Market divergence calls for a highly targeted investment approach that can pinpoint opportunities spread across a USD30 trillion debt landscape.

Summary

- There’s a new investment mantra for emerging markets (EM): ‘Avoid diversification’.

- Having suffered an indiscriminate sell-off, holding the broad market has been painful.

- Across the 80 countries that make up the universe, some have a good policy mix and macro backdrop, other don’t.

- Now’s the time to de-diversify your EM exposure. Today’s macroeconomic landscape calls for a highly focused investment strategy, targeting very specific opportunities.

- In terms of opportunities today, Brazil, Mexico and the Middle East look interesting.

Download 'Why it’s time to de-diversify'

After battling against a raft of headwinds through 2022, emerging markets (EM) are indicating that it’s time for a change in the investment rule book. Portfolio diversification has traditionally been the ‘101’ of sensible investing. Spread your risk to protect your capital if markets take a downward turn.

But EM suffered an indiscriminate sell-off, with over USD110 billion flowing out of the universe over the past 18 months. Holding the broad market has been painful.

Today’s EM landscape is one of divergence. Across the 80 countries that make up the universe, some have a good policy mix and macro backdrop, other don’t.

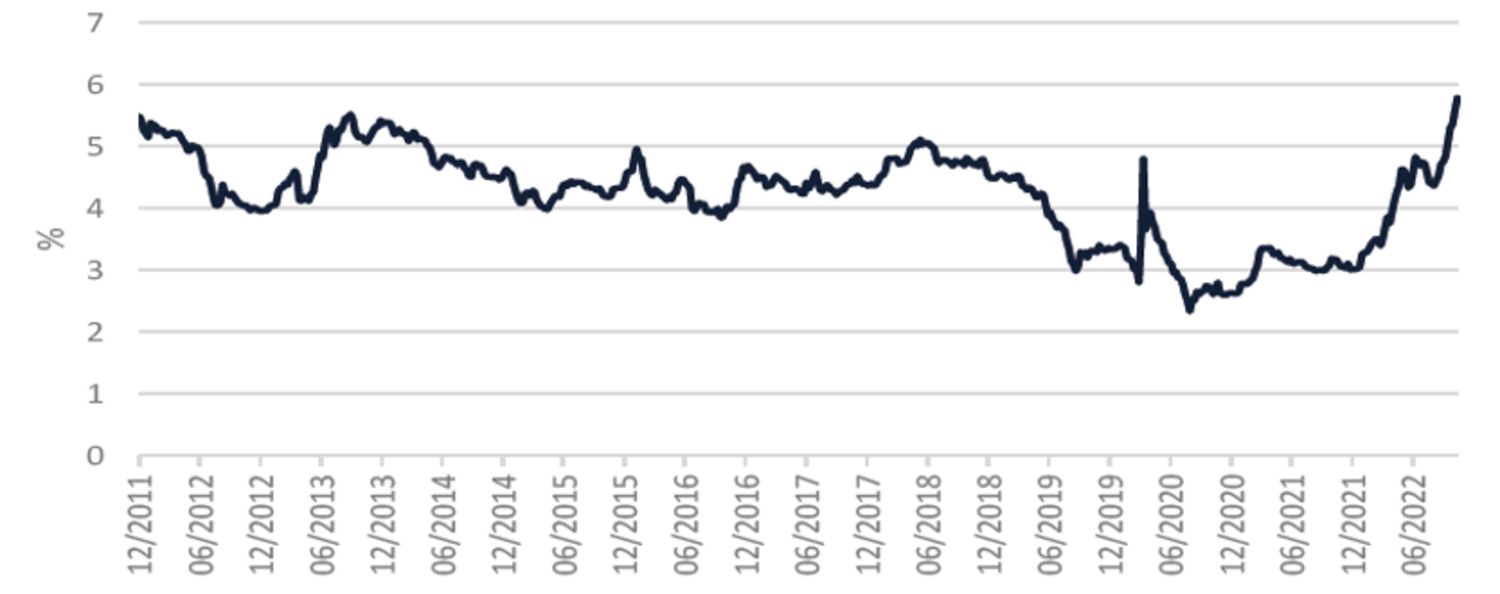

A big source of this dislocation has come from G7 currency moves.

