Fixed Income

Breaking away from the home bias

Fixed Income

Having international exposure in your equity allocation has become the norm. Many NASDAQ companies are household names and Warren Buffett’s long-term tip of ‘buy and hold the S&P’ appeals to investors around the world. The consensus view is that opportunities in international equity markets can be as attractive, if not more so, than those at home. But when it comes to fixed income, the home bias remains strong.

While there’s comfort in the familiar, it also limits the opportunity set and can introduce unintended concentration risks. When the composition of the UK fixed income universe is fully understood, expanding your geographic remit – even after hedging to sterling as we know investors don’t want to run currency risk in their fixed income holdings – could prove less risky than staying close to home.

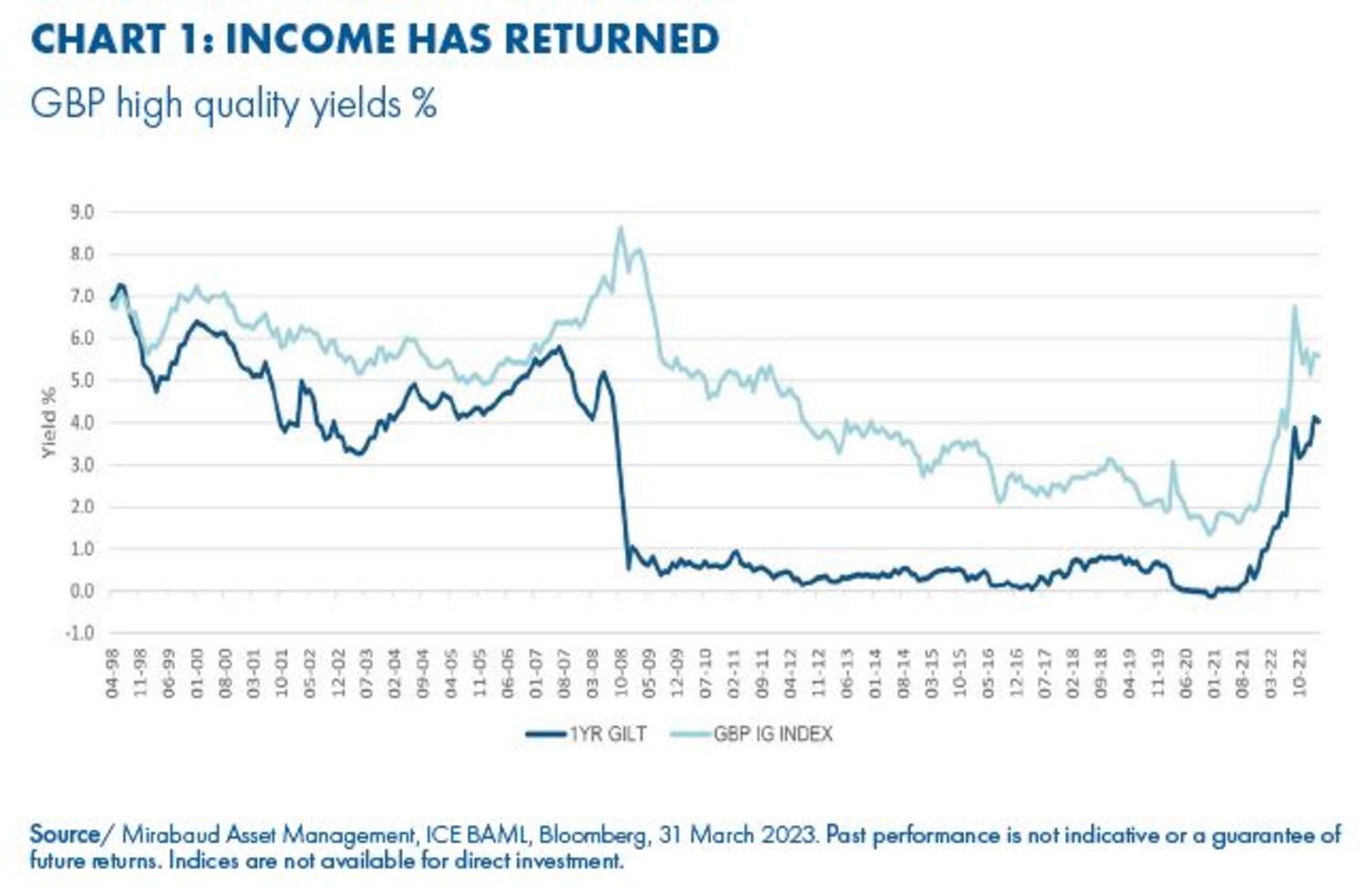

After 12 years of ultra-low yields, income has returned, with segments of the market offering return opportunities akin to equities. Now seems an opportune time to review bond allocations in order to optimise risk-adjusted return potential.

