Convertible Bonds

Convertibles’ future performance is supported by valuations

Convertible Bonds

We’re taking advantage of the summer lull to dig into the seventh asset-class tailwind we highlighted in our July insight.

Based on current low levels of volatility and the credit mispricing of low-delta convertibles, we see valuation as a greater source of alpha than a medium-term risk for the asset class. We expect many convertibles to see their valuations richen, especially if the asset class attracts buying inflows.

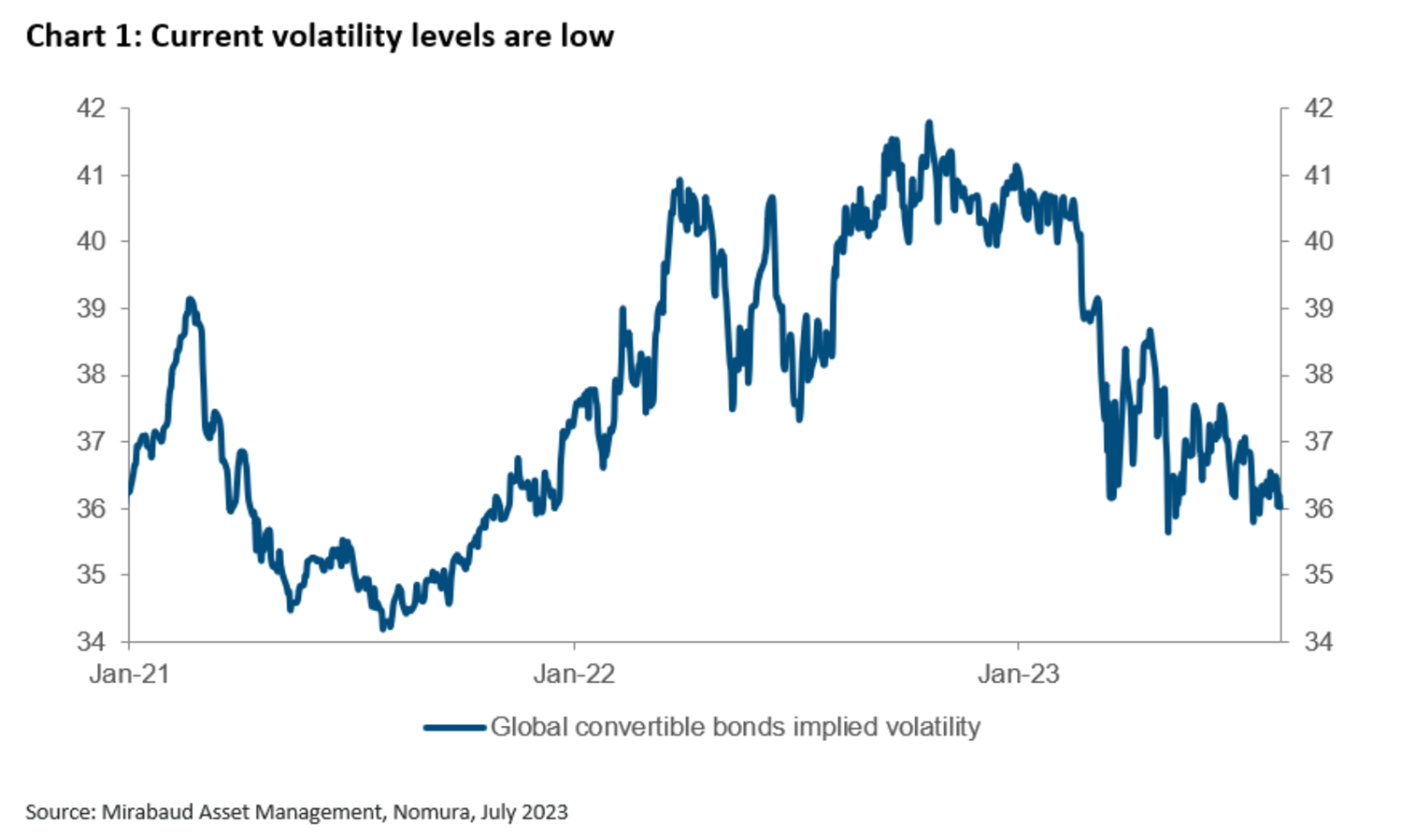

Current low volatility levels are illustrated in Chart 1, with the implied volatility of global convertible bonds dropping by 5.1% this year from 41.1% to 36.0%, according to Nomura data – levels not seen since 2021. Apart from the decline in realised volatility, this slump might also be explained by technical pressure on the market through:

The bright side is that new deals are offered to the market at a discount to their theoretical "fair" value, as issuers make compromises to accept less favourable terms surrounding new offerings to ensure their deals launch successfully. In that context, we expect the vega – which is a derivative of implied volatility – to contribute roughly 10% of prospective total returns in the medium term.

