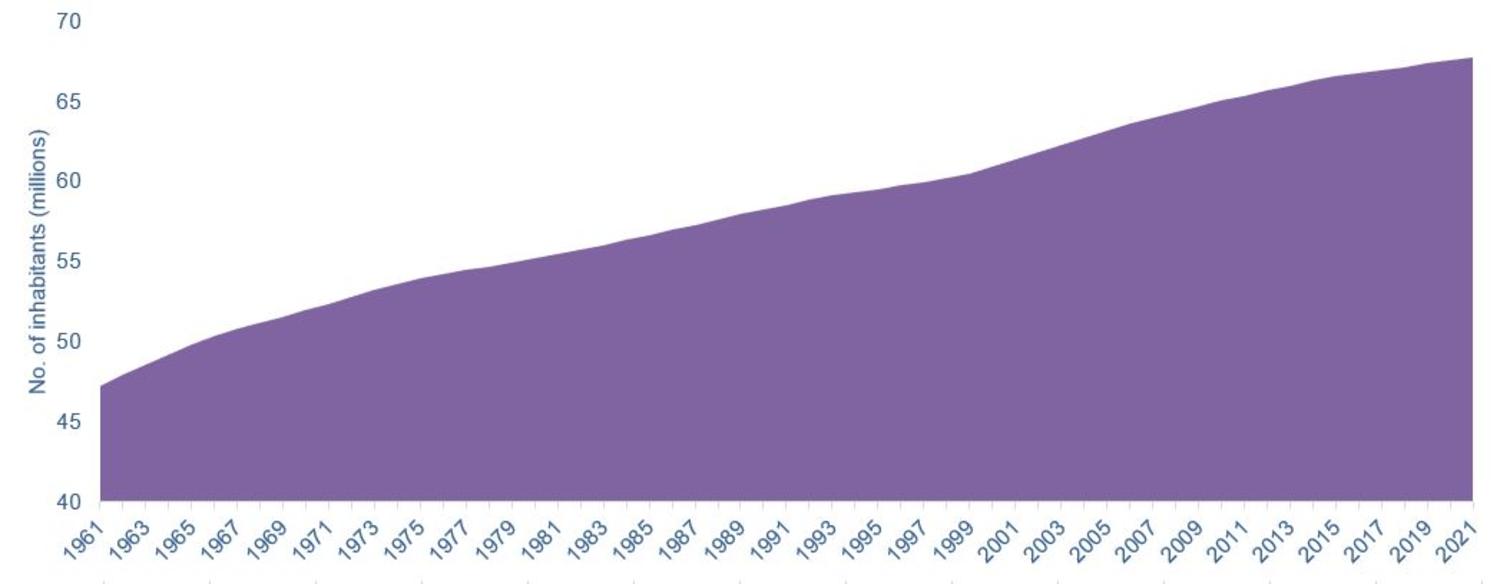

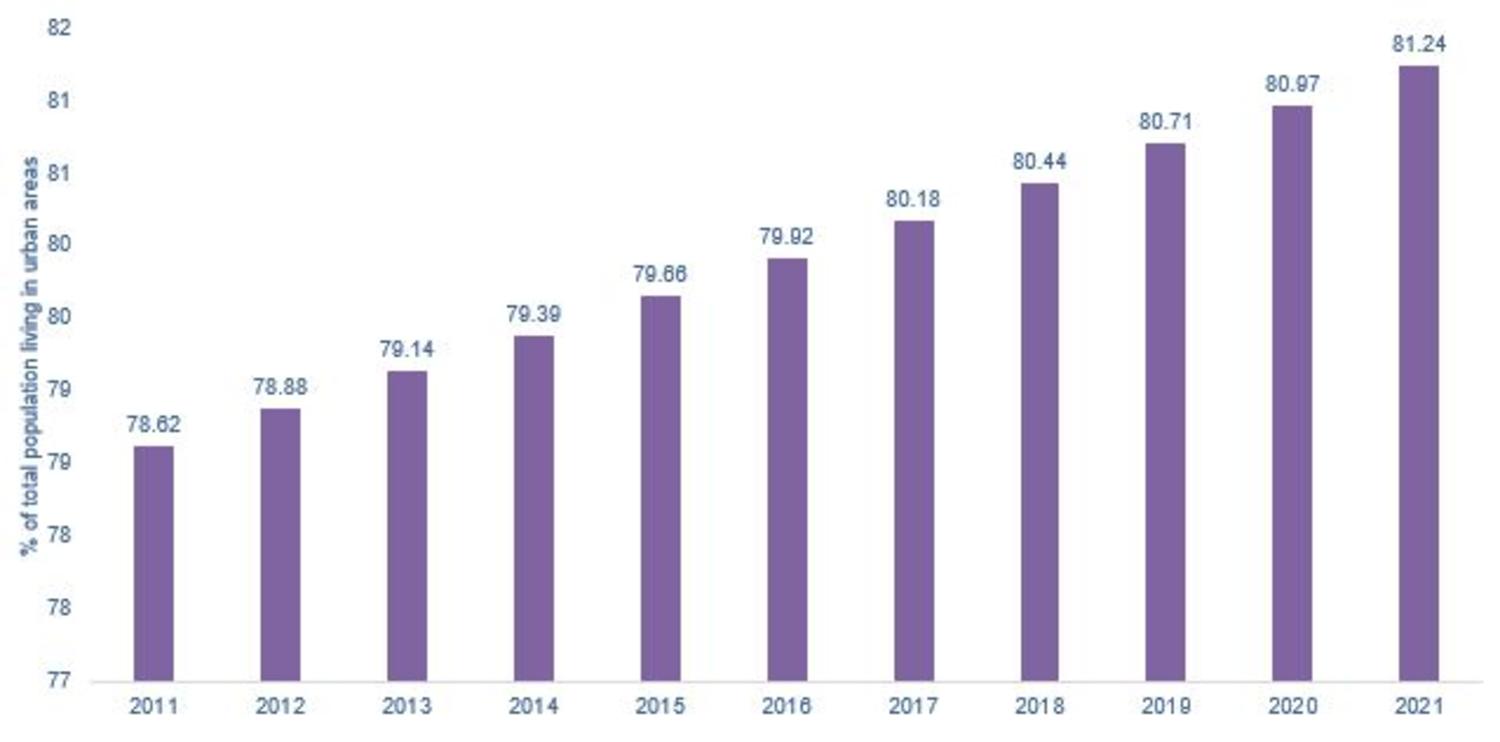

Source/ World Bank, March 2023

Instead of continuing to expand outwards, France has written into law that its major cities must increase their density, with land plots and existing buildings being restructured to ensure they can absorb growing populations.

As cities become denser, they mustalso become more energy efficient; the existing French building stockcurrently accounts for 43% of national energy consumption3.

REGULATION SUPPORTING FRANCE’S SHIFT TOWARDS SUSTAINABLE CITIES

Decret Tertiaire, published in 2019, sets out obligations for the owners of commercial buildings to launch restructuring programmes to reduce energy consumption by 40% in 2030, 50% in 2040 and 60% in 2050. This is driving a huge number of restructurings, requiring significant developer equity.

The ZAN law, adopted in 2021 as part of the Climate and Resilience Bill, sets the path for a stringent reduction plan of artificialisation of soils, which occurs when cities expand into natural and agricultural lands. This will progressively stop the outward spread of cities and drive value increase for assets and plots of land inside city boundaries.

Multiple restrictions on renting high energy consumption homes are also in place, with more stringent laws being added in 2025 through to 2034, at which point all properties rated ‘E’ and under on the Diagnostic de performance énergétique (DPE) scale of energy efficiency will no longer be rentable.

In combination, developers and landlords must look upward not outward, investing in efficient land use and the restructuring the existing building stock to ensure France’s leading cities can house their growing populations in a sustainable way.

It is this unique combination of land development and environmental regulation that creates the investment proposition.

Today’s inventory of unsold new homes is less than 5000 units across France4, which along with increasing land plot scarcity supports long-term value appreciation, while asset owners face increasing equity requirements to implement restructuring works.

