Fixed Income

Harnessing the power of fixed income for a more sustainable future

Fixed Income

There was certainly an equity/ bondholder divide in the early days of sustainable and responsible investing (SRI), but a lot has changed as ESG factors have become fully integrated into everyday investment processes. While bondholders are capital lenders, not company owners with voting rights, they still have a powerful influence.

With the global fixed income universe worth in the region of USD123 trillion1, bondholders have the power to provide financing or remove access to capital – and ESG metrics such as climate impact are more commonly becoming make-or-break factors driving investment decisions. If a corporate or sovereign’s operations are deemed environmentally damaging, they may struggle to access affordable capital and be penalised with higher borrowing costs. At the extreme end of the spectrum, the physical risks associated with climate change can ultimately collapse a company.

In 2019, Pacific Gas & Electric Company (PG&E) filed for bankruptcy protection in the face of a USD30 billion fine for improperly maintaining its power lines. The charge followed a series of devastating wildfires that resulted in wrongful death, personal injuries, property and business losses and PG&E became the first ‘climate bankruptcy’.

The bottom line for issuers is it is – at a minimum – becoming increasingly costly to be an environmentally unscrupulous borrower, and a total disregard for climate risks could ultimately destroy a company. Bond holders are tuning into this broad spectrum of environmental and financial risks, and they are guiding how they deploy capital.

Paris Agreement success depends on rapid, deep and immediate emissions reductions across every industry, according to the Intergovernmental Panel on Climate Change (IPCC). To that end, owners and stewards of capital, such as ourselves, have a crucial role in financing this transition. SIFMA estimate USD5 trillion worth of investment is needed by 2030 to achieve net zero, with change required across all regions and sectors.

Combining the power of committed client capital with long-term active engagement, the strategy is positioned to drive economic transformation as described by the IPCC.

Rather than simply reaping or rewarding success at the finish line, the strategy actively catalyses the net-zero transition by steering change among a cross-section of issuers representative of the real economy.

Our green bond holdings have the most direct correlation with achieving Paris Agreement goals, as their proceeds are dedicated to financing green projects. But all of our issuers must ultimately be looking to move in the same direction on climate change.

Where the bond proceeds are not tied to a specific climate-related/Paris Agreement project (as with green bonds) we identify issuers that are actively looking to evolve their business practices to achieve climate-positive objectives. We then implement a long-term engagement process with clear outcomes, working in partnership with issuers to help them meet their transition commitments, which in turn helps us achieve ours.

We seek to maintain a weighted average portfolio temperature of sub 2°C in line with the Paris Agreement.

Green bonds are issued specifically to raise capital to finance projects that support the energy transition. These bonds make up a minimum of 51% of the portfolio and we tend to focus on clean transport, energy efficiency and renewable projects. Our green bond holdings must pass internal and/or external third-party verification to ensure the proceeds of the bonds are invested in sustainable projects that are robust and that their frameworks are aligned with international standards.