Gilts are the stalwart of UK fixed income, and with yields of 4.3% on the 1-year and 3.7% on the 10-year, they’ve regained their appeal as a core allocation. For a higher target return, you might then look to UK investment grade (IG), which trumps domestic sovereign debt with yields around 5.6%. But buyer beware – a problem lurks under the surface.

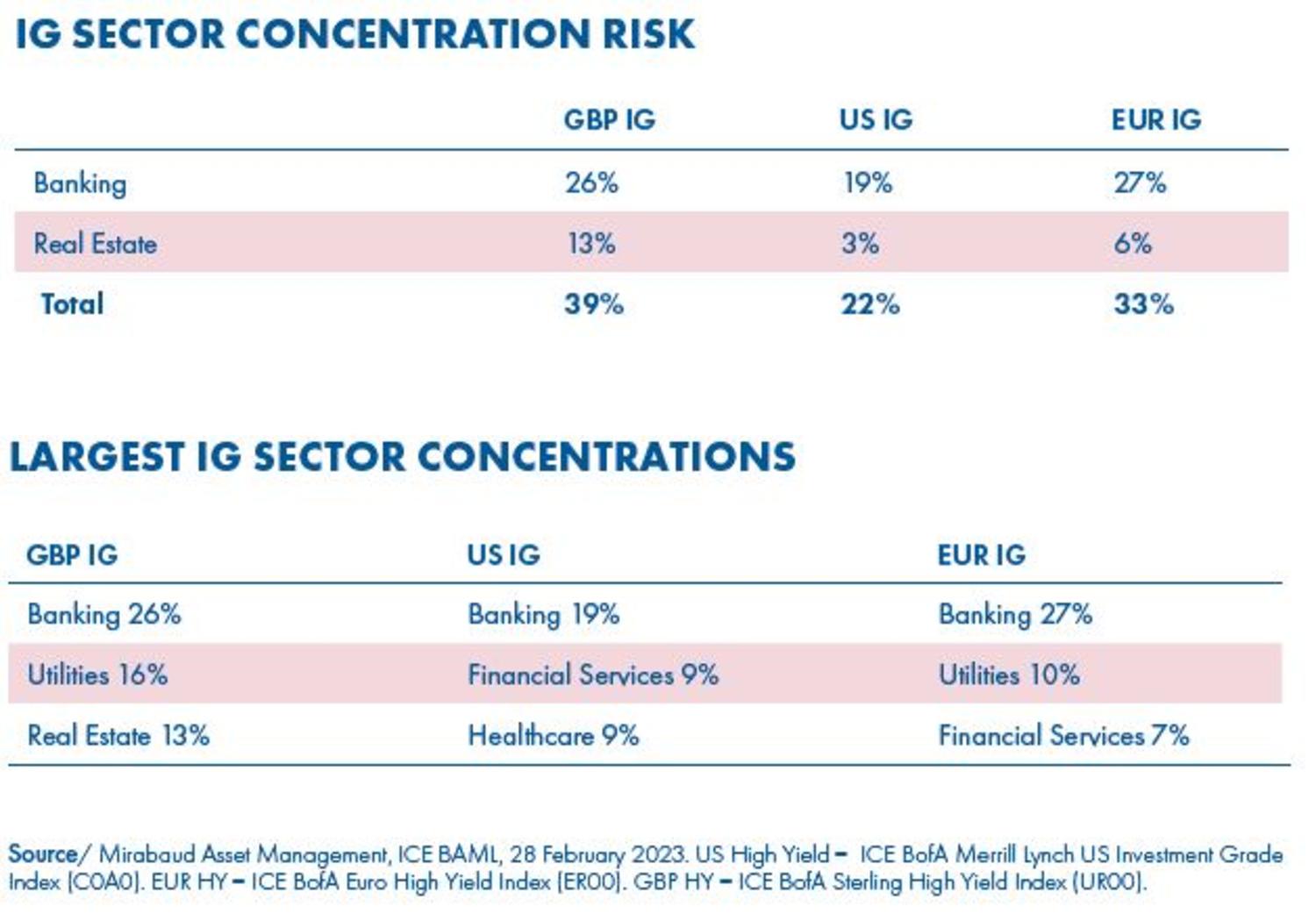

The UK IG market has an unusually strong concentration bias. Of the 940 bonds within it, 39% of these are banking and real estate names. In today’s environment of elevated mortgage rates, this creates significant sector risk, pushing yields out.

To get the best of IG with the lowest level of risk, we believe broadening your geographic remit and taking an international view provides the optimal solution. The US IG market has a lower yield of 4.8% (hedged) but less concentration risk than the UK, with banks comprising 19% of the market and real estate just 3%. There are also opportunities in US IG names in the growth sectors like technology and energy that are not available in the UK market.

