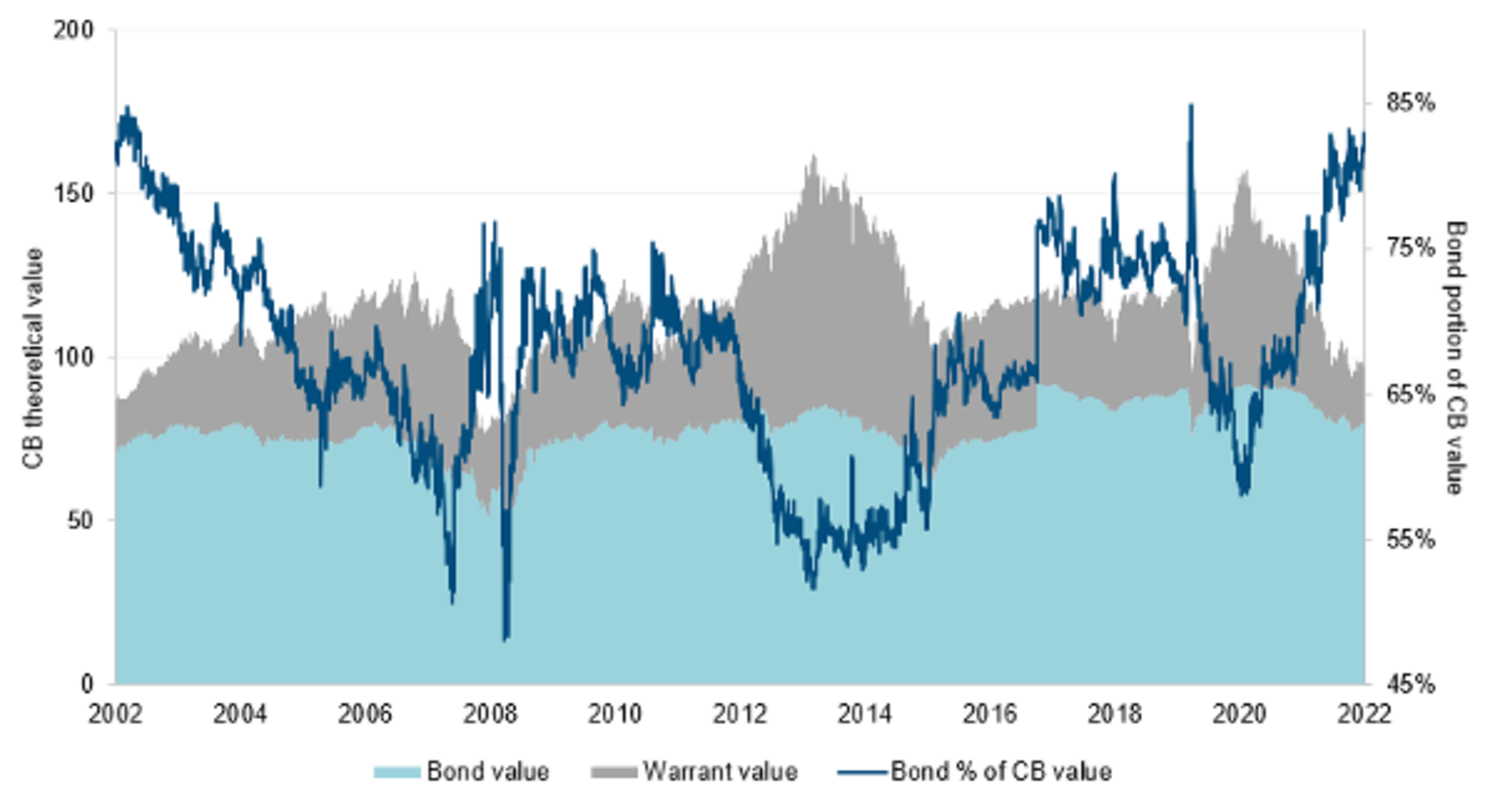

Under typical conditions, the convertible market is far more responsive to the equity market than it is to the bond market. However, as shown in the chart, 82% of a convertible bond’s (CB) value in the US is currently derived from its bond value according to Bank of America (BofA) research, which analysed the theoretical value attribution over the previous two decades.

Given that the market is currently more focused on bonds, it is not surprising that credit and default risks are on the minds of many CB investors – yet credit conditions within the convertibles universe seem generally favourable.