Fixed Income

UK bond buyers beware

Fixed Income

Having international exposure in your equity allocation has become the norm. The consensus view is that opportunities in global equity markets can be as attractive as those at home and should not be overlooked. But when it comes to fixed income, the home bias remains strong.

While there’s comfort in familiarity, considering only GBP debt can result in:

Let’s dig into the composition of the UK fixed income universe to see how

expanding your geographic remit could prove less risky, with greater return potential, than staying close to home.

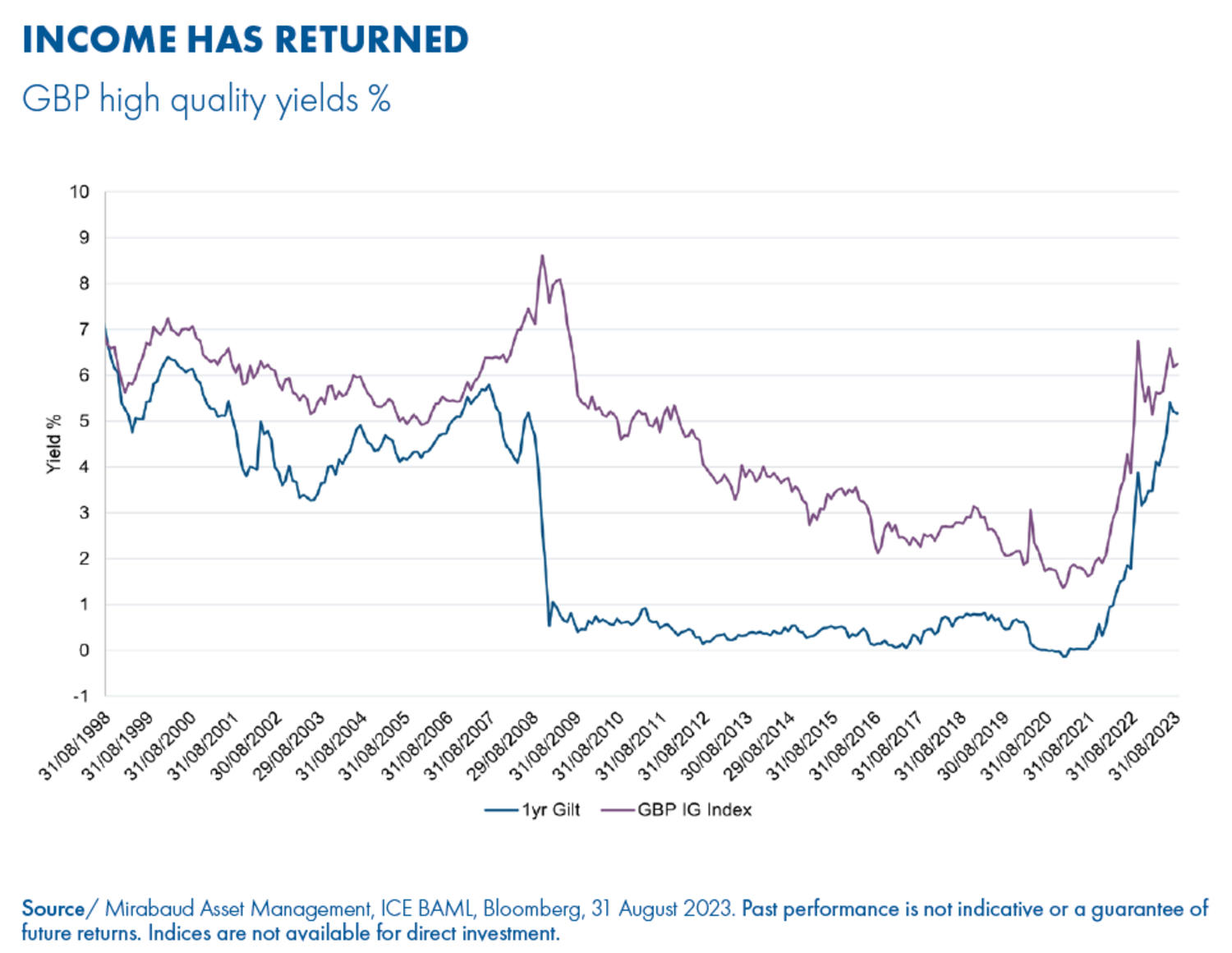

After 12 years of ultra-low yields, income has returned, with segments of the bond market offering returns akin to equities, making it an opportune time to review allocations for optimised return potential.