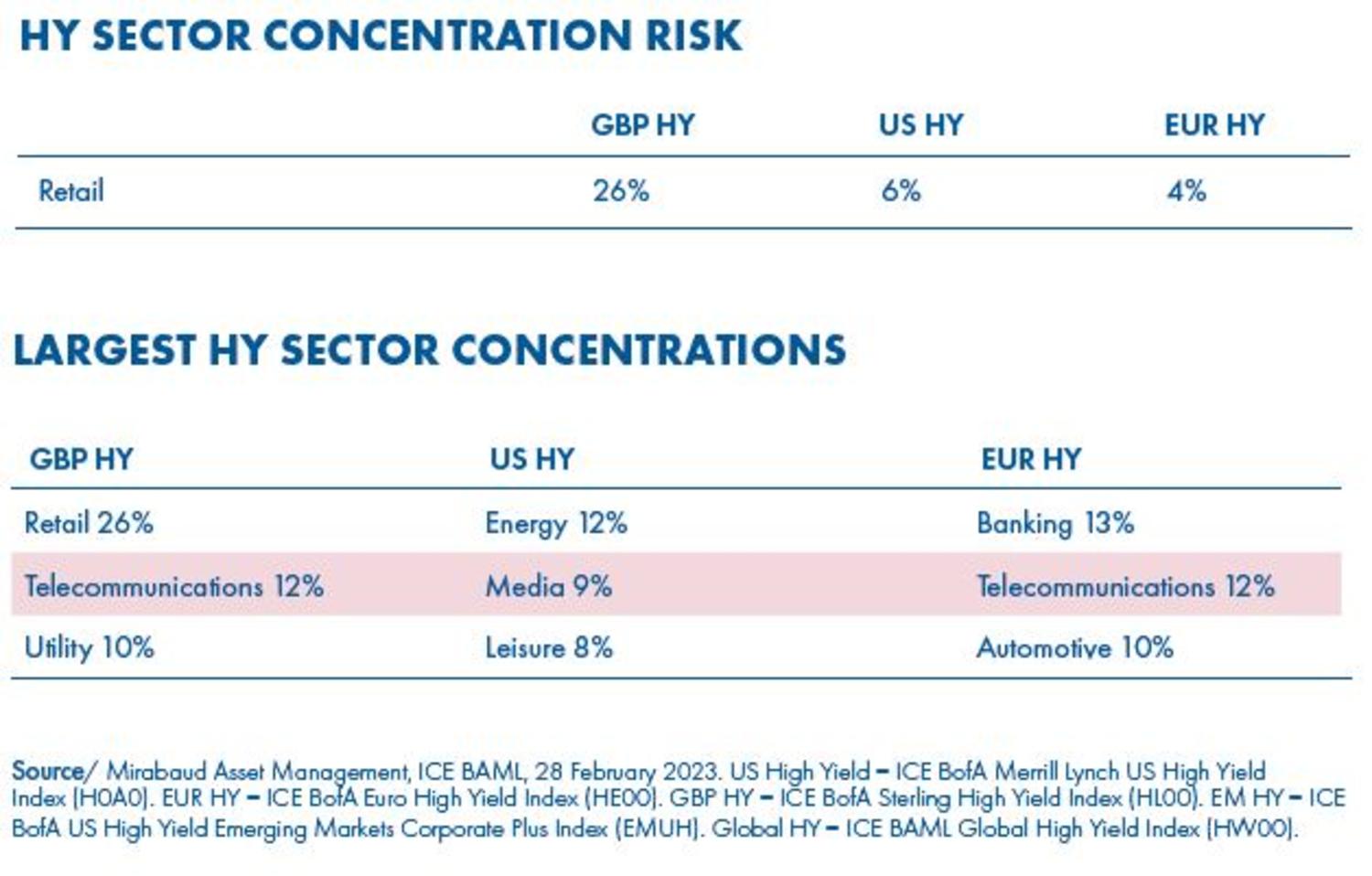

UK high yield (HY) also contains notable concentration risk. The market is small, with 99 bonds offered by 66 issues. 26% of these bonds sit in the retail sector, with supermarket names dominating. Given CPI is proving sticky at 10% and unemployment is forecast to tick up through 2023, the UK consumer is set to decline and this degree of retail concentration could negatively impact returns.

While HY can be an interesting allocation for higher potential returns, we believe exposure needs to come from a better spread of sectors for an optimised risk/return profile. The US and European markets are much larger and are without the elevated concentration risk that the UK has, yet yields are attractive at 8.7% (hedged) and 8.1% (hedged) respectively, versus 10% for the UK.

With short-dated investments now offering appealing yields, it can be tempting to park your portfolio at the short end of the curve. This is a valid strategy for capital preservation – but it does leave you exposed to reinvestment risk and missing market upside.

When a rate-hiking cycle comes to an end, the rally in high-quality, longer-duration assets can be considerable, and in 2019 delivered returns above equities despite being much lower risk. High-quality fixed income has a lot of downside protection, giving it an asymmetric return profile that should do well when the cycle turns.

While holding only UK fixed income introduces what we believe to be unnecessarily concentration risk into a portfolio, and a short-duration bias could have a negative impact when the cycle turns, no market is devoid of opportunities.

Rigorous bottom-up credit analysis should bring some UK gems to the surface and provide protection against interest-rate and default risk, which is elevated by the prevalence of banks and real estate in UK IG and retail in the HY market. These can be complemented by tactical exposures to Europe and the US.