These factors create the core investment case, maintaining price integrity and ensuring the requirement for investment capital.

But what about short-term macroeconomic challenges? Here, the French market is highly adaptable.

The system for land pricing in France is supportive of developers over land sellers, with acquisition prices based on assumed programme revenues (price per m2 x number of m2). This ensures a healthy floor for land plot prices and prevents the market from tumbling into a downward pricing cycle.

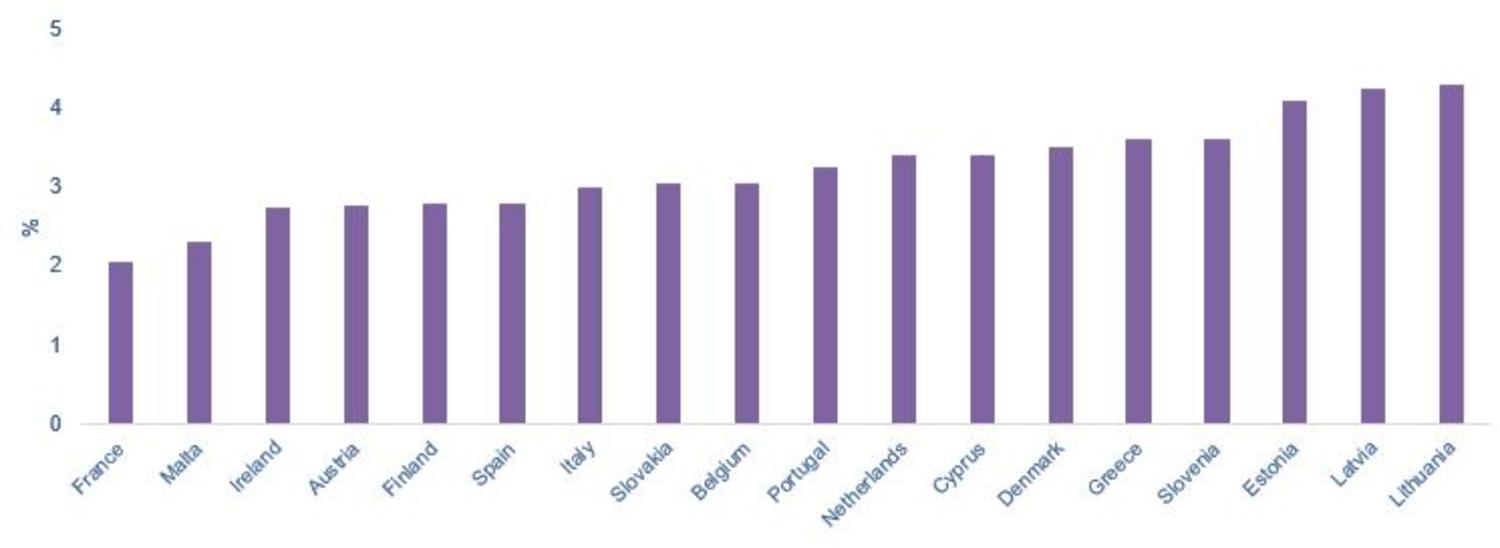

In terms of end-unit purchase financing, mortgage rates have risen across Europe, but French ratesremain at the lower end of the range thanks to the prevalence of fixed-rate financing, which supports market stability and reduces the likelihood of a house price crash.

Revenue assumptions are slightly lower today than they were presummer 2022. But where individual sales have slowed to reflect economic uncertainty, that demand is being replaced by institutional investors who are re-allocating capital away from commercial real estate towards residential projects in the wake of Covid-19 and the shift towards work from home.

Inflation and supply chain constraints also caused build costs to surge between 2020 and 2022. But the weight of construction costs within the total price is not as high as you might expect given that the bulk of expenses come from engineering fees, which have maintained a more stable pricing structure. Regarding raw materials, the price easing that began to come through in late summer 2022 is accelerating, and as the backlog of orders empties out, total build costs are coming down.

Assessing land prices today, developers assume slightly lower revenues combined with current building costs and set a margin target. Any proposed land price will always be structured to protect this margin.