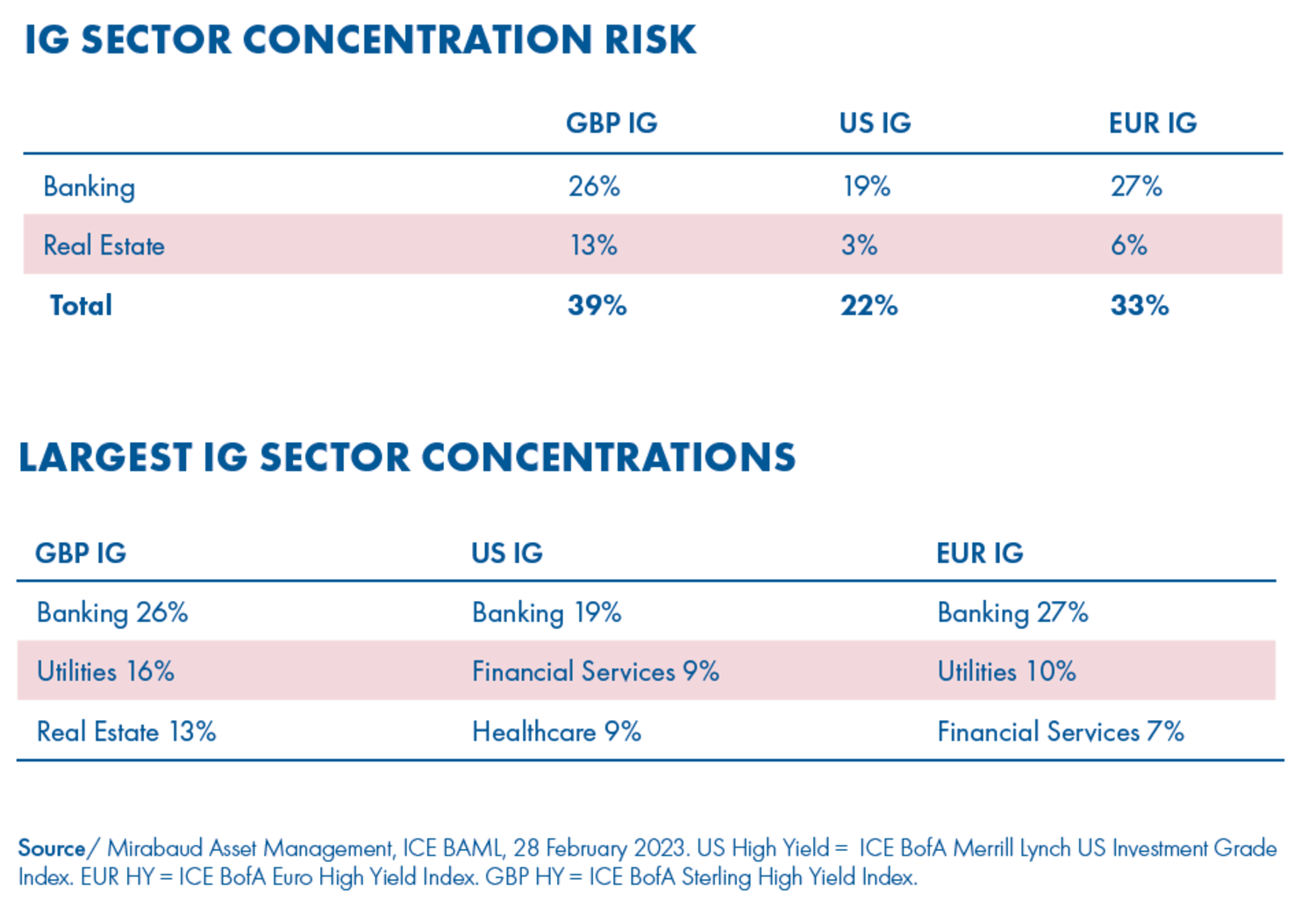

Investment grade (IG) is going to feature in most bond portfolios, but holding only UK names can unwittingly leave you exposed to an alarming level of concentration risk. Of the 347 issuers that make up the UK market, 39% of these are banking and real estate names1. In today’s environment of elevated mortgage rates, this creates significant sector risk, pushing yields out.

To get the best of IG with the lowest level of risk, we believe broadening your geographic remit and taking an international view provides the optimal solution. The US IG market has only a slightly lower yield of 5.9% (hedged to GBP) compared to 6.0% for the UK2, but much less sector concentration risk. In the US, banks comprise 19% of the market and real estate just 3%3. There are also opportunities in US IG names in growth sectors like technology and energy that are not available in the UK market.

