China: still Asia’s engine for growth

Even before this year’s impact to growth from the Russia - Ukraine conflict and its COVID lockdowns, China’s overall policy had shifted to an expansionary mode. This shift has now become more pronounced, to counter the effects of these events in the first half of 2022. China has reduced base rates, lowered the reserve ratios of its commercial banks, and is encouraging local government to raise their full funding for infrastructure projects. Furthermore, numerous targeted measures have been introduced to support key areas such as housing and consumption.

Even so, China’s real GDP growth target of 5.5% this year looks unlikely to be met without further stimulus measures. In November, the Communist Party will be holding its 20th National Congress, where President Xi is expected to bid for an historic third term, which makes achieving growth close to the target more important than usual. Therefore, we expect continued policy support from here, and recent comments from Xi have confirmed his commitment to meeting this growth target.

A revised approach to COVID

There has been a subtle (but important) revision to China’s much-criticised zero-COVID approach, with the move from “COVID zero” to “COVID zero in the community”. In summary, this means infections will be tolerated so long as the infected are in, or taken to, isolation. This is now only one step (home isolation) away from the approach seen in the west through 2020-21.

It’s also important to remember that China had imposed no COVID lockdowns since the brief Wuhan restrictions in the first quarter of 2020. There was, therefore, little experience of how to manage lockdowns without disruption. Lessons were learnt during the Shanghai lockdown that enabled a gradual recovery in the economy to happen before the lockdowns were fully eased. As a result, we would expect any future lockdowns to have far less impact on activity.

China’s harsher regulatory climate looks to be softening

China has also been making encouraging statements in terms of supportive regulation for companies. This is a notable shift – particularly given the regulatory crackdowns experienced by many sectors during 2021 – and could turn regulation from a headwind to a tailwind for Chinese companies. Politicians, officials and regulators have issued several statements in recent weeks confirming their shift towards supporting growth and internet companies, highlighting how integral they are for a healthy, growing economy. A recent hiatus on gaming approvals has also ended, lending further support to China’s domestic platform companies.

US and Chinese regulators are also making progress towards a solution that would enable Chinese American Depository Receipts (ADRs) to remain listed in the US. The ADR issue and the potential de-listing of China stocks from the US had been a sizeable headwind for stocks and internet platform companies in particular. We expect a resolution would be a huge positive for overall sentiment.

Property initiatives have also been an area of focus for Beijing. This includes making it easier to obtain mortgage lending, reducing the minimum down-payment for home purchases and encouraging bank lending to developers. The property sector is a key contributor to China’s GDP and as such we expect further support in support of reaching this year’s growth target.

There is also the potential for the removal of the Trump-era trade tariffs, partly due to the current inflation challenges being experienced. The US is considering removing these tariffs on China imports and if removed, it has been estimated this could reduce US inflation by up to 1%.

Post-lockdown opportunities

Lockdowns and supply disruptions caused a sharp sell down in Chinese equities, especially those tied to consumption. COVID lockdowns commenced at the same time as the beginning of the Russia - Ukraine conflict causing a sharp and sudden sell-down to consumer-focused companies.

In our opinion, this has presented a strong opportunity for a rebound. Furthermore, several measures have been taken to stimulate the economy post the lockdowns. This includes discounts on consumer electronics, smartphones, vehicles and energy efficient household goods. There is a clear message that consumer spending is recognised as important for driving a rebound in growth. Progress had been made to ensure the economy can function during COVID restrictions, mainly by putting processes in place that also balance the need between restricting COVID and maintaining growth.

Another positive comes with the accelerating trend of localisation. Events of recent years had seen many countries, including China, seeking to increase domestic self-reliance. This year’s supply chain disruptions have been helping local companies (such as China automation company, Estun) grow domestic market share as international suppliers struggle with supply delays.

India: economic conditions still positive

Rural growth in India is rebounding

Last year produced a good winter harvest and current high food prices are supporting farmers’ incomes. The summer monsoon season has also started well, which is positive for continued rural strength. Alongside this, government infrastructure projects are picking up, which supports rural communities where farmers often use their machinery and tractors to contract on projects.

Housing demand also strong

Despite recent interest rate hikes, mortgage rates remain low by historical standards. Low home ownership and mortgage penetration, combined with shifting household patterns, presents a long-term structural opportunity. Affordability is near decade-lows and recent structural reforms on developers have made buying a home more transparent and with greater consumer protections

Possible offset to high energy prices

While the west has continued to sanction Russia for its invasion of Ukraine, anecdotal evidence points to an acceleration of Russian energy purchases by India, presumably to take advantage of steep discounts. India is currently in a strong position geopolitically as a US ally to counter-balance Chinese influence in Asia. The US seems to accept that India needs to have a working relationship with Russia for the time being given their military dependence, while continuing to encourage India to diversify its energy and military partners over time.

Southeast Asia: still in recovery mode

Economic activity continues to recover across the region. Lockdown restrictions effectively ended in the first half of 2022 and COVID infection levels are now much lower, with ample medical capacity. Southeast Asian countries have moved to treating COVID as endemic, as in the west. The vaccine rollout took much longer across the region, which means Southeast Asian countries are starting to experience an economic rebound similar to the recovery seen in developed markets during 2021.

