As the global economy grapples with stubbornly high inflation, monetary policy has become a key driver of market uncertainty and volatility. For equities, higher interest rates caused increased funding costs and discounted future earnings, creating valuation headwinds and stoking fears of declining economic momentum.

But as we gain greater visibility on the rates trajectory, we expect to see a shift from systemic risk factors dictating market direction to idiosyncratic factors becoming the driving force. For bottom-up stock pickers, this shift creates the opportunity to uncover tactical return opportunities.

While it’s easy to assume the bigger the market the better the return potential, when it comes to being tactical, the opposite is often true.

Unlike larger markets, the Swiss small and mid-cap market is relatively less covered by analysts, creating opportunities for active managers to identify potentially mispriced opportunities.

A COUNTRY LIKE NO OTHER

Switzerland is often hailed as the world’s most innovative economy due to its highly productive, lean, and agile native businesses, which strive to succeed globally because of the country’s limited domestic market. The country has held its position as the leader of the Global Innovation Index for twelve years in a row, solidifying its claim to the title for 2022.

This achievement is partly facilitated by a long history of political stability, which laid the foundations for wealth prosperity and an efficient market economy. Swiss standards of living, education, healthcare, and industrial productivity are among the highest in Europe. Its skilled, multilingual workforce makes it a top performer in terms of labour productivity1.

THE SMALL & MID-CAP OPPORTUNITY

Switzerland is home to some 8.7 million residents, so about the same population size as New York City. The limited domestic market means Swiss companies must be highly competitive to succeed internationally against their incumbent peers. Their revenue sources are typically spread across multiple regions and currencies, providing investors with global exposure from a secure homebase.

Additionally, the strength of the Swiss franc puts pressure on domestic firms to constantly optimise productivity and lead through innovation.

The Swiss small & mid-cap segment offers a particularly rich terrain to unearth great investment opportunities, in our view. The c.190 companies that make up the segment offer varied business models creating a diversified investment case, while at the same time exhibiting a commonality of operational excellence to cope with cost inflation through productivity gains and innovation.

After the underperformance in 2022, Swiss small and mid-caps are valued at par with their large-cap peers (P/E ratio) as the valuation parameters declined to 10-year averages, despite offering significantly more growth opportunities. Many Swiss small and medium-sized businesses are benefitting from China’s re-opening from Covid-19 restrictions.

If active managers know the space, do the research, and make disciplined stock selections, they can identify and capture attractive business models at an early stage of their journey.

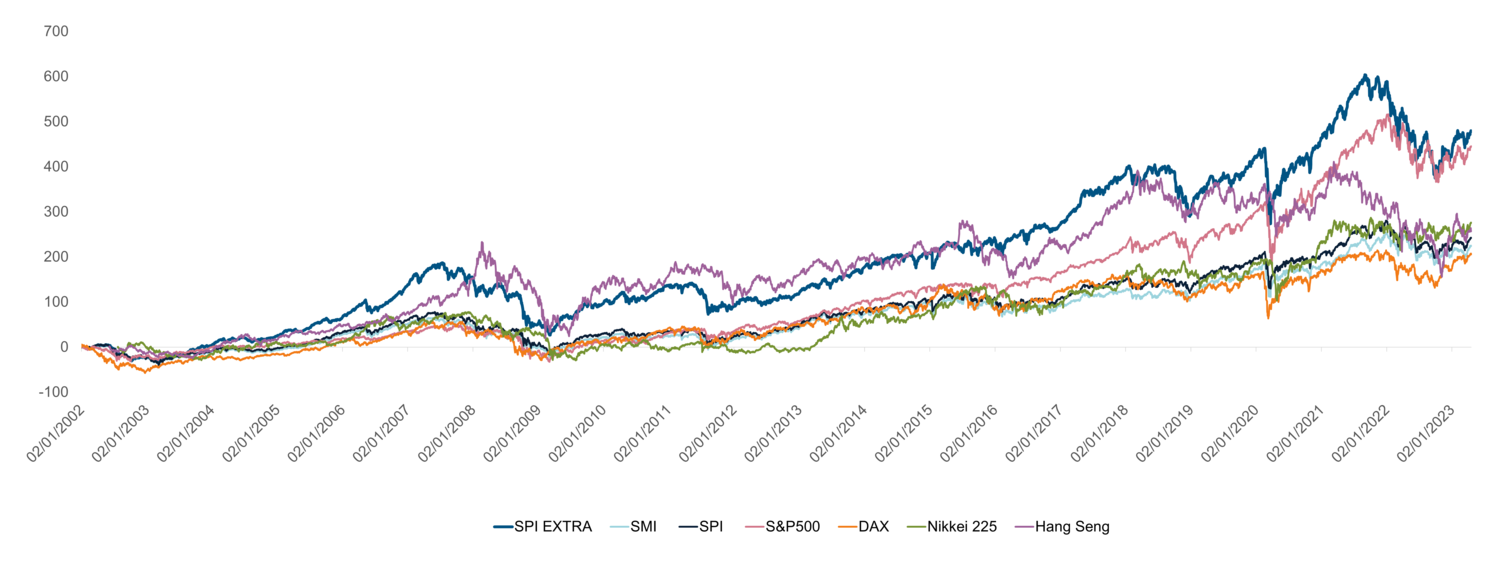

The track record of the asset class speaks for itself. Since 2002, the Swiss small & mid-cap index, the SPI Extra, has yielded a total of 479% (8.6% p.a.), compared to 225% (5.7% p.a.) for the Swiss large cap index, the SMI, and 243% (6.0% p.a.) for Switzerland`s overall stock market index, the SPI2 . The SPI Extra has also outperformed other well-known indices such as the US S&P 500, the German DAX, the Japanese Nikkei 225, and the Chinese Hang Seng, mostly by a notable margin.

We firmly believe the asset class offers a wide range of addressable opportunities that provide tactical flexibility with reduced index tracking.