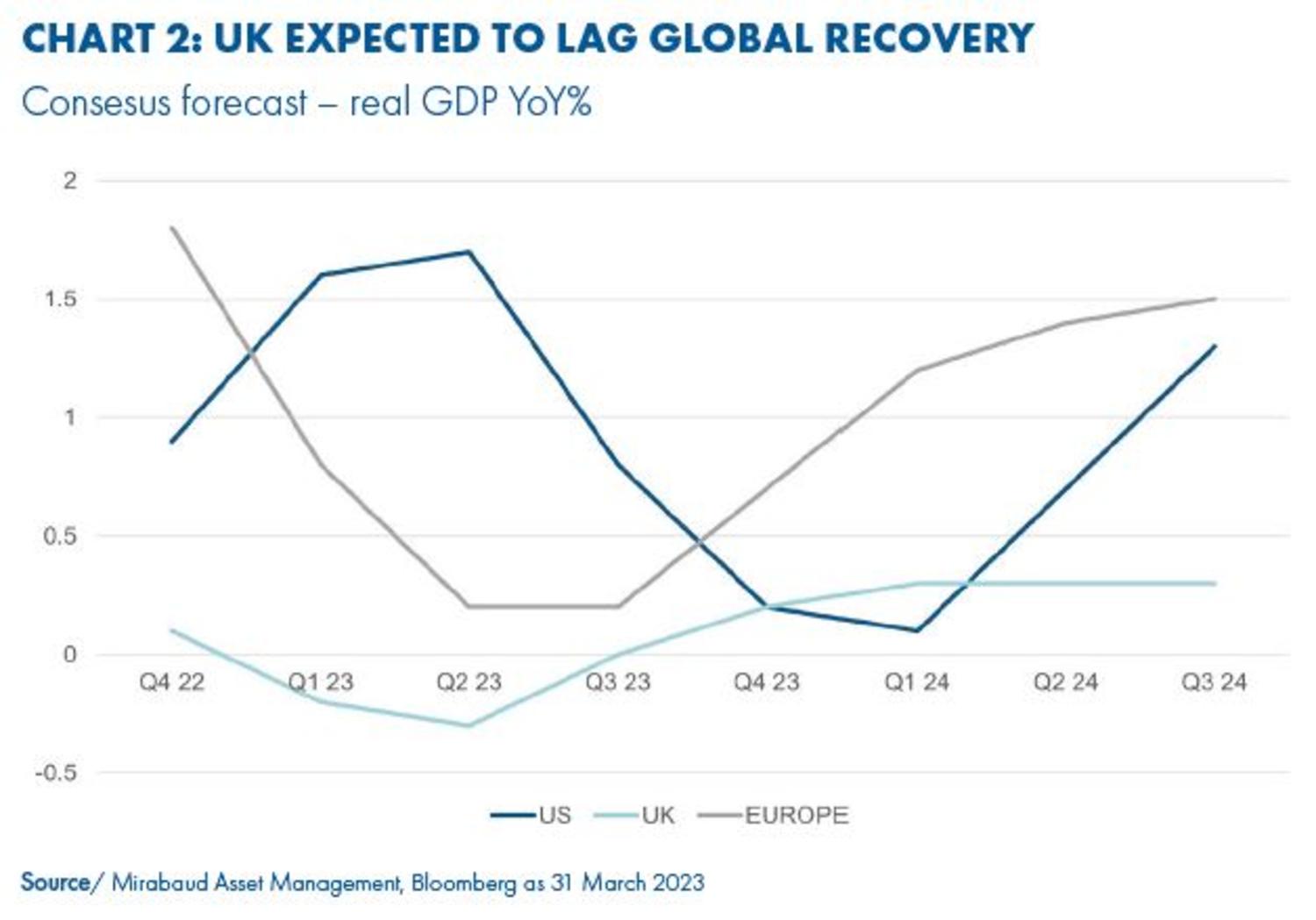

We believe flexibility between geographies can capture the different speeds of economies across the globe – with consensus forecasts that the US and Europe could see that classic “hockey stick” recovery that would be positive for credit spreads, compared to the UK, which is expected to be mired in low growth for some time.

In Europe, we’re currently seeing some interesting opportunities in HY – a market which was unduly punished in 2022 as the peak fear regarding gas prices drove spreads out. Drilling down in sectors, we see long-term structural growth in European telecoms infrastructure, and more short-term opportunities in German manufacturing, which is set to benefit from momentum around the China reopening trade.

In the US, cruise liners and companies associated with the re-opening travel theme continue to perform well, enjoying elevated bookings and strong demand.

Outperforming is never easy and we believe in having as many tools at your disposal as possible to optimise riskadjusted returns. Including geographic flexibility alongside asset allocation, duration, credit quality and sector gives you a fifth lever to pull on as market direction shifts.

Currency risk is an element that can deter investors from expanding their geographic view. It’s true currency moves can be bigger than returns at times, but the perception that it’s prohibitively expensive to hedge your currency risk back to sterling isn’t accurate. Indeed, it’s something we believe investors should actively consider.

The cost to hedge foreign currency bond funds back to GBP is essentially the government interest rate differential – so at the end of April 2023, it cost around 60bps to hedge back from USD to GBP. However, fixed income assets in USD have a higher yield to begin with, as risk assets are priced off a higher risk-free rate. Therefore, the hedging cost nets out and you should invest in the region where you see the highest potential returns going forwards.

