Fixed Income

EM debt: Expect resilience & differentiation

Fixed Income

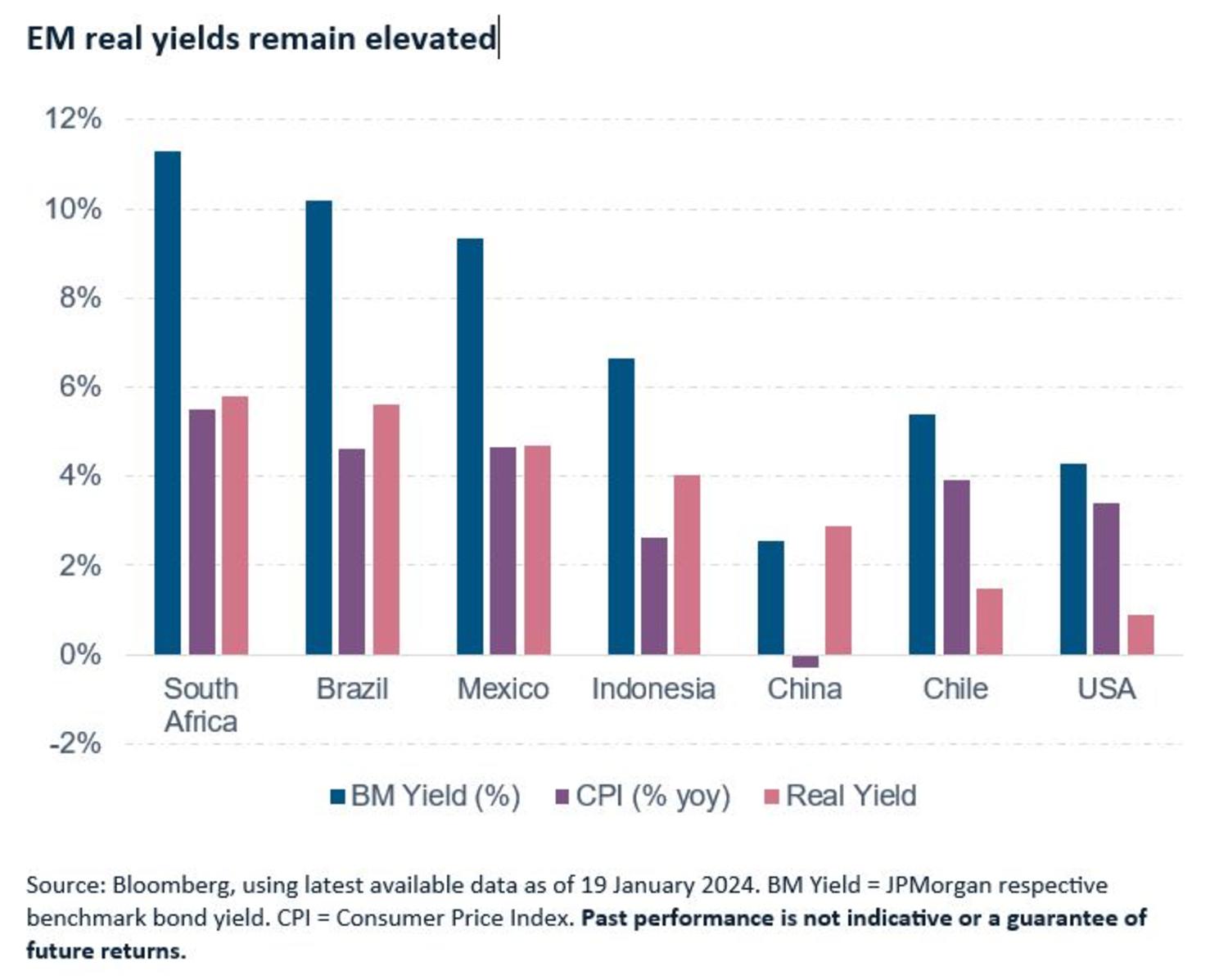

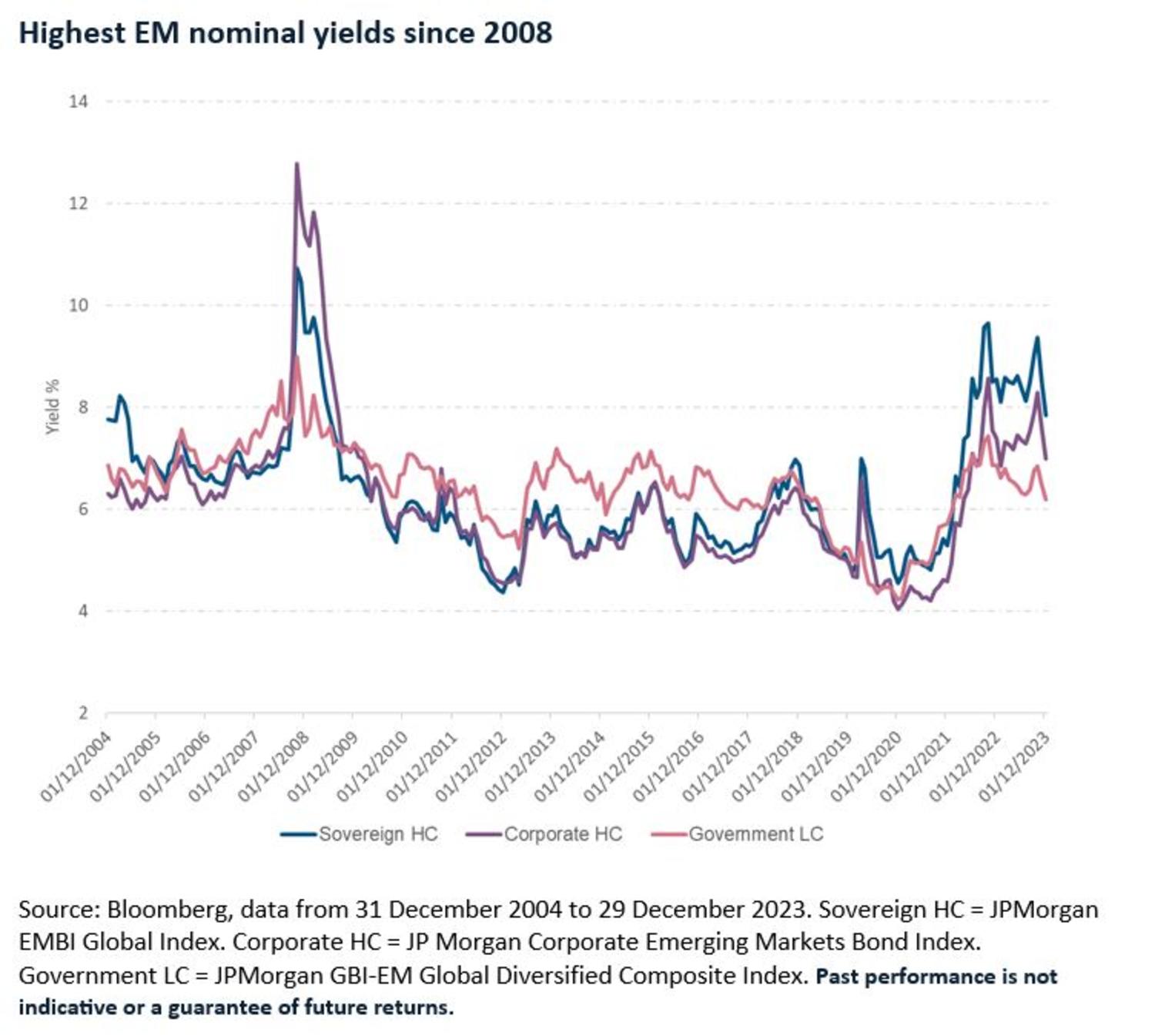

As we enter the new year, the outlook for emerging market (EM) debt remains constructive, driven by favourable macroeconomic trends, high nominal and real yields, benign conditions for credit and currency and low investor positioning.

Additionally, most low-income economies are either in fluid restructuring negotiations and/or engaged with the International Monetary Fund. The return to policy orthodoxy in countries like Turkey and Argentina is broadly viewed as a welcome bonus.

Lower global inflation and an end to the hiking cycle of major central banks lend support to a further decline in global yields, and in the absence of an outright recession, which isn’t our base case scenario, we expect rates, credit and FX to contribute to positive returns.

Historically, EM debt has delivered good performance during the period between the end of central bank rate hikes and the completion of rate cuts, and this time it’s no different, with both hard and local currency indices up more than 20% since the lows of late 2022. Markets have already discounted a fair amount of this process, though not all – particularly in Latin America, where yields remain elevated whilst inflation has fallen rapidly. Once the Federal Reserve (Fed) begins reducing its Fed Funds target rate, the barrier to easier policy with several EM central banks should diminish.

A heavy EM electoral calendar and geopolitics are set to dominate the headlines in 2024, though in most cases it is unlikely that such events will have durable effects.

China’s economic outlook remains tilted to the downside, which we primarily expect to affect countries with high exposure via trade and commodity linkages. However, we expect the effects on the broader EM debt universe to be limited, given mitigating factors of falling weights in corporate indices, as well as China’s low-beta status on both sovereign hard and local currency.

Over the last few years, the dispersion of returns amongst countries and different segments of the EM debt universe has risen substantially. For example, in hard currency sovereigns, the average high yield spread is now over 5x higher than its investment-grade counterpart. In local government bonds, the average yield in Latin America is 2x higher than in Asia. These differences provide a favourable ground for active managers to take advantage of.

Overall, we think resilience and differentiation for EM debt is likely to continue this year. On the sovereign side, investment grade and high-quality high yield spreads are tight, but yields remain elevated, whilst we believe the distressed area offers a lot of optionality.

For corporates, fundamentals remain in good shape and default rates are expected to decline for a second consecutive year. Local markets are still attractive, in our view, particularly in Latin America and Eastern Europe.

To conclude, given where yields are, we believe only a very modest decline in US Treasury rates and/or the US dollar is needed for the asset class to generate high single-digit returns.

Continue to