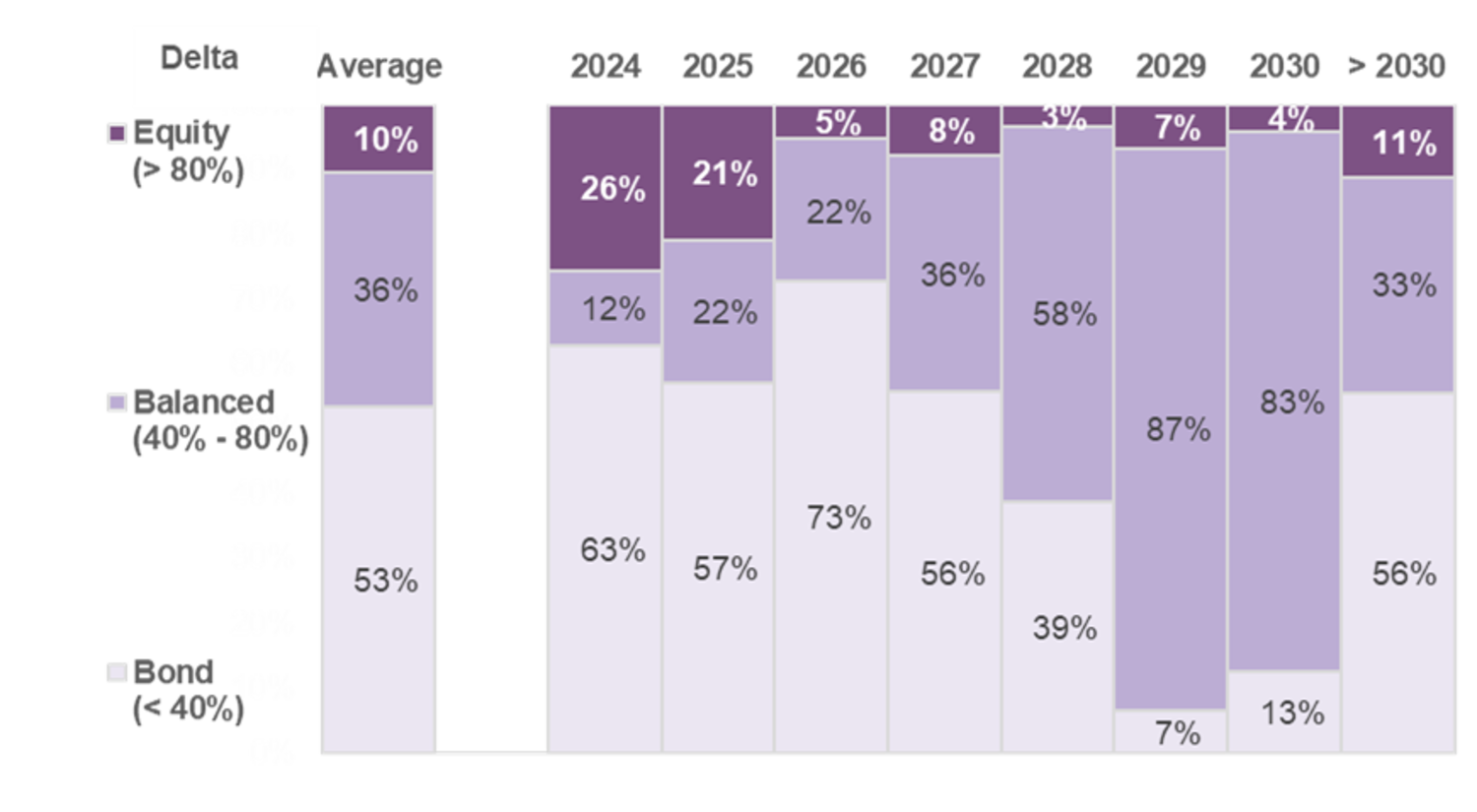

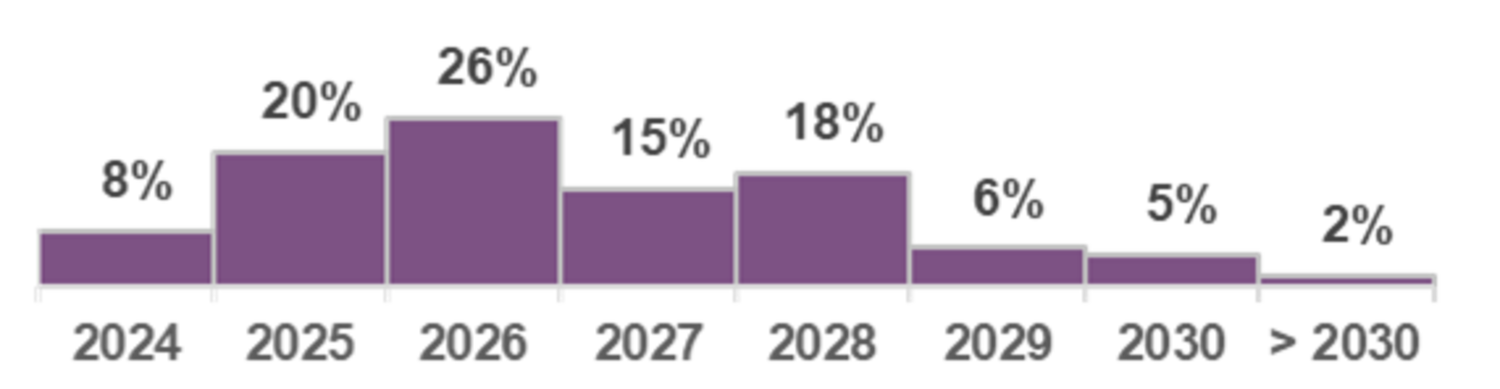

A primary justification for investing in convertibles is their asymmetric performance compared to the return of the underlying common stock. Positive asymmetry accounts for the convertible indices' historical equity-like returns, which have been characterised by lower volatility and less downside than equity indices. But let’s not forget that convertible bonds (CB) are a mutant