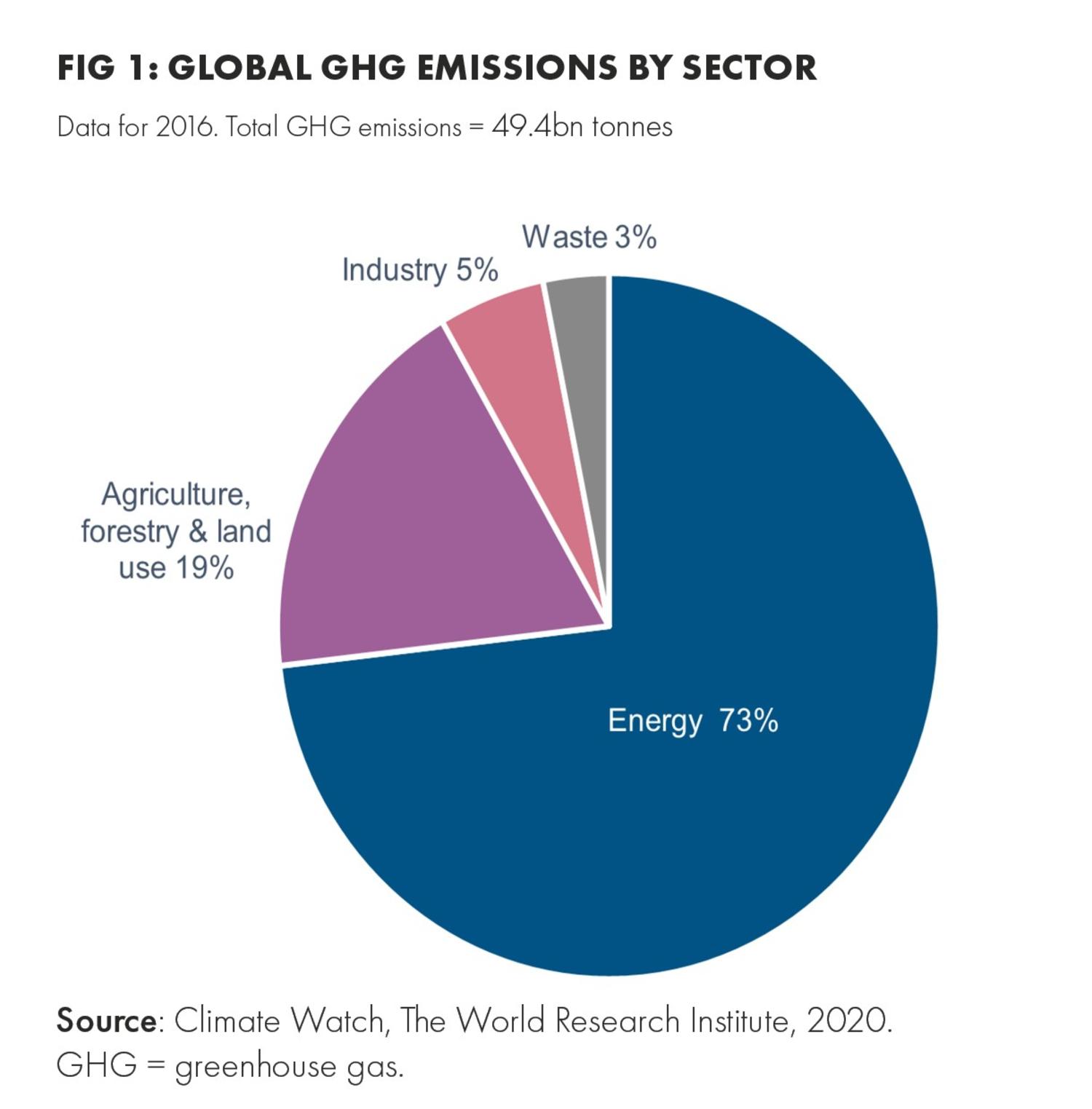

Transition bonds are corporate bonds issued by companies that have either willingly committed to meet Paris Agreement goals or are implementing change to meet future net zero climate targets. These companies are the ones that can make a real difference in high-emitting sectors like energy, utilities, and industrials (see Fig 1).

High emitters are key to the climate transition because their business models are tied to a significant proportion of global greenhouse gas emissions. We believe they represent areas where we can drive the most ambitious change. Rigorous engagement efforts are essential.

We believe combining green and transition bonds results in maximum impact, as transition bonds essentially ‘lead the charge’ on the energy transition, and green bonds provide dedicated funds.