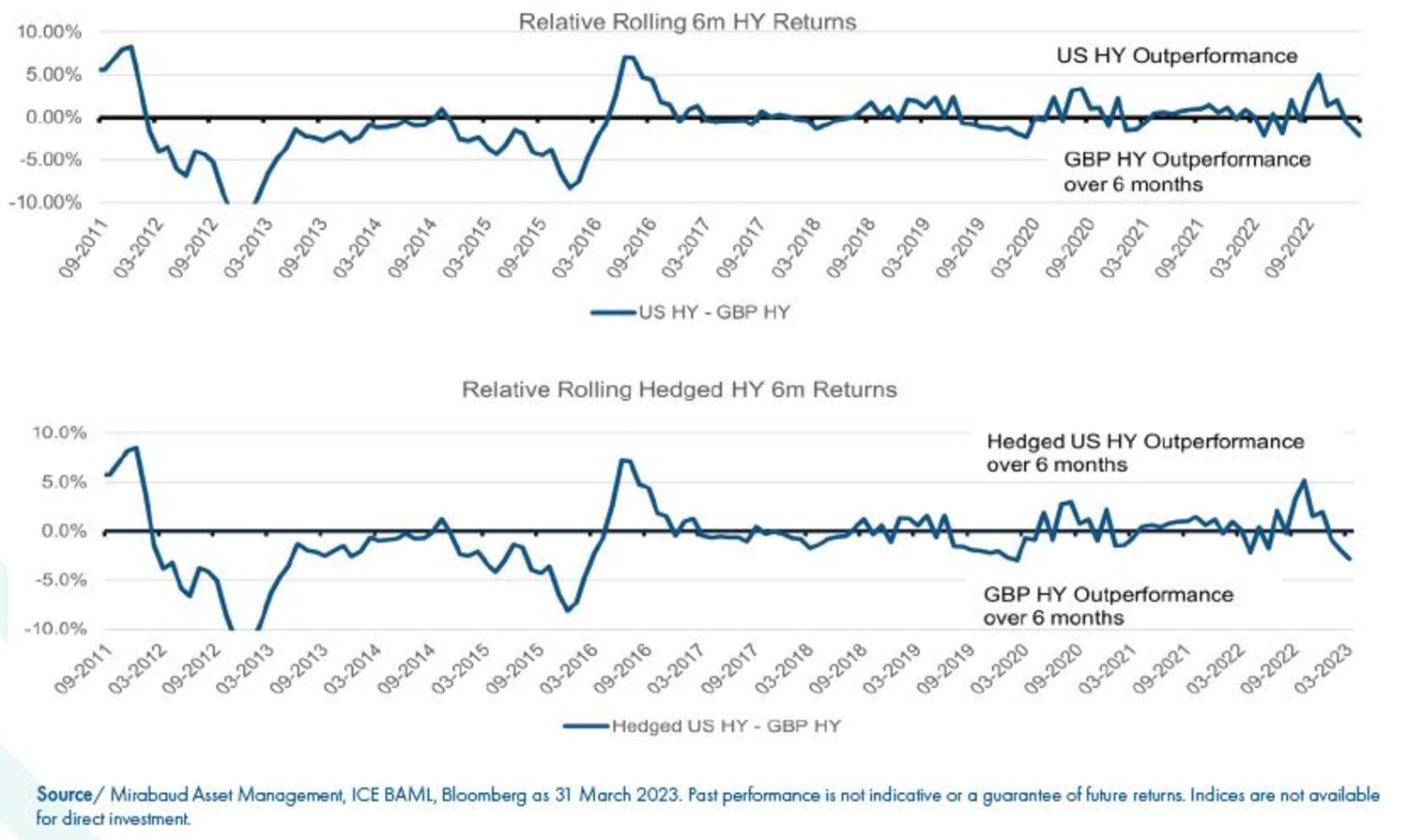

To prove this, we can see six-month periods where US HY outperforms GBP HY by +2%, even after hedging costs are applied – so holding the higher-yielding US assets with a stronger outlook cancels out the hedging costs and generates a better overall return. The same can be seen in the IG market. But putting return potential to one side, we believe the real benefit is the additional diversification that currency exposure brings – even if overall performance is neutral, your portfolio risk will be lowered.

While UK fixed income presents opportunities, underlying market risks could leave your portfolio unduly exposed to concentration and duration risk. We believe evaluating your fixed income allocations through a global lens provides the best way to optimise risk-adjusted returns.

At Mirabaud Asset Management, we believe our nimble and flexible approach, implemented by a small, hands-on team, presents the best way to capture upside potential while managing downside through active hedging.

Fixed Income

Continue to