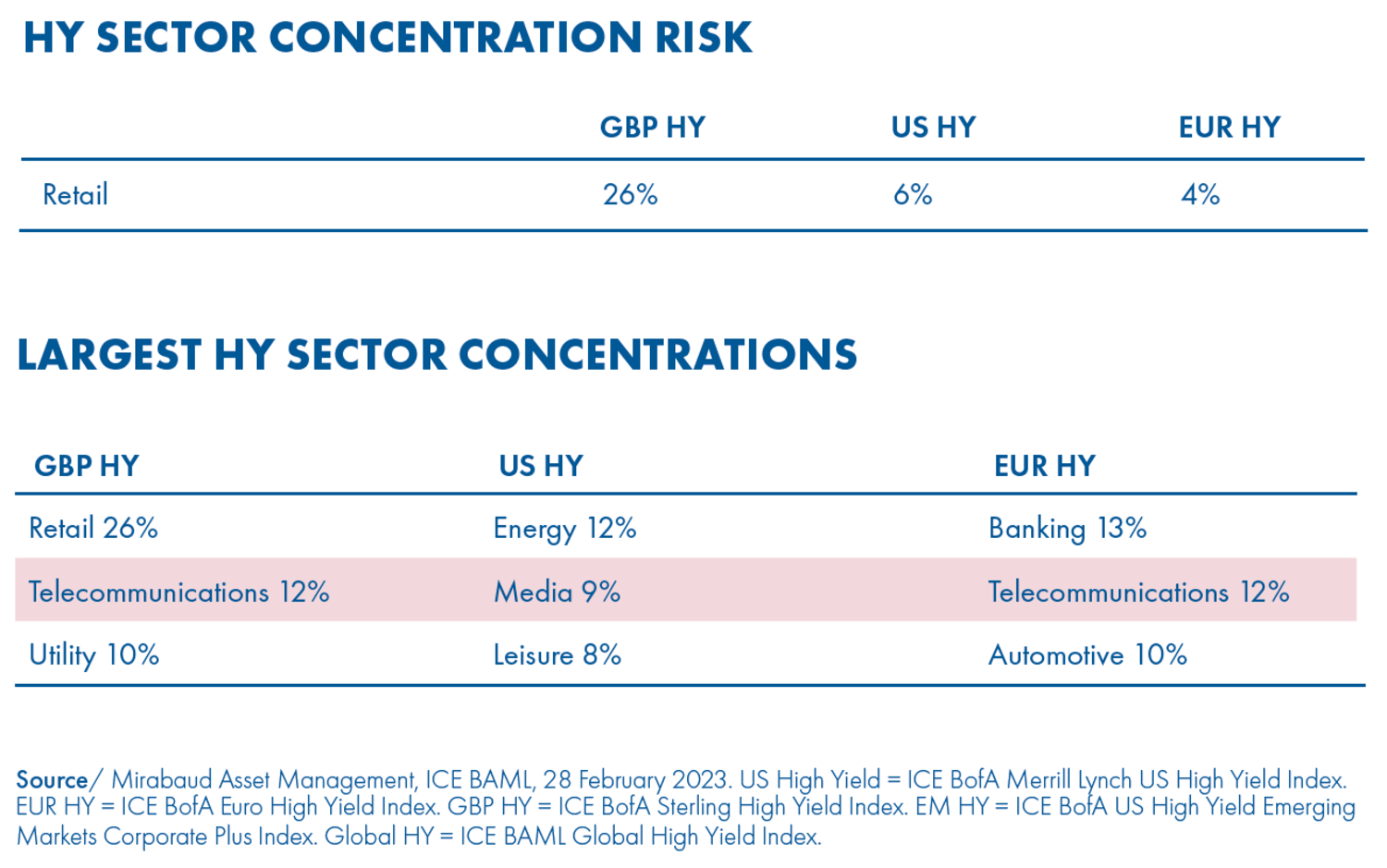

The story is similar in high yield (HY). The UK market is small, with 99 bonds offered by 66 issues. 26% of these bonds sit in the retail sector, with supermarket names dominating4. With CPI sitting at 6.7% and unemployment ticking up, the UK consumer is set to decline and this degree of retail concentration could negatively impact returns.

While HY can be an interesting allocation for higher potential returns, we believe exposure needs to come from a spread of sectors for an optimised risk/return profile. The US and European markets are much larger and are without the elevated concentration risk that the UK has, yet yields are attractive at 8.7% (hedged to GBP) and 8.6% (hedged to GBP) respectively, versus 10.4% for the UK5.

We believe allocating across geographies lets you capture the best of the opportunity set while minimising concentration risk. But maybe you’re wondering ‘at what cost?’

