is why we consider our approach as more pragmatic than dogmatic: a company’s trajectory is more considered than the absolute level when examining its ESG credentials. Investors who exclusively base their judgments on ratings may overlook ‘improvers’, whose demand may climb along with their rating. Investing in businesses that exhibit this upward momentum can lead to higher financial returns.

As fixed income investors, we adopt an ownership mindset akin to that of shareholders, which fosters fruitful dialogue and influences the company. Using only negative screening would eliminate this opportunity.

Therefore, when assessing a company, we evaluate its corporate social responsibility (CSR) practices, the financial materiality of ESG risks and how effectively management are addressing them.

We analyse how the company contributes to the sustainable development agenda and transition to low-carbon economy through its operations, services or products. For instance, we push them to set emission reduction targets over a set time horizon by joining the science-based targets initiatives or encourage them to complete a questionnaire from the Carbon Disclosure Project (CDP), and to sign the United Nations Global Compact.

Our investment approach is more holistic with the integration of ESG factors alongside traditional financial analysis. Maintaining and monitoring this ongoing dialogue is central to how we implement our stewardship responsibilities and informs the investment decisions we make on behalf of our clients.

Continuer vers