Convertible Bonds

Convertibles approach optimal convexity

Convertible Bonds

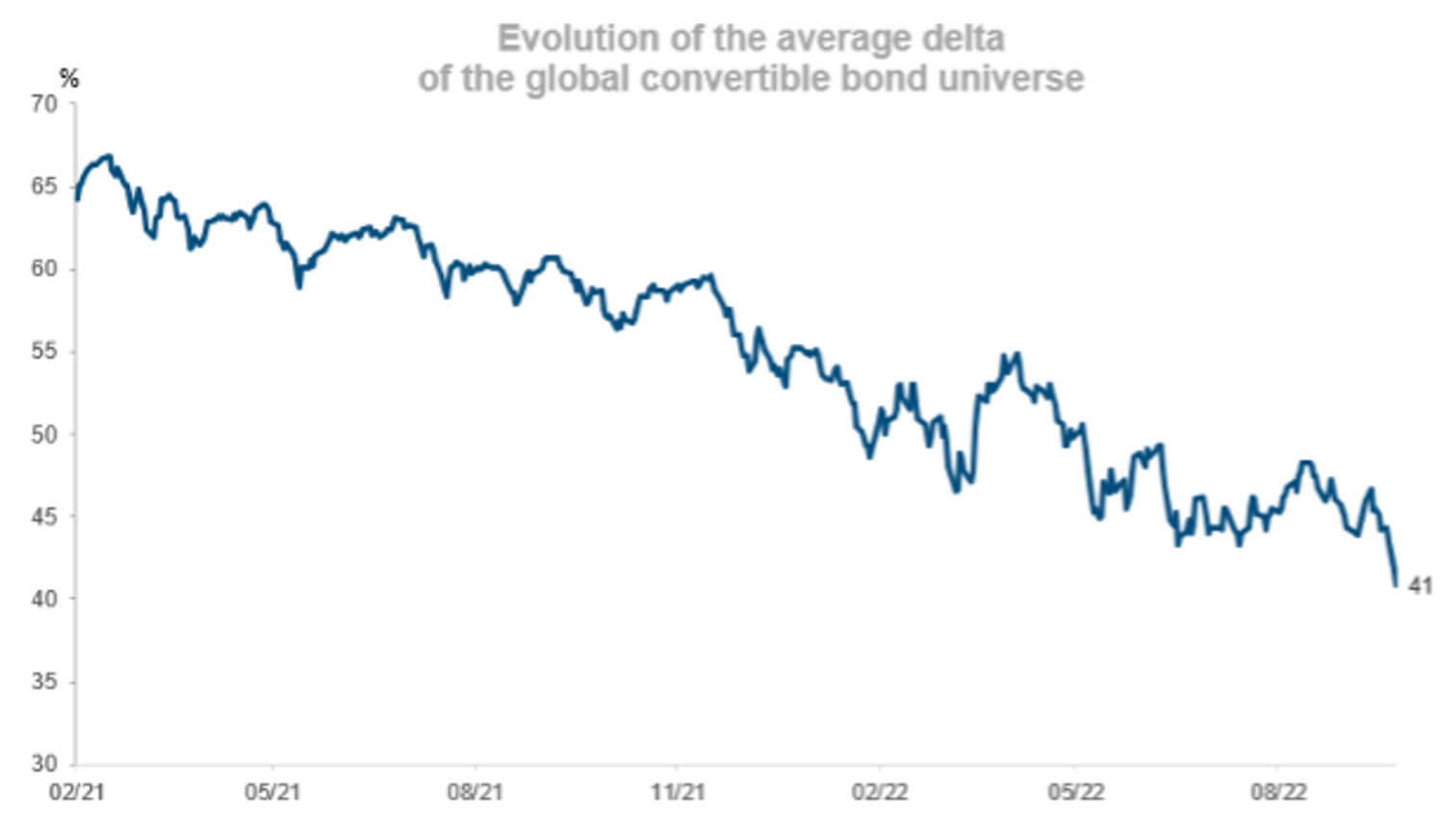

In early 2021, the equity sensitivity of liquid global convertible bonds was 65%. Fast-forward to today, in which time global equity and credit markets have suffered heavy losses, and sensitivity has fallen to 41% (at 26 September 2022).

This means a sizable portion of convertibles that previously had equity profiles are now trading in the optimal zone to display convexity.

Convexity gives convertible bonds an asymmetrical risk-reward profile – rising proportionally more when the underlying shares increase and providing a degree of downside mitigation if the equity value falls.

Depending on the specifics of the bond and market conditions, convertible bonds may act more like a stock or more like a corporate bond.

Right now, a significant portion of the convertible universe is displaying ‘bond-like’ characteristics, meaning convertibles should offer investors a protective profile within their portfolios should market losses continue.

With the global macro environment plagued by uncertainty, this combination of improved convexity plus bond-like characteristics means convertibles currently display a very interesting risk/reward profile, in our view.

We think equity markets are still not sufficiently discounting a recession, and we predict that an earnings shock will cause fresh lows in risk assets. But despite the unfavourable outlook, heightened volatility means we could see short-term upticks.

As a hybrid asset class, convertible bonds come into their own in this type of situation as they offer dynamic allocation switches out of bonds into equities, and vice versa. As a result, they can lower the risk of entirely missing a market rebound or, conversely, prolonged suffering during a declining market.

In today’s environment of extreme geopolitical uncertainty and rising interest rates, convexity could prove to be a profitable characteristic to have in your portfolio.

IMPORTANT INFORMATION

This marketing material is for your exclusive use only and it is not intended for any person who is a citizen or resident of any jurisdiction where the publication, distribution or use of the information contained herein would be subject to any restrictions. It may not be copied or transferred.

This material is provided for information purposes only and shall not be construed as an offer or a recommendation to subscribe, retain or dispose of fund units or shares, investment products or strategies. Potential investors are recommended to seek prior professional financial, legal and tax advice. The sources of the information contained within are deemed reliable. However, the accuracy or completeness of the information cannot be guaranteed and some figures may only be estimates. In addition, any opinions expressed are subject to change without notice.

All investment involves risks, returns may decrease or increase because of currency fluctuations and investors may lose the amount of their original investment. Past performance is not indicative or a guarantee of future returns.

Issued by: in the UK: Mirabaud Asset Management Limited which is authorised and regulated by the Financial Conduct Authority. D14 In Switzerland: Mirabaud Asset Management (Suisse) SA, 29, boulevard Georges-Favon, 1204 Geneva. In France: Mirabaud Asset Management (France) SAS., 13, avenue Hoche, 75008 Paris. In Luxembourg, Italy and Spain: Mirabaud Asset Management (Europe) SA, 25 avenue de la Liberté, L-1931 Luxembourg.

Continue to