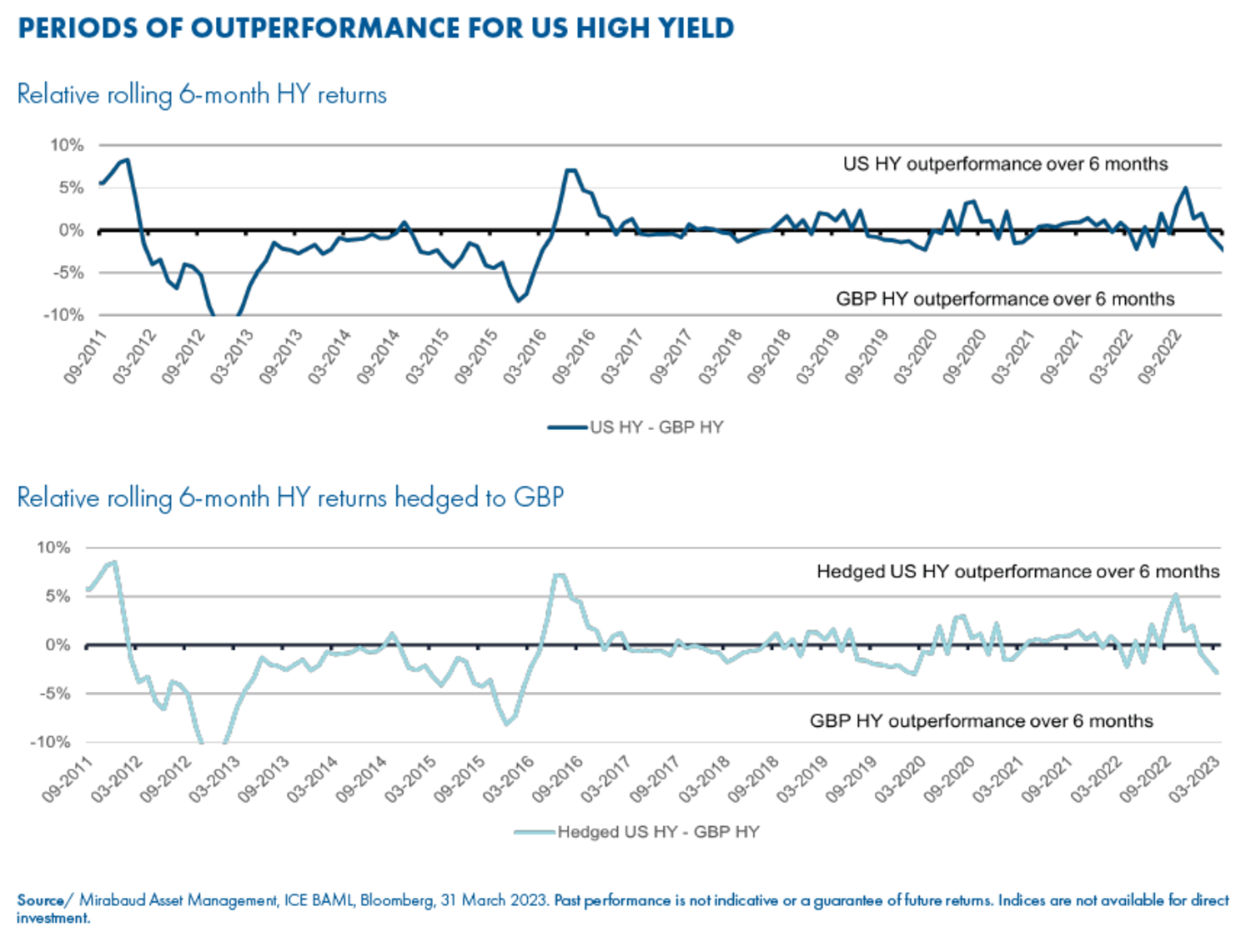

The perception that it’s prohibitively expensive to hedge FX risk back to sterling isn’t accurate. In fact, the potential pay-off means it’s something we think investors should actively consider.

The cost to hedge foreign currency bond funds back to GBP is essentially the government interest rate differential – so at the end of August 2023, it cost around 8bps to hedge back from USD to GBP. However, fixed income assets in USD have a higher yield to begin with, as risk assets are priced off a higher risk-free rate. Therefore, the hedging cost nets out and you should invest in the region where you see the highest potential returns going forwards.

To illustrate this, we can look at six-month periods where US HY outperforms GBP HY by +2%, even after hedging costs are applied. Holding the higher-yielding US assets with a stronger outlook cancelled out the hedging costs and generated a better overall return.

The same illustrations played out in the IG market. But putting return potential to one side, we believe the real benefit is the additional diversification that currency exposure brings – even if overall performance is neutral, your portfolio risk will be lowered.

Including geographic flexibility in your investment arsenal can give you a useful fifth lever to pull on (alongside asset allocation, duration, credit quality and sector) as market direction shifts.

So while yield has returned to UK fixed income, having a strong home bias could leave your portfolio unduly exposed to sector concentration risk. Evaluating your fixed income allocations through a global lens is, in our view, the best way to optimise risk-adjusted returns.

1, 3 & 4 Mirabaud Asset Management, ICE BAML, 28 February 2023

2 & 5 Bloomberg, 22 September 2023

Fixed Income

Asset management

Head of UK Wholesale

Of the 940 bonds within the UK market, 39% of these are banking and real estate names. In today’s environment of elevated mortgage rates, this creates significant sector risk, pushing yields out.

We believe our nimble and flexible approach to fixed income investing, implemented by a small hands-on team, presents the best way to capture upside potential while managing downside risk through active hedging.

The Mirabaud Sustainable Global Strategic Bond strategy is a dynamic, ‘go-anywhere’ fixed income solution that aims to achieve an attractive total return through a high level of income combined with long-term capital appreciation.

The strategy is positioned to avoid a home bias and singlemarket concentration risk through a fully hedged, global portfolio diversified by geography and sector. It is currently tilted towards the US, where historically high all-in yields are supported by robust economic fundamentals, while the lack of a strong rebound in China is weighing on the outlook for Europe and emerging markets.

Continue to