Many of the frontier markets, which are dependent on external financing (typically USD-denominated) are suffering, whereas EMs that have a domestic market, with local currency-denominated debt, have a greater degree of resilience to developed market interest rate changes.

It’s this divergence that’s prompting an allocation adjustment. Now’s the time to de-diversify your EM exposure. Today’s investment landscape calls for a highly focused investment strategy, targeting very specific opportunities. Think active and concentrated, not broad and passive.

Where to focus?

In terms of opportunities, Brazil, Mexico and the Middle East look interesting.

Brazil

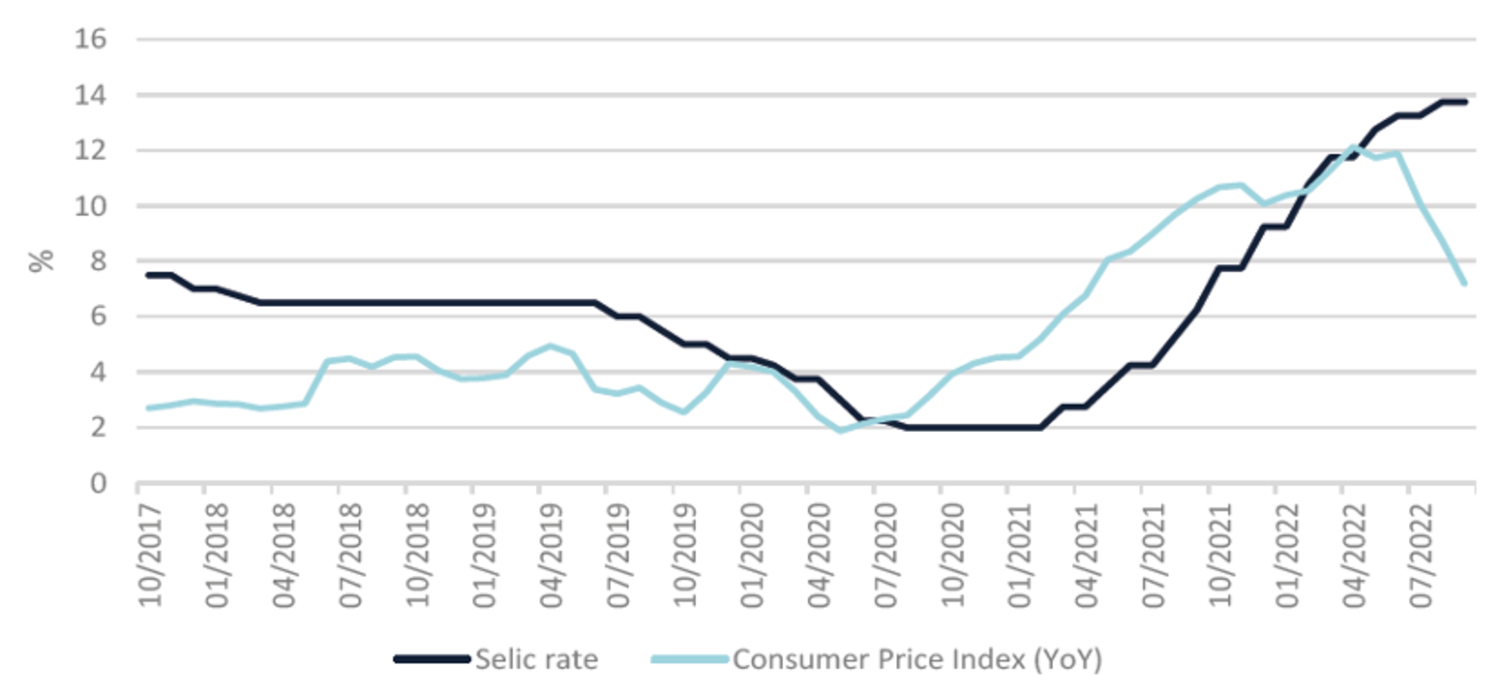

For those with the scope to hold local currency exposures, Brazil could be a good place to start. Brazilian local currency sovereign debt has delivered 14.3% year-to-date (to 3 October), whereas the hard currency equivalent is down -10.3%. Yields on real-denominated government bonds are currently 12%; inflation has peaked and has fallen below 9%, generating a positive real yield for investors.

Brazilian inflation is on a downward trajectory