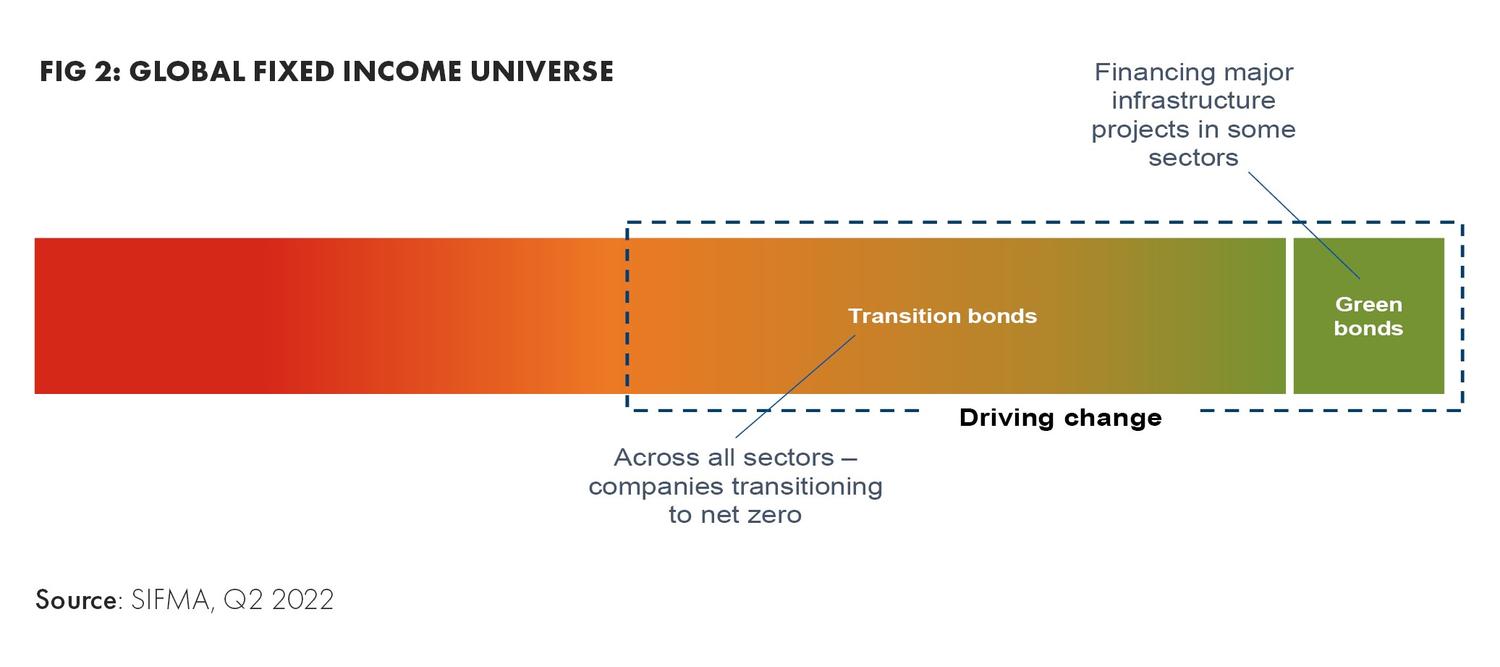

Additionally, the green bond market is a very small subset of the fixed income universe (see Fig 2). We believe including transition bonds within the strategy significantly increases overall impact potential by allowing us, as active investors, to catalyse change through engagement, as well as by providing financing.

Our rigorous, hands-on credit research process allows us to identify the transition bonds mostly likely to deliver impactful change – these bonds become ‘winners’ for the climate and for our clients.

We believe it is essential to invest across both sub-sectors to fully support the transition to a low-carbon world and access opportunities arising from the energy transition.

A huge amount of opportunity results from our ability to invest in transition bonds. They allow us to look at high-emitting sectors and identify issuers that are willing to commit to improving the operational practices to deliver real, positive environmental impact.

The combination of transition bonds in carbon-intensive sectors with rigorous active engagement efforts (to support issuers’ transition plans) creates a powerful financial and environmental opportunity.

Through positive screening, we select companies that are either aligned, or are making progress towards alignment, with a sub-2°C trajectory by 2030 and net-zero by 2050. We layer this analysis with engagement work to have a greater proportional impact on reducing emissions.

In particular, we look a lot at the energy sector, which is cyclical in nature and capital intensive. The bonds of energy companies tend to carry a premium valuation and typically have a higher beta than the market, so when the market appreciates, we would expect them to outperform and when it falls, they typically underperform. The strategy can invest globally across the credit-rating spectrum, giving us full flexibility to capture potential opportunities as they arise.

We believe the strategy offers the best of both worlds – climate impact without style drift. As an SFDR Article 9 strategy, our robust ESG & Climate Integration process delivers genuine climate impact without compromising on sector exposures that others may exclude due to issuers’ current (rather than their possible future) emissions levels. It’s a genuine green strategy that behaves closely to a normal global strategic bond strategy – something we believe is quite unique.

1 SIFMA, Q2 2022

Fixed Income

Continue to