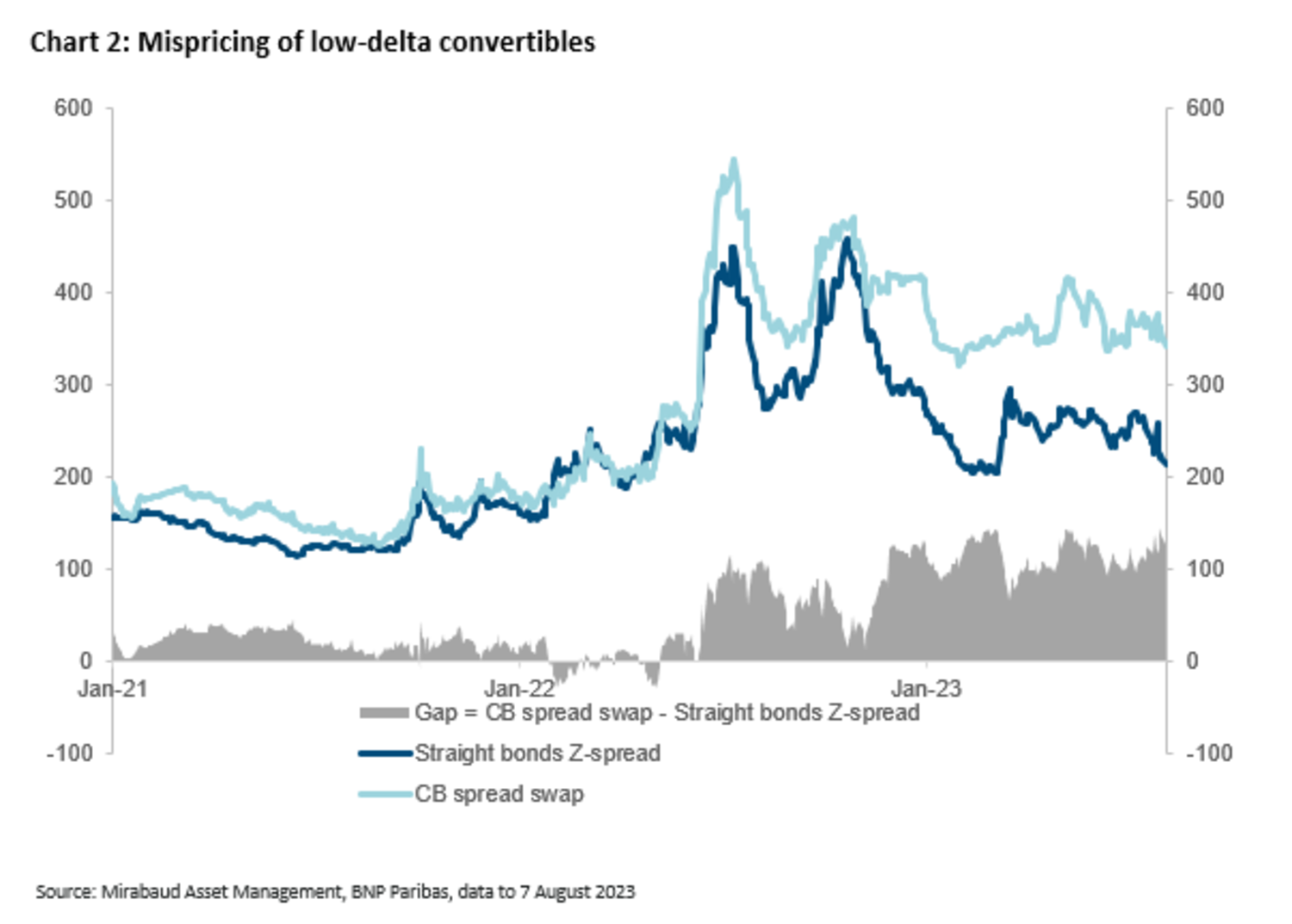

Chart 2 illustrates the mispricing of low-delta convertibles, with the credit spread evolution of an index of European convertibles compared to an index of straight bonds from similar issuers3.

The average spread discount between the two indices is 132bps (350bps vs. 218bps), which is unusual, in our view, given that convertible bonds consist of a corporate bond and a call option on the issuer's underlying stock.

When the conversion options are valued using a volatility assumption (capped at 45%), as well as the maturity and current price of the convertible bond, the average implied spread comes in at 409bps ─ that is 191bps higher than the average spread of the equivalent straight bonds, according to BNPP.

In our view, the current discount is explained by the lack of capital from market participants, which makes the current backdrop for convertibles attractive.

Given the current divergence, the asset class may appeal to traditional credit investors searching for any positive convexity to come, beyond what could be derived from traditional credit instruments, as well as investors concerned about the possibility of a fall in equities from here.

1 BofA

2 Nomura

3 BNPP

Continue to