Furthermore, the global economic situation is creating strong benefits to commodity producers. Prolonged strength in the price of commodities such as oil, gas, palm oil, nickel, iron ore, etc., have been positive for certain Asian counties, including Malaysia and Indonesia. This strength has also helped reduce the traditional sensitivity (negative impact) of Southeast Asian currencies to a stronger US Dollar.

Taiwan and Korea: tech sector de-rating

The de-rating experienced by Taiwan and Korean technology sectors that began in 2021 has continued through the first half of 2022. This is despite many leading companies consistently beating earnings expectations and raising guidance at each earnings release. As a result, many quality tech names are trading at extreme multi-year valuation lows. This is effectively already pricing in a high degree of demand destruction, making the current risk/reward arguably favourable.

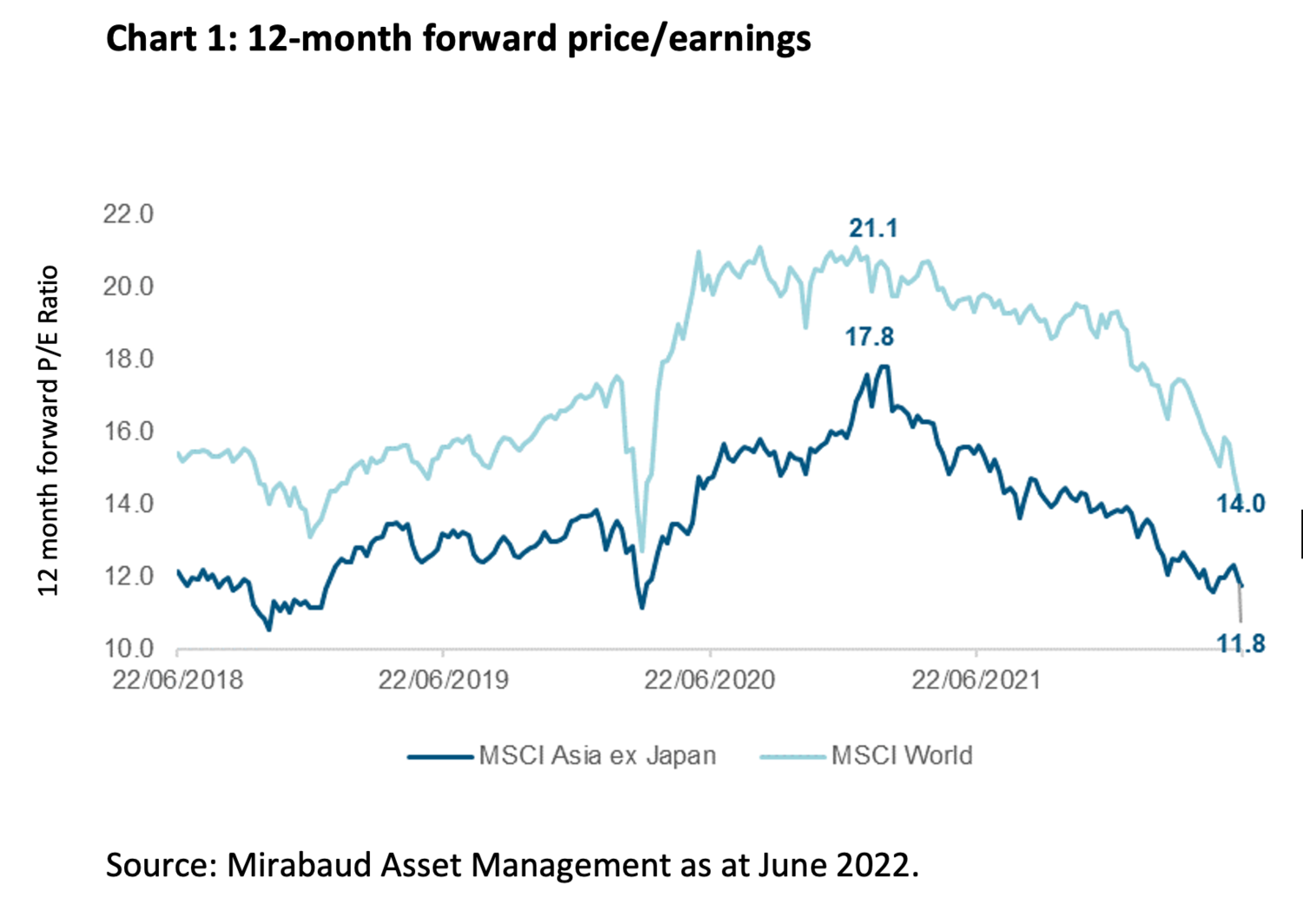

Final thought: relative valuations are improving

Asia continues to trade at a significant discount to developed marketsand has seenearnings per share (EPS) downgrades through 2022 in contrast to the upgrades in the US. We are starting to see earnings surprises in key areas such as China internet platform companies and the more accommodative regulatory stance and supportive measures taken by China look like being positive tailwinds. As a result, we believe we are at an upward inflection point for earnings, which combined with the improving fundamentals outlined above should provide the basis for a strong second half of 2022.

Equities

The opportunities in Asia