asset class and their sensitivity to their underlying equities varies in combination with stock market variations and the flow of new issues, as well as the redemption or conversion at maturity of older papers.

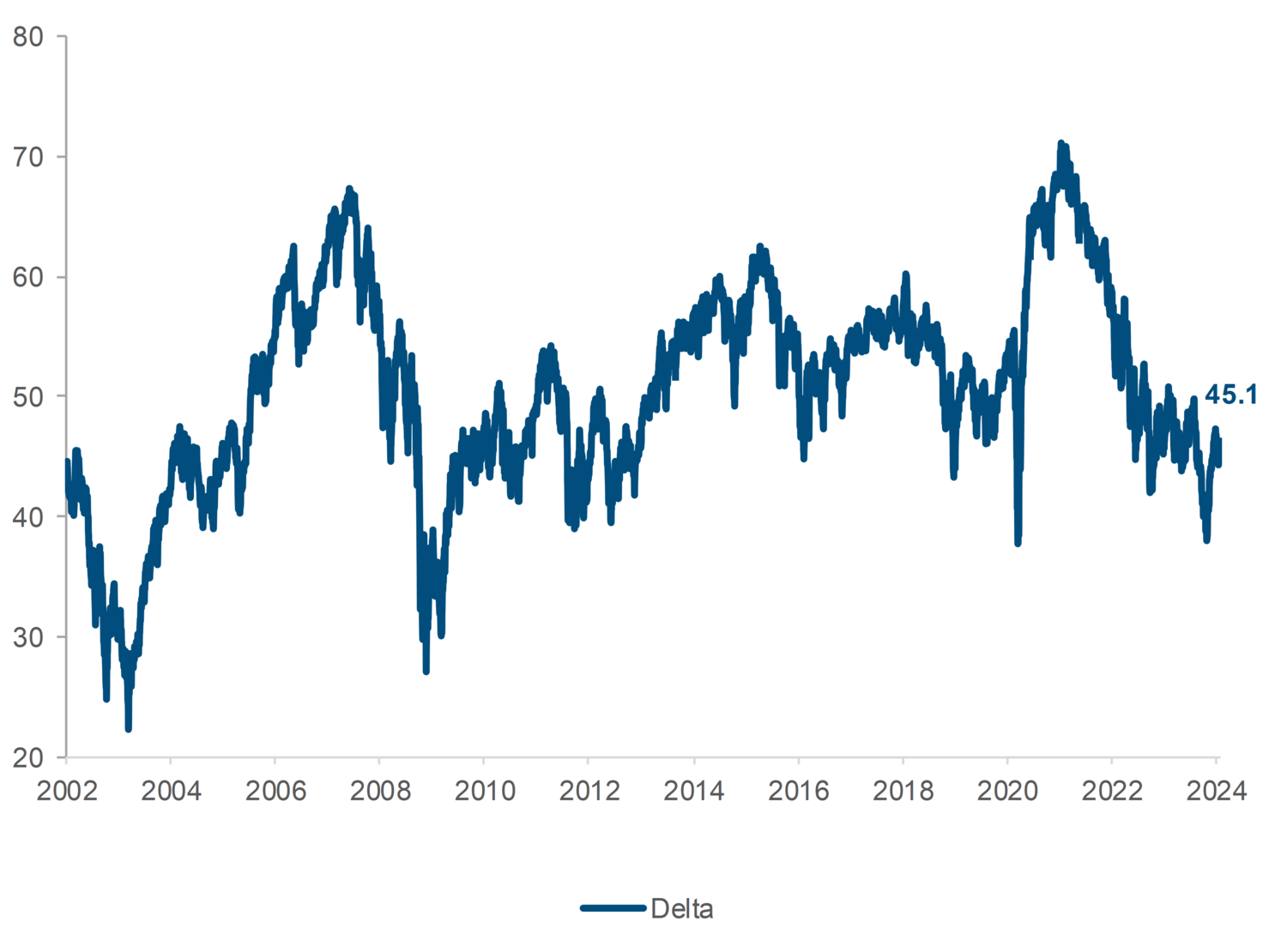

The usual metric used to measure the rate of change of the market price of a convertible relative to the share price move is delta. This could also be viewed as the probability of a convertible expiring in the money.